Chijioke Dozie On Carbon’s Performance/Prospects & Why African Fintech Is The Safari Investors Won’t Stop Riding

The African Fintech Frenzy

Every year, for the last four years at least, funding for African startups in the fintech segment has comfortably outstripped whatever amount of investment other tech startup sectors have managed to rope in.

Actually, it used to be more of a close call some years back. In 2017, just like in the year prior, African fintech generated the loudest buzz and garnered the highest investor interest with the amount equalling USD 30.68 Mn in 47 deals, representing 18 percent of the total funding secured.

Not far behind, Cleantech came second that year with a total of USD 18.1 Mn invested across 19 deals. Essentially, fintech startups took nearly a third of all African venture funding in 2017.

And the gulf-in-class between fintech and ‘others’ has only widened over the last few years. In 2019, as much as 50 percent of the record USD 1.340 Bn raised in total across 427 deals went to the fintech sector where USD 678.73 Mn was invested in 105 deals, buoyed by mega deals led by American and Chinese investors. Fun Fact; the next best sector, Cleantech, scored USD 145.24 Mn — not bad but further behind fintech than ever.

Compared to 2018 values, the funding amount in the fintech sector surged by 138.48 percent last year, though the number of deals only grew by 12.90 percent.

With one of Africa’s flourishing fintech players, Flutterwave, already getting things started in the new year with a USD 35 Mn Series B and Boston-based accelerator, Catalyst Fund, already targeting fintech companies in Africa and other emerging markets with its freshly-minted USD 15 Mn fund, it is more likely than not that the fintech frenzy will continue.

And this sparks interest into why the bulk of Africa-focused venture capital funding is geared towards fuelling fintech.

Doing Fintech Like It’s The Catenation Of Carbon

Before one of Nigeria’s fastest-growing fintech companies, Carbon, became the fintech fiefdom cum challenger bank not-unlike Monzo, Atom, and N26 that it is today, it was a microlending platform known by a really frank name, PayLater.

As part of last year’s rebranding effort which saw a coming together between its OneFi holding company (which had earlier acquired Nigerian payment solutions company, Amplify, for an undisclosed amount) and the PayLater product, Carbon emerged as a one-stop-shop for all things fintech. Something of a digital bank actually, offering services ranging from savings products to investment options, fund transfer, loans, and bill payments.

The new name may have been influenced by the idea of building something as essential and ubiquitous as the sixth chemical element on the periodic table.

While Carbon, which recently expanded into the fintech hotbed that is Kenya in addition to its operations in Nigeria, Ghana, and South Africa, may have taken everyone by surprise with its quiet consolidation and boisterous resurgence, one particular bold move from last year saw the startup lay down a marker.

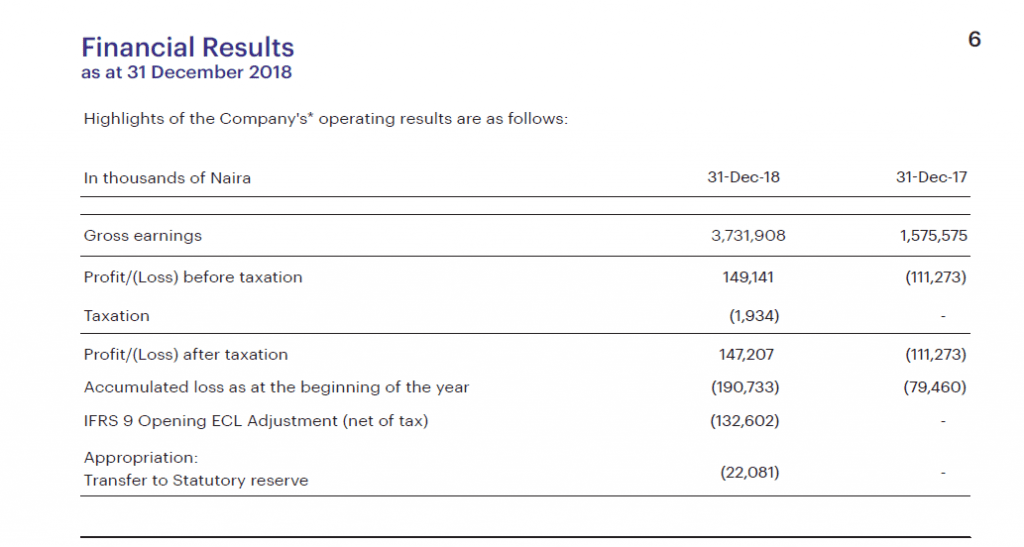

Last year, Carbon pulled off something somewhat unprecedented when it willingly posted on its website company financials audited by KPMG. This was four months after the company obtained a credit rating as a pre-IPO venture. Then, the startup promised to keep making its financials public from that year onwards, regardless of whether the numbers are pretty or not.

For perspective, the list of pre-public (early-stage) that have gone down this path is a very short one, and that’s if a one-item document can be called a list.

