The African tech landscape is bustling with possibilities, yet the recent challenges faced by local startups following a decision by notable startup favourite Mercury Bank, to shut down accounts linked to Nigeria and several other countries, has been both a rude awakening and a reality check.

Mercury's issue with businesses in the affected countries, whose accounts are to be blocked or terminated by August 22, highlights the vulnerabilities in relying on foreign banking systems.

However, this incident has not only disrupted operations but could also pave the way for local fintech companies to address the unique needs of the African market.

As Nigerian startup founders join their counterparts in other affected regions to promptly seek alternative ways to manage their international banking activities and needs, there’s now an emphasis on finding lasting solutions more than ever.

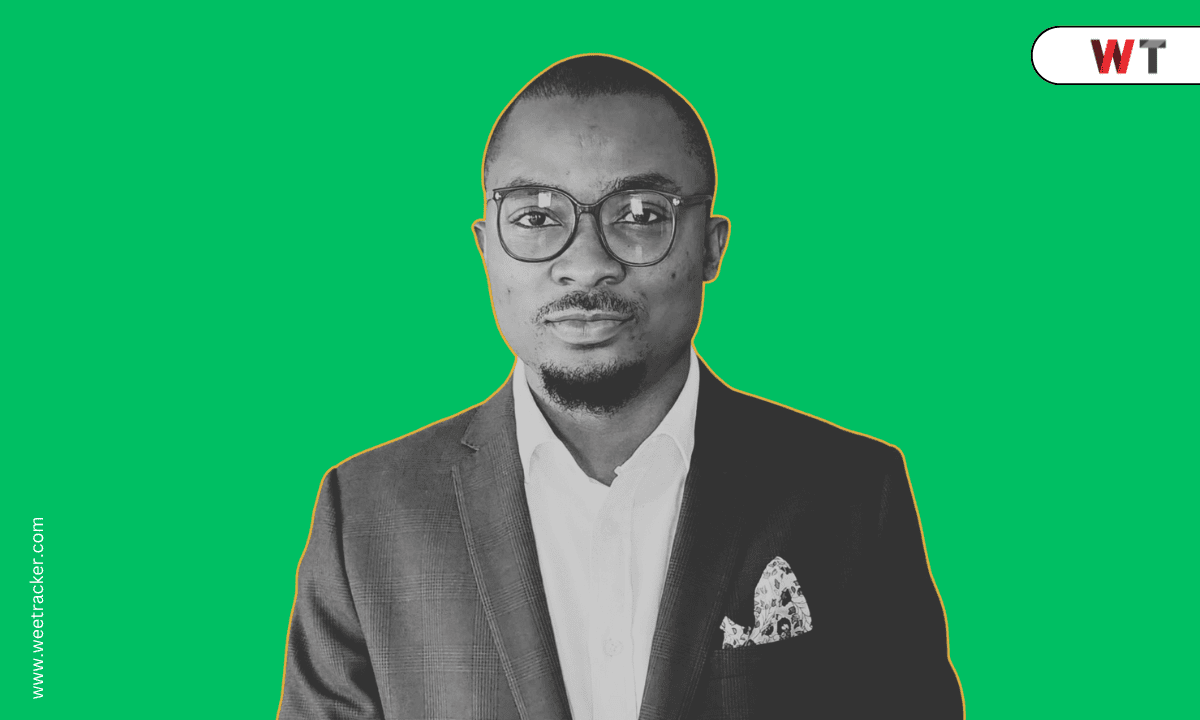

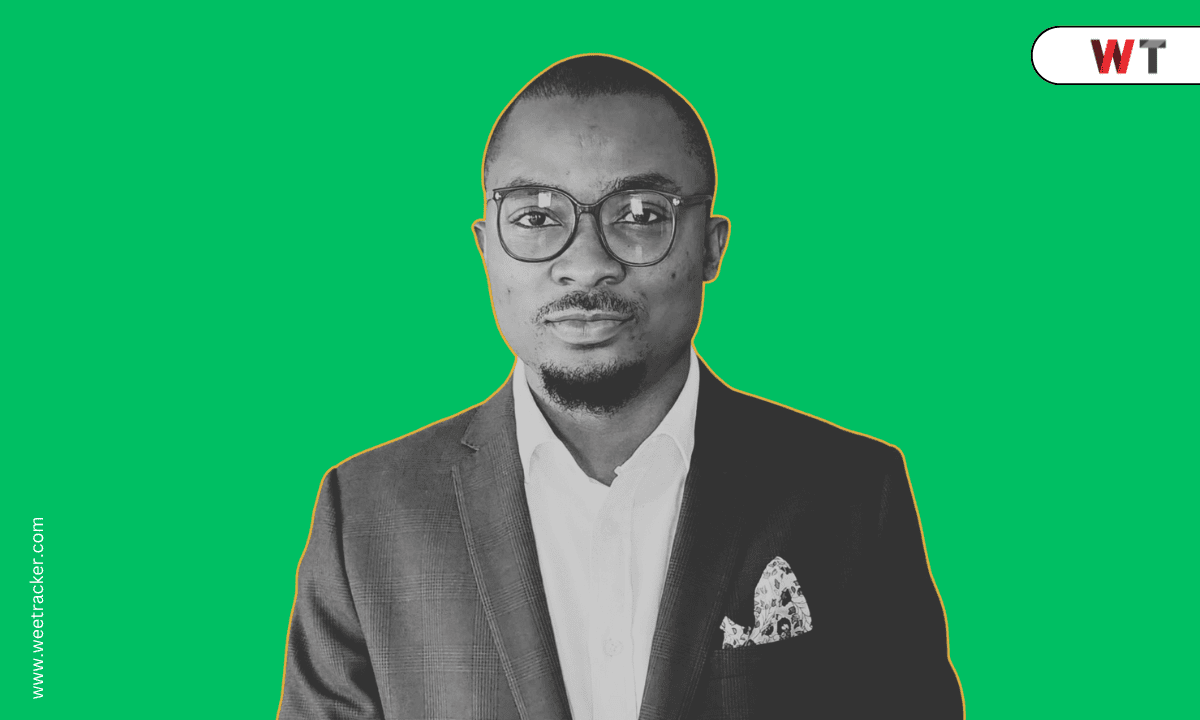

Austin Okpagu (pictured in featured image), Country Manager - Nigeria for global business banking/payments player VertoFX, tells WT in a recent interview that the underlying issues that contributed to the challenges with Mercury fuel the broader need for improved cross-border payment solutions in Africa and perhaps more importantly, the need for local solutions from founders who truly understand the nuances of the Nigerian market.

"The Mercury situation illustrates a critical gap in the financial infrastructure available to African businesses. For many startups, the reliance on global financial services providers comes with inherent risks, including regulatory uncertainty and potential account closures," Okpagu tells WT.

"This underscores the necessity for stable, locally developed financial solutions that are better suited to the unique challenges and nuances of the African market," he adds.

Mercury, a U.S.-based banking platform, closed the accounts of several Nigerian businesses, citing regulatory and compliance issues. This move has had a profound impact on the affected businesses, both in the short and long term.