Mara Phones: The Report Card Of Africa’s Most Eminent Smartphone Ambition

There are perhaps only a few things more unnerving than accidentally getting your smartphone spoilt beyond repair when you just cannot afford it. The worst happens when the gadget nazi at your favourite repair shop says it’s best to either get a new one or repair it and expect it to develop further issues anytime from when it gets fixed.

Again, it feels like the demons of tech are haunting you when you realize you have no other option than to go below your present smartphone stratification.

This was precisely the ordeal of Harrison, a resident of Ibeju-Lekki, Lagos, whose 6-month-old iPhone 11 Pro Max was shattered in an intense yet misplaced chase by SARS, a now-notorious unit in the Nigerian security system.

Having been wrongly labelled a fraudster because he cleaned up good and wore seemingly expensive outfits, Harrison saw no other option than to try to abscond from the ruffian-turned-officers whose intentions were to extort him or bury a bullet in his leg to drive home a point.

Long story short, the 23-year-old was able to slip through the unlawful Special Anti Robbery Squad.

Nevertheless, his beloved Apple phone, the most expensive gift he’s ever gotten from his affluent uncle, suffered the collateral damage. With little to no immediate means of getting it fixed, Harrison decided to buy a cheaper for-the-meantime alternative, a Mara Phone.

But Harrison could not find any of Africa’s indigenous smartphones at his most-visited gadget hub, SLOT. The outlet, which was just a stone-throw from the Novare Mall, Lekki, could not point him in the right direction either.

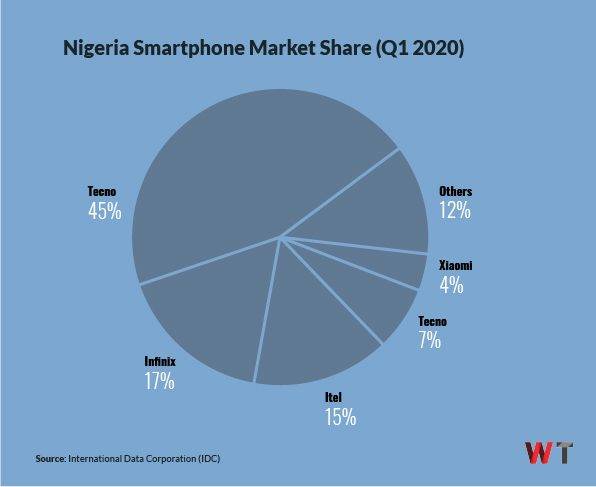

Apart from the sales rep’s advice for him to buy a Transsion-produced phone, he was pretty much bewildered by whether anyone could find an African-made gadget in Nigeria, Africa’s largest consumer market.

Conjuring an unfamiliar storm

A year before now, no African country could ceremoniously claim to have spawned a gadget known across the world. But with a record-setting launch in October 2019, Rwanda blazed the trail for other nations in the continent to follow.

The East African country unveiled the first-ever Made in Africa phones, setting up a factory for assemblage in the capital, Kigali. Later, Mara Corporation, a multi-sector business services company, opened another phone factory in South Africa, the continent’s most industrialized country.

The Mara X and the Mara Z were the firstborns of the Africa-made smartphone family. Interestingly, at the launch, Ashish Thakkar, CEO of Mara Corp, said the two gadgets would wrestle with Samsung.

For context, Samsung’s cheapest smartphone, at the time, cost USD 54, a Rwandan Franc equivalent of 50 K. Then, the company’s most inexpensive non-branded phone sold at USD 37, which was 35 K Rwandan Francs, at the time.

Built on Google’s Android operating system (OS), Mara X is sold at USD 190, while Mara Z goes for USD 130. The former is a high-performance device that offers 3GB RAM and 32GB of internal storage while brandishing a 5.7-inch display, 13 MP back-and-front cameras, and a security system that helps maintain the phone’s speed.

The Mara Z, on the other hand, is the lighter version of the X, developed to specifically cater to consumers in need of frugality with their data spends. It is operated by Android Go, a stripped-down version of Android distribution designed for low-end and ultra-budget smartphones. The device hosts lighter versions of apps like YouTube and Gmail, all backed by a 3,500 mAh battery.

