5 Juicy Highlights As Mobile Money Clocks 1 Billion+ Users Globally Of Which Half Are Africans

In the latest State of the Industry Report on Mobile Money, the GSM Association (better known as GSMA), declared that 2019 was a major milestone for the mobile money industry.

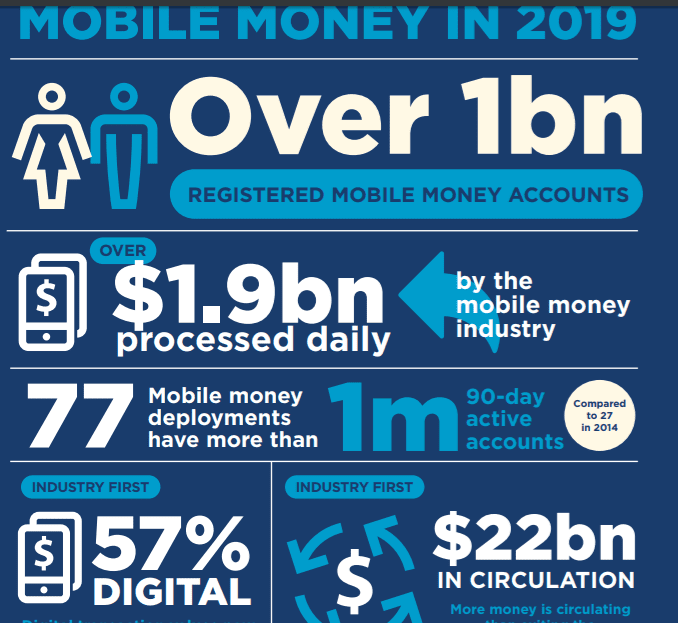

And there sure were many findings that support that claim. For starters, the number of registered mobile money accounts surpassed 1 billion for the first time. As a matter of fact, the GSMA put the actual figure at 1.04 billion mobile money accounts worldwide.

“Reaching the 1 billion mark is a tremendous achievement for an industry that is just over a decade old,” the GSMA remarked in the latest report.

“The mobile money industry of today has a host of seasoned providers with a broad set of operational capabilities, a full suite of products and a global reach.”

According to the institution, the State of the Industry Report on Mobile Money 2019 examines what one billion registered accounts signify for the mobile money industry, mobile money users and the future of the mobile money ecosystem.

But let’s get all that out of the way for now. There were many other juicy bits in a summary of the report which highlighted all the many milestones reached. And we’ve extracted the coolest of the bunch.

Africa Leads The Way

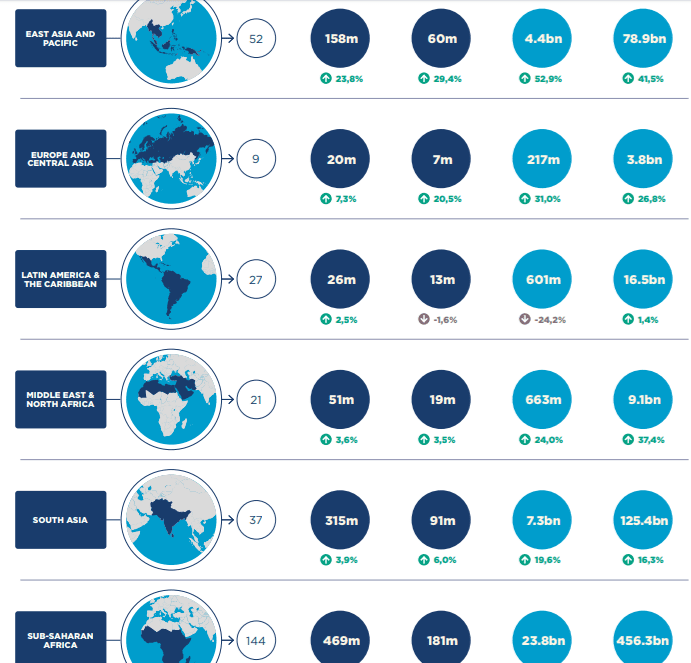

Actually, the GSMA mobile money report revealed growth on all fronts but here’s an interesting fact: With 469 million registered mobile money accounts, Sub-Saharan Africa accounts for nearly half of the 1.04 billion mobile money accounts recorded globally.

That is to say, the larger part of the African continent accounts for approximately 45.1 percent of all mobile money accounts registered globally. The latest figure represents an uptick of 11.9 percent from the previous year.

Sub-Saharan Africa also trumped all other regions studied by the GSMA on all fronts with 181 million active mobile money accounts and a total of 23.8 billion transactions valued at USD 456.3 Bn in 2019.

The closest contender was the East Asia and Pacific region which posted USD 78.9 Bn worth of mobile money transactions in 2019, which was done in 4.4 billion sessions

There’s more money in the mobile money system than ever

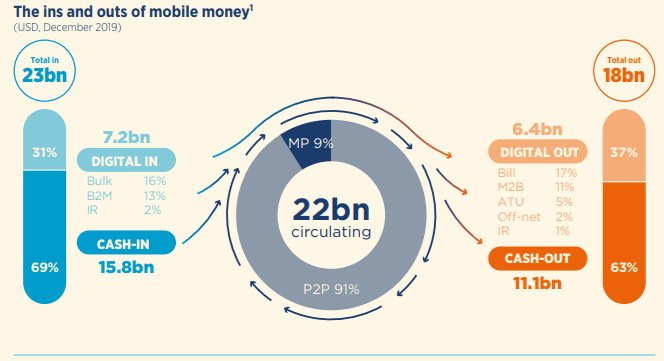

The mobile money industry is now processing almost USD 2 Bn a day. Here’s another industry first – the total value in circulation (peer-to-peer and merchant payments) reached USD 22 Bn in December 2019.

This is more than two-times what has been recorded over the last two years and significantly surpasses the total value of outgoing transactions (USD 17.5 Bn).

It’s actually the first time that more value is circulating in the mobile money system than exiting.

Mobile money agents have 7x more reach than ATMs & 20x more reach than bank branches

Here’s a particularly interesting statistic from the GSMA report: Per 100,000 adults in today’s world, there are 11 banks, 33 ATMs, and 228 mobile money agents.

Obviously, the most available financial services outlet for the greatest number of people are mobile money agents.

With 290 live services across 95 countries and 372 million active accounts, mobile money is entering the mainstream in most markets where access to financial services is low. Also, 77 deployments worldwide have over a million active accounts (90-day) compared to 27 in 2014.

According to the report, mobile money services are especially available in 96 percent of countries where less than a third of the population has an account at a formal financial institution.

The digitisation of payments has reached new heights

For the first time, digital transactions represent the majority (57 percent) of mobile money transaction values. A larger proportion of money is entering and leaving the system in digital form, rather than through a cash conversion.

The GSMA primarily attributes this to the industry becoming a more integral part of the financial ecosystem (i.e. interoperability), and lower barriers to third-party integration. This could be a signal that providers are taking bolder steps to ensure digital transactions become a part of their customers’ everyday lives.

Mobile money user trust and relevance are at an all-time high

Overall growth in transaction values has been impressive in the past 12 months. Total transaction values grew by 20 percent, reaching USD 690 Bn in 2019, which means the industry is now processing close to USD 2 Bn a day (over USD 1.9 Bn).

This growth and scale is a positive signal for the industry as it demonstrates higher levels of customer trust, greater relevance for users and the capacity of mobile money to digitise an increasing amount of capital.

Featured Image Courtesy: AfricaTimes