After Mr Price, It’s ShopRite’s Turn To Call It Quits On Nigeria

Plenty of exits are happening across the retail landscape of Africa. The latest in the fold is that of ShopRite Nigeria, which has revealed its consideration to abandon the West African country’s consumer market.

This development follows that of Mr Price, one of South Africa’s biggest retailers, which cut ties with the so-called economic powerhouse of Africa. Weak economic growth, volatility and inflation were among the firm’s major reasons for the exit.

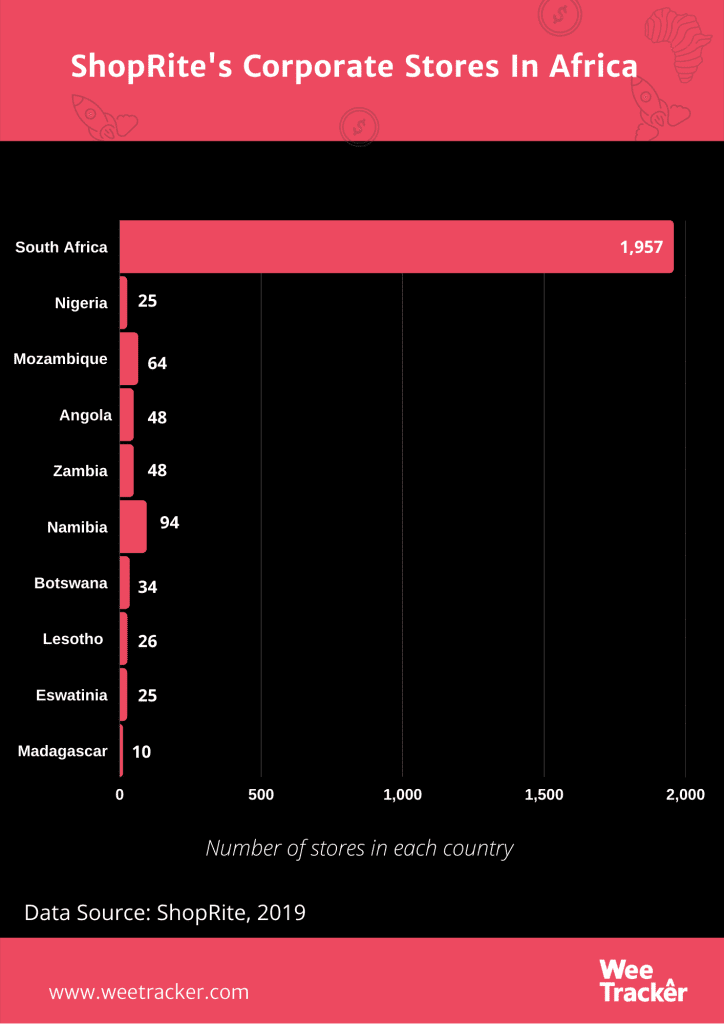

“ShopRite Nigeria”, an offshoot of the South African-born business which has 2319 corporate and 275 franchise outlets in 17 countries across Africa, has been around for the last 15 years.

The Cape Town-based grocer has begun the official process which considers the sale of the majority or entirety of its supermarkets stake in Nigeria, according to its trading statements released for the 52 weeks that ended June 2020.

ShopRite says the results for the financial year do not reflect any of its operations in Nigeria, because it will be addressed as a discontinued operation. Its international supermarkets contributed 11.6 percent to group sales, while the South African division accounted for 78 percent of overall sales.

While international supermarkets experienced a 1.4 percent decline in sales from 2018, SA operations saw a rise of 8.7 percent. Due to the coronavirus-regulated lockdowns, customer visits to the chain went down by 7.4 percent. Nevertheless, the average basket spend climbed by 18.4 percent during the period of restriction.

Meanwhile, the second-half sales climbed as it gained market share, despite the fact that the main lower-income customers of the business continue to struggle with the pocket impact of the Covid-19 and the following lockdowns.

According to a statement from the supermarket operator, sales in its core South African business increased by 9.4 percent in the last 3 months of the fiscal year through June. Nevertheless, it spent USD 19 Mn on coronavirus-related expenses.

Potential investors have approached the South African retailer, indicating interest to takeover the Nigerian arm of its operations.

ShopRite Nigeria has experienced difficulties in the past as a result of different events. Most importantly, the fallout from the South African xenophobic attacks last year gave the business’ financials a punch.

About 3 months ago, the firm blamed an 8.1 percent drop in Nigerian sales on the attacks, reporting for the end of the second half (H2) of 2019.

In April, ShopRite decided to abandon the apparently troublesome retail market of Kenya due to financial difficulties.

Image Courtesy: Paweł Czerwiński Via Unsplash.