Earlier in the year, Vodacom, Mara Phones’ sales partner, told us that a percentage of the devices’ sales will be used to invest back into worthy causes. The setting up of Africa’s first smartphone factories cost about USD 50 Mn, part of which was provided by the Bank of Kigali, Rwanda’s largest commercial bank.

According to the firm, it has been producing an average of 10,000 smartphones per month based on a market demand, one which it says is growing gradually.

Binding a perception-shaped demon

After spending millions of dollars on building factories and producing smartphones that would appeal to the average African, one of Mara’s seemingly big problems is being African. 90 percent of the company’s workforce comprises youths, 60 percent of whom are women.

That’s just to tell the effort the group is making to do things a bit differently from others. But with all the budget gospel and the new testament for indigenous products, what is the biggest odd against the firm?

Ramazan Yavuz, Senior Research Manager for the Middle East and Africa subsidiary of the International Data Corporation (IDC MEA), summed up the narrative.

As his first and seemingly most vital take on the subject matter, he says, “Perception is definitely a big challenge for Africa-made gadgets. The continent has long been importing gadgets, and existing local production ventures are not very visible to the outside world”.

A good number of African brands manufacture their gadgets in China to enjoy the advantages of saving costs. The legacy needs to be reversed in Africa to build the Made in Africa brand equity in the technology landscape.

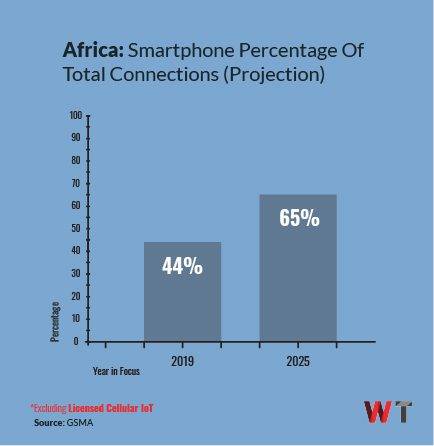

That makes Mara’s ambition cannot be easily written off, both from an African and a global viewpoint. Smartphones remain at the epicentre of today’s African life-and-work style. Africa never had the luxury of a computer revolution, jumping from zero to mobile in a blink.

Everything on the continent is mobile-first, and even now, Netflix is finally falling in line. To buttress, westerners were introduced to the internet via desktop computers, but Africans first accessed the web using mobile phones.

So it makes sense to have smartphones built in Africa for Africans, regardless of the costs. However, everything seems rigged from the jump, because opinions suggest that pushing smartphone from the continent is disadvantaged firstly by the fact that it is “African”

But is being Africa-made really a downside? Morson Hart, CEO of VIAHART, tweeted last October that “There is no way that phone is not made mostly of imported parts. I’d even be surprised if simple stuff like the plastic shell was moulded in Africa. Also, the founders of Mara are African-born, but they’re of Indian origin”.

But he more recently explained to WeeTracker: “I don’t think that perception towards Africa-made phones is the problem. I think the problem is the supply chain on the continent. I know a lot about Africa compared to the average American, so I can say people here wouldn’t really care if their phone was made in Africa. Maybe they can succeed in Africa, but they need to be very transparent with how their phones are made”.

To be fair, most phone factories are more or less assembling plants because most of their phones’ components are obtained from elsewhere. Case in point, American phone manufacturers like Apple design and assemble their products in China. Transsion, the Africa-focused manufacturer who hasn’t sold a single phone in its home country, has its factory in China.

But it does not seem to favour labelling their products as Made in California or Made in America. African counterparts choosing to take on a different moniker sends mixed signals.

Does Mara deserve some accolades?

Mara Corp is not the first company to claim an African-made label for its phones. Some 4 years back, South Africa-based Onyx Connect joined hands with Google to locally produce USD 30 Android phones. The manufacturer divulged that a higher percentage of the phone’s components would be gotten from Chinese sources.

Only the design, phone cases, and future research/development would be done on the continent. Even SICO Technology, which sat on the adjudged first Egyptian-made smartphone, disclosed that only 45 percent of its components are sourced locally.

Even when most of their materials are sourced from outside, these brands have their home countries attached to their “Made In” catchphrase. The practice can be understood based on the premises of manufacturers wanting to leverage their country of origin to appeal to their customers.