Before Carbon, only e-commerce giant, Jumia, had provided a glimpse into what startup financials look like on the African continent. And that was even because first, its parent company, Rocket Internet, was on the verge of going public, and then Jumia itself soon landed on the cusp of an IPO on the New York Stock Exchange (NYSE).

While declaring a startup’s financials is quite common in global tech hubs, it’s a rarity in these parts. Most startups would rather not volunteer such transparency for reasons bordering on reservations on disclosing losses, giving market intel to competitors, attracting unwanted attention from regulators, and guarding against negative negotiation leverage for partners if the numbers are too pretty.

But Carbon went ahead with it anyway, taking the lead and showing everyone else how it’s done. And it helped that the numbers were good too — the company had revenues in 2018 of USD 10 Mn, according to its online annual report, and turned a profit of around USD 500 K. Not bad for a Series A-stage startup in Africa.

Carbon’s CEO, Chijioke Dozie, said the rationale behind disclosing financials had something to do with reassuring investors (current and potential), shaking off stereotypes for Nigeria, attracting the brightest recruitment prospects, and placing Carbon in a good position globally.

Although the company is yet to let everyone in on its financials for 2019 (this will be out in Q2 2020), it did hint at another stellar year in a Medium post wittily titled: This is NOT a Year in Review.

Here’s a summary of some of the highlights of Carbon’s 2019;

- launched in Kenya

- launched Cashback rewards for customers who repaid on time — over NGN 130 Mn returned so far

- became PCI-DSS certified

- went low to NGN 10.00 transfers when others stayed high

- did NGN 51 Bn in bills and payments, NGN 2.8 Bn in fixed investments and NGN 23 Bn in loans disbursed

Why Funders Are So Keen On African Fintech

WeeTracker picked the brains of Chijioke Dozie, the visionary co-leading Carbon with his brother, Ngozi Dozie, and he shed some light on the secrets behind Carbon’s performance and prospects and why African fintech is the scene of so much action.

Source: Forbes

Q: Following Carbon’s stellar 2019, what would you say are the major factors that make fintech such a hot spot in Africa at the moment?

Chijioke Dozie: In a market like Nigeria, for example, 60 percent of working adults are in the informal sector and don’t formally record much of the information that will give them access to mainstream financial services. Fintechs make it easier for many of these individuals to access credit, lowering the barriers to entry and taking advantage of existing infrastructure to connect them to the funds they need.

Fintechs also offer a faster and more cost-effective way to deliver potentially life-changing financial services to a wider range of people than the traditional banking model has done to date.

Q: In the latest African Startup Venture Capital report by WeeTracker, fintech topped the charts by far, attracting investment worth USD 679 Mn. Fintech has topped the chart every year for the last 4 years at least. Why do you think investors are so keen on fintech?

Chijioke Dozie: One of the main reasons why fintech has emerged as a popular choice for investment in Africa is because it addresses the issue of financial inclusion, which is a key enabler for boosting shared prosperity across the continent. For many Africans, financial inclusion is not just about access to a bank account to deposit their money. It is about having access to advisory and business management services that can enable their lives and businesses to thrive and flourish.

Fintech presents a great opportunity to address the pain points experienced by Africans in terms of access to credit, due to an underdeveloped banking system for the mass market. Leveraging the power of the mobile phone, fintechs are well-positioned to serve previously unbanked/underbanked people across the continent.

Q: Besides the reduced fees and attractive rates, what factors are responsible for Carbon’s highly impressive 2019?

Chijioke Dozie: At Carbon, our aim is to enable frictionless access to credit. With this in mind, we have made our processes as hassle-free as possible, making it easy for individuals to access the funds and services they need with maximum convenience.

By lowering the barriers to entry and working with the infrastructure already in place, from Bank Verification Numbers in Nigeria to National Identification Cards in Kenya, we are able to improve access to potentially life-changing funds in an effective and efficient way.

Q: After launching in Kenya late last year, how does Carbon hope to spread its fintech gospel in a country that already has some strong players?

Chijioke Dozie: Our aim is to drive more purposeful and responsible lending in Kenya and to become fully integrated with existing players in the market so that our products can truly impact individuals and businesses as widely as possible.

The Kenyan fintech landscape is indeed a very competitive one. Kenya’s progressive regulatory environment and high levels of financial inclusion also make it one of the leading lights on the continent. We plan to bring some of our learnings from other successful fintech markets to Kenya, as well as explore what has made Kenyan fintech so successful and how this success can be replicated in other markets.

Q: Where will Carbon go next after Kenya and what is the plan for 2020?

Chijioke Dozie: Our aim is to be a Pan-African digital bank for African and Africans in the diaspora, and our expansion into Kenya was the first step in realising that vision. We want to be the most diverse digital finance platform anywhere and we are looking forward to expanding the range of services we deliver to customers in the markets we serve.

We also want to use our experience and expertise to support and encourage budding entrepreneurs across the continent to address the common obstacles to innovation and business growth.

Featured Image Courtesy: TheSparkNG