Are Foreign Investors Abandoning Africa’s Largest Economy? The Numbers Say “Yes”

Last week, the National Bureau of Statistics (NBS) released its quarterly data on the state of the Nigerian economy and the numbers revealed that for the second consecutive quarter, Nigeria’s gross domestic product GDP has dropped, implying a decline in local productivity.

This week, there’s yet more data from the NBS and yet more bad news. This time, it’s not about the declining domestic economy or the dwindling foreign reserves. It’s about the fact that foreign investors seem to be deserting Nigeria, at least, that is what the numbers say.

According to the NBS, foreign investment into Nigeria in the second quarter of 2019 dropped to USD 5.82 Bn compared to USD 8.48 Bn recorded in the first quarter. Meanwhile, twenty-seven (27) of Nigeria’s thirty-six (36) states seem to have gotten the hardest end of the stick as foreign investment appears to not have reached them at all.

The latest capital importation data released by the NBS revealed Lagos and Abuja as the holders of pole position in the area of foreign investment receipts. In fact, both cities accounted for almost all the foreign capital that came into the country during the second quarter of the current year.

Lagos, Nigeria’s commercial hub, attracted foreign investments to the tune of USD 4.13 Bn in Q2 2019, while Nigeria’s capital city, Abuja, saw USD 1.67 Bn worth of foreign capital being shipped in.

Breakdown Of The Data

The nation had a relatively good run in Q1 2019 when a total of 19 states attracted some amount of foreign capital, with 17 states being left out.

But things seem to have taken a turn for the worse in Q2 2019, during which as many 27 states were unable to turn in any form of foreign investment.

Per the data from the NBS, states that didn’t manage even a single investment from a foreign entity in Q2 2019 after posting at least one in Q1 are Ondo, Delta, Akwa Ibom, Niger, Bauchi, Kwara, Borno, Katsina, Kano, Imo, Cross River, Benue and Adamawa.

On the bright side, foreign capital did reach some states that were ignored in the first quarter of the year. Edo and Nassarawa got investments of USD 1.4 Mn and USD 100 K respectively.

How The Sectors Performed

A look at the latest data shows that portfolio investment remains Nigeria’s biggest source of foreign investment inflows. Portfolio investments accounted for a massive 73.76 percent (USD 4.29 Bn) of total capital importation.

Other investments accounted for 22.41 percent (or USD 1.30 Bn). The least amount came in as Foreign Direct Investment (FDI) which was clocked at USD 222.89 Mn or 3.83 percent in Q2 2019.

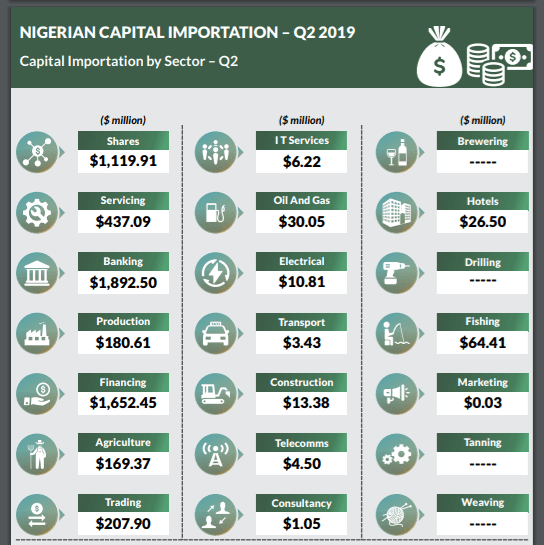

Naturally, some sectors were more affected by the dip in foreign investments into the country in Q2 than others.

The banking sector which has been one of the biggest recipients of foreign investments in Nigeria suffered a huge set-back as it received USD 1.89 Bn in Q2 2019, as against USD 2.85 Bn received in Q1.

Similarly, other areas like financing, shares, and production also suffered from the dip in the country’s foreign capital importation fortunes.

But some sectors did fare slightly better than the previous quarter. Foreign investments into Nigeria’s agriculture sector improved slightly from USD 124 Mn in Q1 to USD 169 Bn in Q2. Other sectors with improvement include hotels, fishing, servicing, transport and trading.

The sectors that had it worse than anyone else were brewing, drilling, weaving, and tanning. These four areas did not get any piece of the action.

How Will The Decline In Foreign Investment Affect The Country?

The continued decrease in foreign investment can only mean one thing — investors are not keen on putting their money in Nigeria at the moment. And this could be due to lack of confidence in the economic policies of the current administration.

The decline in foreign investment is a huge setback for the affected states and this may have had something to do with regression recorded in the Nigerian economy during the same period.

Importantly, the cutbacks on the inflow of foreign capital into Nigeria, particularly in the portfolio investment category, would imply negative development for the Nigerian capital market. It’s always bad news for stocks when foreign portfolio investment takes a hit.

Also, the tepid activity around foreign direct investment in Q2 2019 suggests investors fear for the economic prosperity of the country and have chosen to play it safe by taking their capital elsewhere.

In general, the dwindling foreign investments indicate a bleak future for the individual states and the country at large.

Featured Image Courtesy: Stears Business