Because only relatively few people know about these phones, barring actually using it, the approach appears to not yield much fruit. Though unconfirmed, these brands may be thinking of throwing in the towel or have already left their businesses to chance.

However, when it comes to Mara Phones, there are significant differences, the chief of which is the backing of a government that wants to be tech-forward and transformation-centric. If the company was embarking on this journey solo, perhaps the flaks would be well-placed.

Saheed Adepoju, a Nigerian software engineer who works with Intel, makes a strong case for the company’s Rwandan backing. “You also notice a lot of government involvement to drop down the costs of production and, in turn, make them affordable. Also, for them to get a large volume of order, there may be government policies and government or a telco buying them in large numbers for it to be affordable as well,” he says.

The Rwandan economy is currently enjoying a new lease of life, but only if you remove the effects of the coronavirus pandemic from the picture. The economic transformation is getting investors’ attention, as in the last decade, the country’s GDP averaged a growth rate of 7.5 percent, making it the highest in Africa.

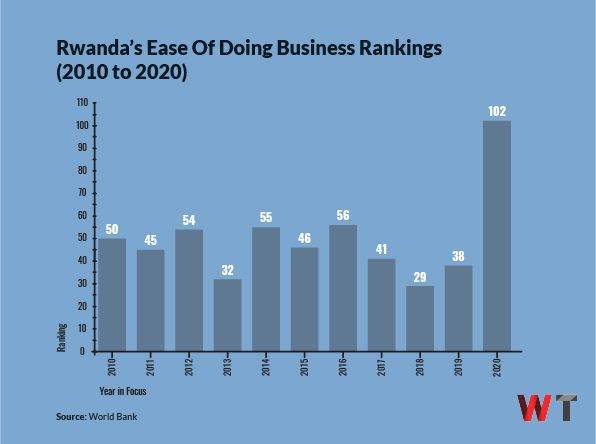

Per the World Bank’s 2018 Ease of Doing Business Index, Rwanda has towered above countries like Belgium, Italy, and Israel to become the world’s 29th most business-friendly country. In 2019, it occupied a better 38th position. Currently, it is the second-easiest place to do business in Africa, behind only Mauritius.

Hailing from a country deemed one of Africa’s most innovative might as well put Mara Phones in a better light and give it an upper hand. Besides, the company is leveraging an agreement after the continent’s own heart, the African Continental Free Trade Agreement—a pact that will form a 55-nation, USD 3.4 Tn economic bloc.

Though the agreement is still in the very early stages and further delayed by the pandemic, Mara Phones have already been launched, and there’s plenty to see regarding how these two ambitions will intersect.

Mara might have to pull off a Transsion

Mara is the first to do manufacturing in Africa, making the motherboards and sub-boards, and managing a thousand pieces per phone. But the manufacturer is not the first to strategize capturing African consumers.

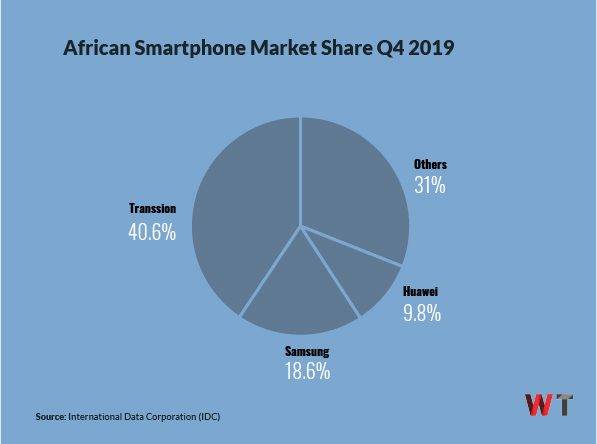

In fact, another phone maker seems to have done the job already and now mans the big gate of the continent’s smartphone market. Transsion, the Chinese firm that produces Infinix, Tecno, and Itel phones, hasn’t sold a single phone in its home country, but it has more slices of Africa’s fledgling device turf than anyone else.

Regardless of the COVID-19 outbreak’s economic effects, Shenzhen-based Transsion Holdings saw a 33 percent jump in net profit for the first half of 2020.

