South Africa’s Naked Insurance Scores Additional USD 2 Mn Investment

Johannesburg-based artificial intelligence-driven car insurance provider, Naked Insurance has secured additional USD 2.2 Mn to grow its team, ramp up customer acquisitions and expand into new short-term insurance product categories.

After the company’s success at meeting key milestones, two venture capitalists; Yellowwoods and Hollard, have invested additional funding in the startup to enable the company to accelerate its growth and expand into new product lines.

“We are proud to receive this vote in confidence from our investors and look forward to rolling out new products in response to customer demand,” says Naked co-founder, Alex Thomson.

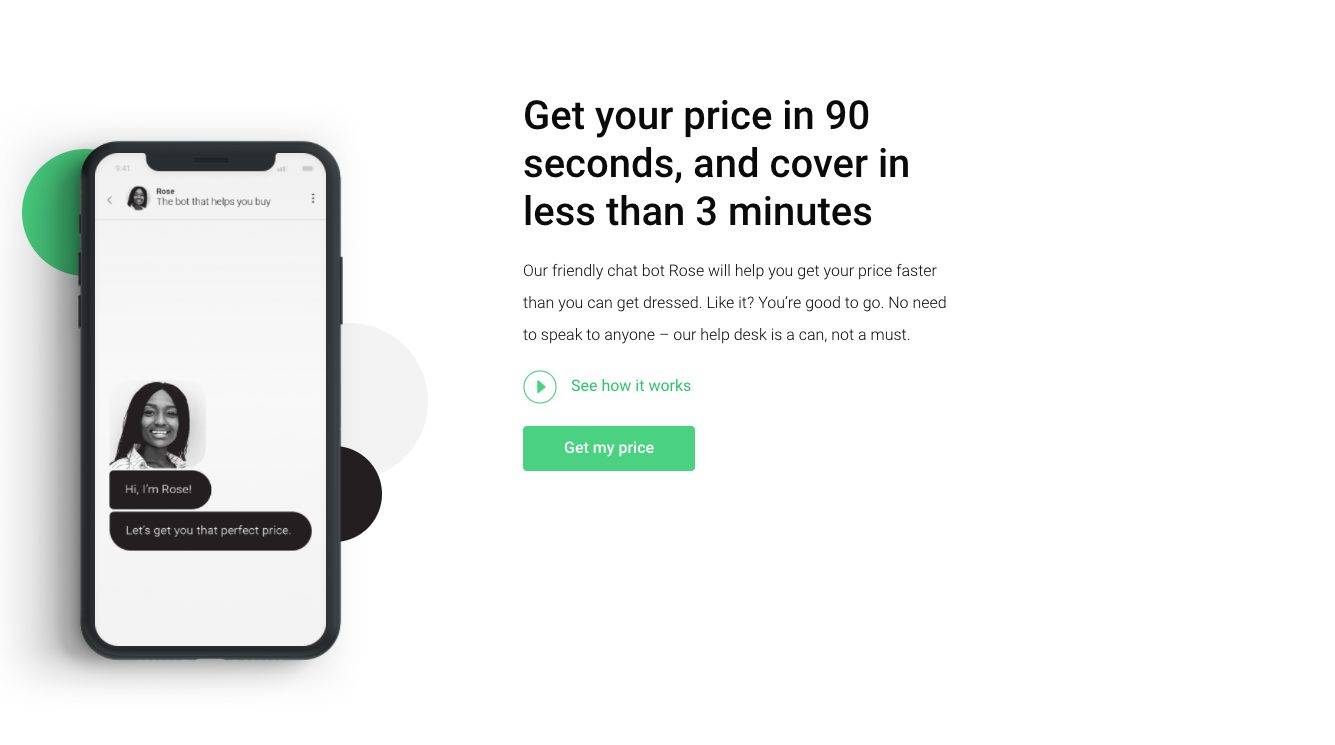

The contrivance by actuaries Thomson, Sumarie Greybe, and Ernest North, Naked leverages AI and automation to lower costs, puts customers in the cockpit of their insurance experience, reduces fraud and enhances insurance as a social good. Customers can afford to go online and get a final insurance quote for their vehicles in less than 90 seconds without having to fuss with a center agent.

“We’re delighted by the response our insurance offering has received from the market. Our proposition of putting the customer in control, value for money and customer fairness is resonating with connected customers who are looking for a better car insurance experience”, Thompson enthused.

Naked’s offering is built on the latest technology, free from legacy costs. Innovations in how Naked reaches its customers mean that it has lower sales and servicing costs, enabling it to offer lower premiums to the customer.

In dissimilarity to traditional insurers, Naked takes a fixed portion of premiums to run the business, with the balance going into a pool to cover claims. Naked’s income doesn’t depend on whether claims are paid or not. This business model resolves the inherent conflict of interest in traditional insurance: that paying fewer claims results in higher profits for the insurer. Money left over in the claims pool goes to charities nominated by customers rather than towards company profits.

Instead of filling in forms and phoning call centres, customers can use the Naked mobile app – available for Apple iOS and Android – to manage their policies and claim after an incident. The app includes functionality such as Naked CoverPause™, an innovation which gives customers the ability to pause their accident cover if the car won’t be used for a day or more – instantly reducing the premium for that time. Naked uses AI to pay valid claims quickly and repudiate fraudulent or invalid claims to the benefit of its customers.

According to Nic Kohler, Head of Insurance at Yellowwoods, “We are proud investors in Naked because we embrace innovation that delivers an improved customer experience and enhances fairness for policyholders. Its strong performance over the past six months validates its business model, giving us confidence in its ability to drive further growth and innovation in the months to come.”