How Online Freelancers In Africa Are Paying For Germany’s Wirecard Fraud

Until the middle of last month, Wirecard, the German payment company that once boasted a valuation of USD 25 Bn, was regarded as one of the biggest tech success stories from within Europe. That was before it unraveled as perhaps the biggest tech fraud in history.

Oddly, thanks to the “single global village” that the world has become, online freelancers in Africa are also paying the price for an elaborate fraudulent scheme that was pulled off halfway around the world.

Platforms like Fiverr and Upwork are among the popular global freelancing sites where many individuals in various African countries are known to sell their skills and get paid from gig work.

From copywriting and graphics designing to voiceover artistry and video editing, these platforms basically exist to enable total strangers to connect and exchange value — money on one end and finished projects on the other.

There are various means through which individuals can withdraw funds earned from this platform but for online freelancers in Africa, there aren’t very many options.

The problem? One of the ‘few’ options available to freelancers in Africa, Payoneer, was affected by the Wirecard debacle and many people now have their funds trapped, or completely gone, at worst.

“Many freelancers like myself who use Payoneer to receive payment are not able to get our money due to this issue. Our funds are trapped. I just want my money released to me, I don’t even understand the issue,” lamented one Ghanaian copywriter who freelances on Fiverr.

Another Nigerian who sells his logo design skills on Upwork rues not withdrawing much earlier, though she was saving up for a new laptop.

Due to the bankruptcy of the German company Wirecard, which owns the British branch, Wirecard UK & Ireland, that issue cards to Payoneer, all accounts of users have been frozen and funds cannot be withdrawn. It’s not clear how long the freeze will last, nor is it certain that funds are safe.

Payoneer offers multiple ways for business owners, professionals or freelancers to get paid online by international clients and global platforms. The payment service is integrated into many online freelancing sites.

Typically, Payoneer issues and delivers cards to users with which they can access funds withdrawn into local bank accounts. The payment service is particularly popular among online freelancers in Africa who are often unable to use other withdrawal methods on global freelancing sites.

Image Credits: Opera News

It is yet unclear how many African online freelancers have been hit by the unfortunate turn of events and how much money is involved. However, it can be imagined that it is a massive blow as the African continent is known to be among the world’s top freelance work hubs.

An increasing number of companies are choosing this new model of employment. In a study conducted by Payoneer, around 21,000 freelancers from 170 countries around the globe were interviewed. The report shows that Africa holds 10.1 percent of the world’s freelancers – and continues to grow.

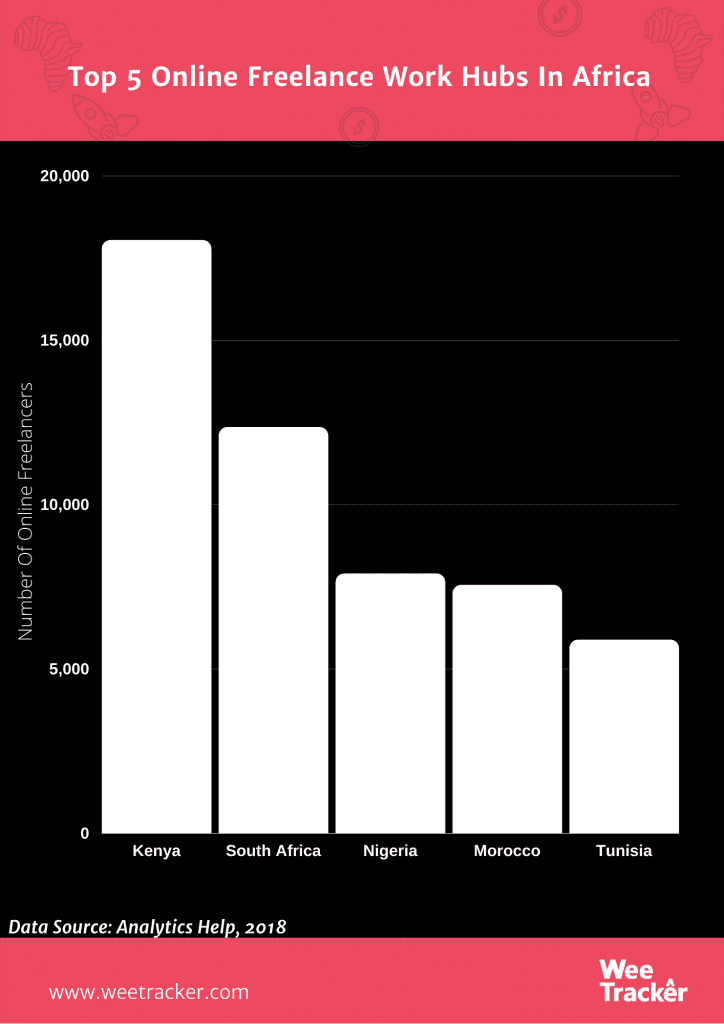

In 2018, a report titled: “Global Internet Freelance Market Overview for 2018,” was released by Analytics Help, studying the population of online freelancers across the globe.

With a total of 18,042 online freelance workers, of which 14.08 percent are deemed active, Kenya is the highest-ranking African country in the Global Internet Freelance Marketplace Overview for 2018 — coming in 15th place on the global rankings.

South Africa ranked 20th globally, with the study identifying a total of 12,354 online freelancers from Africa’s most-industrialised economy.

Countries like Nigeria (31st with 7,897 freelancers), Morocco (33rd with 7,553 freelancers), and Tunisia (43rd with 5,884 freelancers) made up the rest of the top five African countries with the greatest population of online freelance workers. The United States, India, The Philippines, Pakistan, and Bangladesh make up the global top 5.

As it is, any freelancer or even professionals and merchants, for that matter, using Payoneer to receive payment is hamstrung, no thanks to the well-publicised Wirecard fiasco.

Last month, the company admitted that USD 2 Bn on its balance sheet might be “missing” or “probably never even existed.” Either way, there’s a USD 2 Bn hole in its books.

Wirecard functions as a payment service provider, with clients including FedEx and KLM. Merchants use it to accept payment through credit cards, Apple Pay, Paypal, Payoneer, and others.

The company was established 20 years ago, starting out by processing payments for gambling and porn websites. The payments giant now operates in English with a global footprint, supposedly massive Asia operations, and ties to numerous top banks, raising more than USD 1 Bn in venture capital along the way.

In June, auditors from Ernst & Young (EY) said that they couldn’t locate USD 2 Bn in accounts. It is likely that the funds never existed. Wirecard shares crashed; the company filed for insolvency; its longtime CEO, Austrian Markus Braun, resigned.

Braun was subsequently arrested on accusations of inflating profits and misrepresenting the company to investors, though he’s since been released on USD 5.7 Mn bail.

The accounts holding the USD 2 Bn were supposed to be in the Philippines. Interestingly, The Financial Times traveled to one Wirecard address there last year and discovered the home of a retired seaman and his family who were obviously bemused.

The entire Wirecard debacle has been described as Germany’s biggest tech fraud scandal and an accounting mess bigger than any seen before in corporate history. And somehow, freelancers on the African continent are caught up in a mess that was made in Germany.

Update: Payoneer reached out to WeeTracker to explain that freelancers in Africa can now use Payoneer services exactly as they do normally. The company said the UK regulator ran an audit of Wirecard Card Solutions Limited in the UK and found that in line with their responsibilities under the e-money license, all customer funds are held in safeguarded bank accounts and lifted the freeze they imposed 3 days beforehand.

Featured Image Courtesy: daughtersofafrica.org