The phone maker’s smartphone revenues grew 32 percent year-on-year to USD 2 Bn in the second quarter of the same year, a snapshot of just how the firm dominates both the low and middle sectors of the continent’s market.

By shipping 32 percent more smartphones in the same period, the Star Market-listed firm bucked a worldwide trend that saw phone shipments fall 16 percent to 331.8 million.

More than anybody else, Transsion produces its phone with the modern-day African in mind. A part of its success has been by focusing exclusively on building phones with locally-tailored features such as multiple SIM slots, longer battery life, and a camera technology calibrated to darker skin tones.

It has also offered phones significantly cheaper than those offered by Samsung, Huawei, and of course, Apple. The strategy has seen its brands become ubiquitous across the continent.

Enough about Trassion; what is Mara bringing to the table? Well, all fingers are definitely not equal, especially as the supply chain system in Africa is a lot less organized than that obtainable in China, where most of the world’s phone components come from.

As Mara reaffirmed to WeeTracker, it aims to offer excellent quality, robust smartphones at an affordable price. Firstly, neither the Mara X nor the Mara Z has multiple rear-facing cameras, which have now become de facto for most smartphone brands. Still, experts rate the phones’ camera at a 9/10, and there is still a lot for room for the brand to tech things up.

Mara X sports a 3500 mAh battery, while the Mara Z houses a 3075 mAh Li-Po counterpart. Considering that some Transsion phones come with as much as 5000 mAh batteries in a quest to appeal to Africans who have limited access to electricity, Mara might have to ramp up its game to become a darling in the continent.

There is no available data on how many smartphones the company has sold, so the manufacturer may have to rely on more than just an African marketing strategy.

According to a piece of information IDC supplied WeeTracker, since the opening of its South African factory in Q4 2019, Mara phones have made decent strides in the market. The vendor entered the South African market with Mara X and Mara Z models sold via its website. Backed by Vodacom, the vendor is also selling through Pick n Pay.

While Mara Phones had growth prospects and aimed to establish a market share by the second half of 2020, COVID-19 disrupted the plan and slowed down the shipments. If the pandemic and economy are friendly, Mara’s plans to launch more models before the busy Christmas period (Mara Z1, Mara X1 and Mara S), will increase their market share

Not to forget that other brands like Samsung, Huawei, Oppo, Xiaomi, OnePlus, Vivo, and Redmi are also vying for more share of the African smartphone market. Products are being rolled out almost every now and then.

Meanwhile, Mara’s focus market, Rwanda, is yet to be conquered as only 15 percent of people there own a smartphone. The brand may have to be able to crack its home market before taking on elsewhere, even South Africa, where it has branched a factory. Well, if there’s anything we’ve learned from the space, it is that affordability does not work the magic alone.

Laddering up in terms of distribution

Mara told WeeTracker that it is not just selling its phones to Rwandans or Africans but also to people outside the continent. Except these consumers are somehow Africans/Rwandans in diaspora or people in drastically underserved markets who actually buy, there remains a cloud of doubt regarding the phone maker’s actual business strategy.

For one, getting locally-sourced components and assembling the products in Africa is already a drawback because of the continent’s supply chain fragmentations.

“The biggest challenges for local brands in Africa are economies of scale and lack of production ecosystems. Considering global smartphone brands achieved economies of scale, African brands need both investment support and government support to nurture their brands and go beyond Africa borders,” IDC’s Ramazan Yavuz told WeeTracker.

He points out that for brands like Way-C, Mara Phones, and Encipher Limited to succeed against existing top brands, they have to ladder their way up to distribute their products, first locally, then globally.

Mara requires a well-structured distribution network, which means having an abundance of retailers stocking and selling the products in every conceivable part of the continent.

There is no immediate way to find out how long it took Transsion Holdings to create a robust distribution channel in Africa, but since Mara commenced operations last October, by now, things should have been set in stone.

But, as Harrison, our protagonist, complained, “Getting this phone in Lagos, I don’t think it is possible outside ordering online. I have to have direct contact with this phone before I get it. It is coming from Rwanda and South Africa, and I know that our logistics isn’t strong. So, I decided to just buy an Infinix Hot 7”.

