With Debt At Worrying Levels, Nigeria’s Foreign Reserves Dips To Record Low – Loses USD 81.1 Mn

As per the latest data from the Central Bank of Nigeria (CBN), the country’s foreign reserves have dipped to its lowest in six weeks.

CBN’s data have it that Nigeria’s foreign reserves now stand at USD 45.09 Bn, short of the USD 45.17 Bn estimated as of 10 June 2019. Between then and now, total reserves dropped by USD 81.10 Mn.

Nigeria’s foreign reserves reached the USD 45 Bn mark and even crossed the threshold in May 2019. And it did seem like the reserves was going to shoot up even further until the recent downturn in fortunes.

In May, the external reserves increased by USD 212.2 Mn to reach the USD 45 Bn mark. In June 2019, it increased by USD 155.6 Mn. The reserves posted in June signaled a 35 percent point increase within a period of three weeks in 2019, which is actually up there as the best figure posted so far this year. The recent decline suggests foreign reserves are in free fall.

On the whole, Nigeria’s foreign reserves have been doing fairly well in recent months and this was particularly evident when the gross value hit USD 45 Bn earlier this year. The fluctuation and consequent decline suffered in recent weeks could be partly attributed to fluctuations in oil prices, due to the sustained tension in the Middle East and uncertainties around the U.S/China trade standoff.

Another reason for the decline could be found in the recent regression in the Nigerian capital market and, to some extent, interventions of the CBN in the Investors and Exporters’ window (I&E).

The introduction of the I&E had done a good job of beefing up the country’s external reserves but according to the governor of the CBN, Godwin Emefiele, there were still a number of issues.

Emefiele disclosed that the apex bank was committed to stabilizing the Exchange Rate and building the country’s reserves through a coordinated policy approach. He also stated that the CBN could consider devaluing the exchange rate if the price of crude falls to between USD 50.00 to USD 45.00, which means depleting reserves.

But as things stand, the reserves stock at the current estimate will be good for financing Nigeria’s current import commitments for the next nine months — unless there is some major turn of events in the works – and this would imply that the economy is relatively viable.

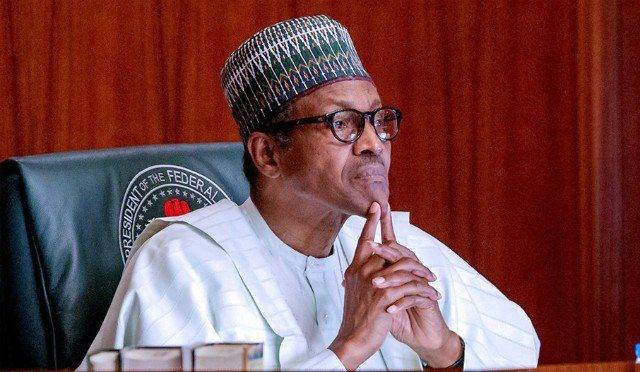

Featured Image Courtesy: pmparrotng.com