Nearly Half The Countries In Africa Are Up To Their Neck In Debt & Can’t Pay Back – IMF

With borrowing on the rise on the African continent — something that has to do with the government of many countries in Africa looking for quick ways to finance their way out of trouble — the International Monetary Fund (IMF) is urging caution.

The IMF is advising African governments to pump the brakes on borrowing while revealing that 40 percent of African countries are in a position where they can’t afford to pay back their debts.

The Managing Director of IMF, Kristanlina Georgieva, has identified Africa as a place of numerous opportunities, though this is threatened by insecurity and other socio-economic problems.

“Africa is a continent of opportunities and what we are looking for is for this opportunity to be harnessed to the maximum. It is also a continent with many troubles; so, we have to be mindful of these risks especially security risks,” she said.

Georgieva also noted that while the Bretton Woods institution is optimistic about some of its investment, it is also concerned about the debt stress levels on the continent.

“Are we worried about debt levels in Africa? Yes, because 40 percent of the countries have gone into debt distress levels. In some cases, we are concerned about that but in other cases, we see that investment is going to pay off over time.”

“Take the case of Kenya, we advise Kenya to be more cautious in building debt but we have seen good macroeconomic policy in Kenya.”

Indeed, the debt stress levels in the East African Community (EAC) has become a cause for worry in recent times. Five of the countries in the region — Kenya, Uganda, Tanzania, Rwanda, and Burundi — have accumulated a debt of over USD 100 Bn in the last few years. And the IMF is advising caution.

“In cases where debt is dangerous like Zambia, we do say you need to get a handle on your debt. In Ethiopia, we say you need to renegotiate some of your debts because it is non-concessional for things that should be on a concessional basis,” said Georgieva.

Meanwhile, the IMF boss emphasized on the sustainability of debt, stating that borrowing is not bad in itself and countries which experienced higher growth did it by borrowing for investments that could generate growth and also eliminating red tape for local and foreign investors.

“One has to remember that debt on its own is not bad. It is bad when it goes with the wrong things and when it goes with the speed that the economy cannot handle,” Georgieva said.

Next month, the IMF is expected to meet with African leaders and the issue of unsustainable debts is to feature in discussions prominently.

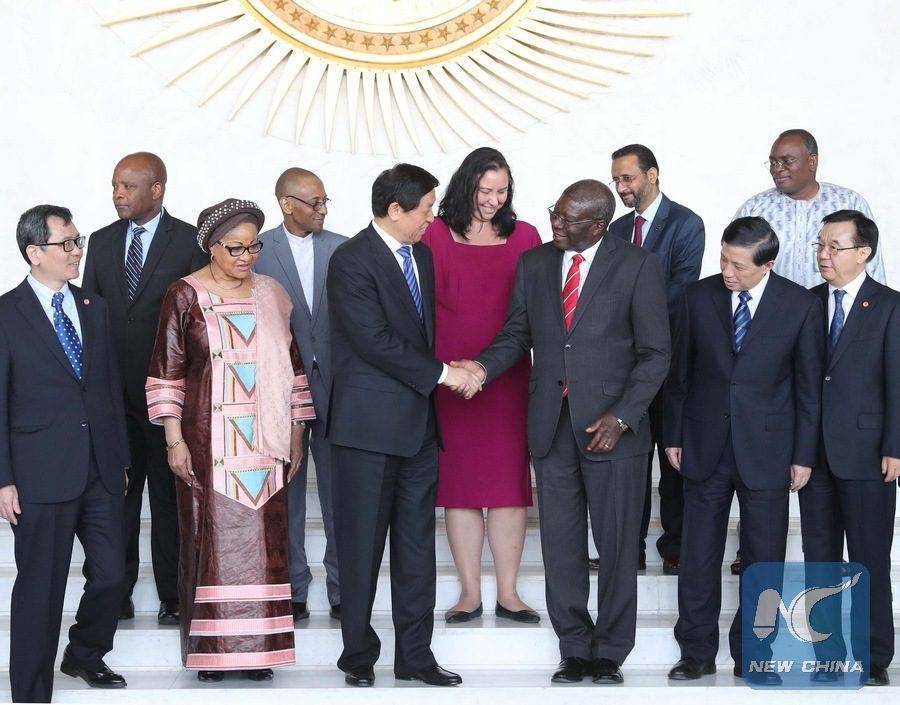

Featured Image Courtesy: XinhuaNet