That smartphone is one of the cheapest smartphones from Infinix, retailing in Nigeria—Africa’s largest smartphone market—at USD 83 (NGN 32 K). If Mara cannot be readily accessed in this country yet, Mara still has much work to do against the odds.

Teachings from the gospel according to the coronavirus point out that Africa’s supply chain problems need to be solved. Per IDC’s Worldwide Mobile Phone Tracker, the continent’s smartphone market saw shipments drop to 20.1 million in the first quarter of 2020, compared to 21.5 million in the first quarter of 2019. The 17.8 fall was higher than the 14.9 percent, which the IDC predicted in March 2020.

Asides from the AfCFTA’s play to fix it, companies that deem themselves pan-African need to formulate effective distribution channels for their businesses to succeed. Mara Phones are no different.

Just as it has hooked up with Vodacom in South Africa, linking with Safaricom in Kenya, Glo, or 9mobile in Nigeria could go a long way in putting these phones out there and exponentially drive sales.

If it means working directly with African governments to make these phones available to certain people sects in their respective countries, then so be it, as far as a formidable distribution channel is established.

However, plans for more may have been stalled as a result of COVID-19. That would mostly affect the company because it is still in its first year of operation. Nevertheless, there is room for more.

“We were affected as we had to close both factories, although we were lucky enough to retain all staff during this time. We have a highly efficient R&D process, which has enabled us to announce the launch of 5 new products despite the challenges presented by COVID-19,” a Mara Phones spokesperson informed WeeTracker.

Africa-made versus the world

Products-wise, the world is a connected place. In London, people drive BMWs made in Germany and VWs that come from South Africa. Some of them wish they could afford to own Tesla cars, which are made using Congolese cobalt.

The English eat Kenyan beans and crave holidays in Mauritius and surfing in Morocco. iPhone components are from China, Intel chips from Vietnam and some clothes Americans wear come from Bangladesh. Not everybody cares about where a product is from, as far as it is quality and in tandem with modern-day needs.

Charlie Robertson, a London-based global chief economist, says, “Personally I think it’s inevitable that a large proportion of manufacturing will move to Africa in the 21st century and people will buy those goods. We fly in Airbus planes whose wirings are done in Morocco, which is a mark of quality”.

He continued: “I think Africa has a high capacity to surprise the ignorant positively, ignorant until they visit for themselves. I think there are enough Africans who understand how to make good products, to be able to make good products, and the right product at the right place will often sell itself”.

More often than not, the first any continent or country-made product like Mara Phones do better on price than quality, to be fair. Because of fragile currencies, they sell low-quality goods initially.

As time goes on, they amass dollars, investment in better equipment. That’s how China goes from making cheap plastic toys to manufacturing globally-sold Huawei phones. With the same process, Vietnam went from selling shrimp to making Hondas and Samsung products.

So, there is every possibility that much of African production has to go through the cheap, low-quality phase before becoming a force to be reckoned with.

Even though countries like Morocco and South Africa are suggesting that it is unnecessary, there is still a lot of time to see what works and what does not. With regular electricity supply and competitive exchange rates, industrialization can be enabled even for brands like Innoson Motors to get underway across the entire continent.

There is still much to be done as per smartphone penetration in Africa. Many understand that more people in the continent now have mobile phones compared to a decade ago.

Nevertheless, the progress is overhyped as 800 million out of 1.2 billion people still do not access the internet, whether voluntarily or involuntarily. What’s more, just 2 of every 3 African women own a cell phone, and barely 1 in 3 uses their mobile data regularly.

Joe Barrett, President of the Global Mobile Suppliers Association, Africa (GSA Africa), said: “China successfully developed a device industry by nurturing suppliers serving customers in their own market, and then exporting to the rest of the world. India has been doing something similar. There is no reason why countries in Africa could not learn from other regions and follow similar strategies to grow their devices industries.”

“Each buyer has its own unique set of needs, expectations, quality and capability requirements, cost thresholds, and attitudes to security or certainty of long-term supply and support. Any organization ticking all the right boxes has an opportunity to sell its devices,” he told WeeTracker.

Sources for African Companies Attempting To Produce Phones: Face2Face Africa, All Africa, Techweez & Mara Phones