African Startup Funding Suffered A 57% Slump In Q1 2020 Due To COVID-19

It is no news that the COVID-19 pandemic that is sweeping through virtually every part of the globe is leaving crippled industries, ruined economies, and job cuts in its wake.

The news, however, is found in the narrative that the devastation may have hit the African startup ecosystem too where funding seems to be shrinking.

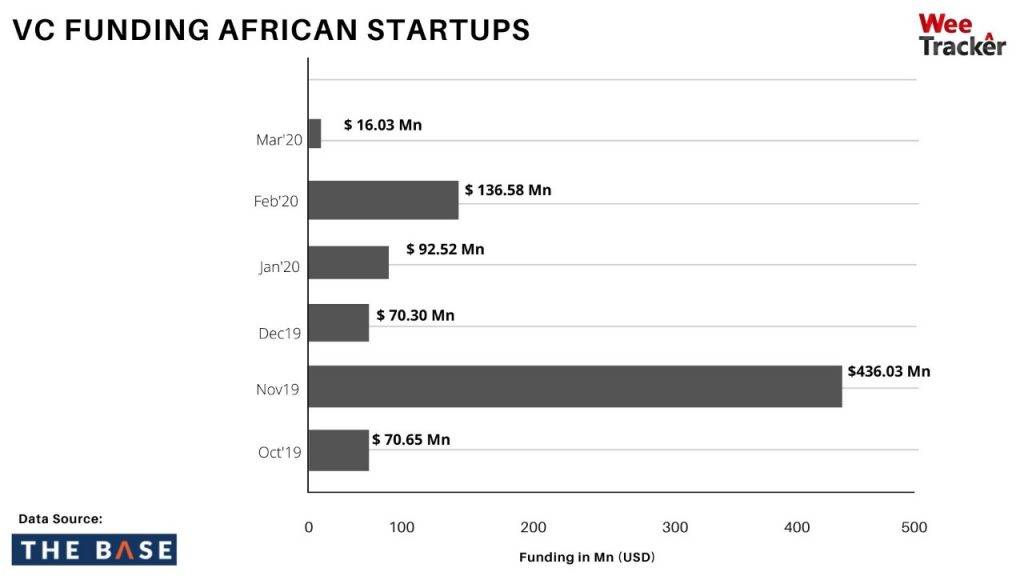

As we at WeeTracker Research have gathered, the cumulative sum raised by African startups in Q1 2020 declined by just over 57 percent when compared to the previous quarter.

In Q1 2020, disclosed African startup funding amounts totaled USD 245.13 Mn. The number of announced deals was 86, including funding from accelerators, incubators, grants, and prize monies.

Last quarter (Q4 2019), African startups raised USD 576.98 Mn in disclosed funding in a total of 109 announced deals. Apparently, there have been a quarter-on-quarter decline in the amount raised and the number of deals recorded.

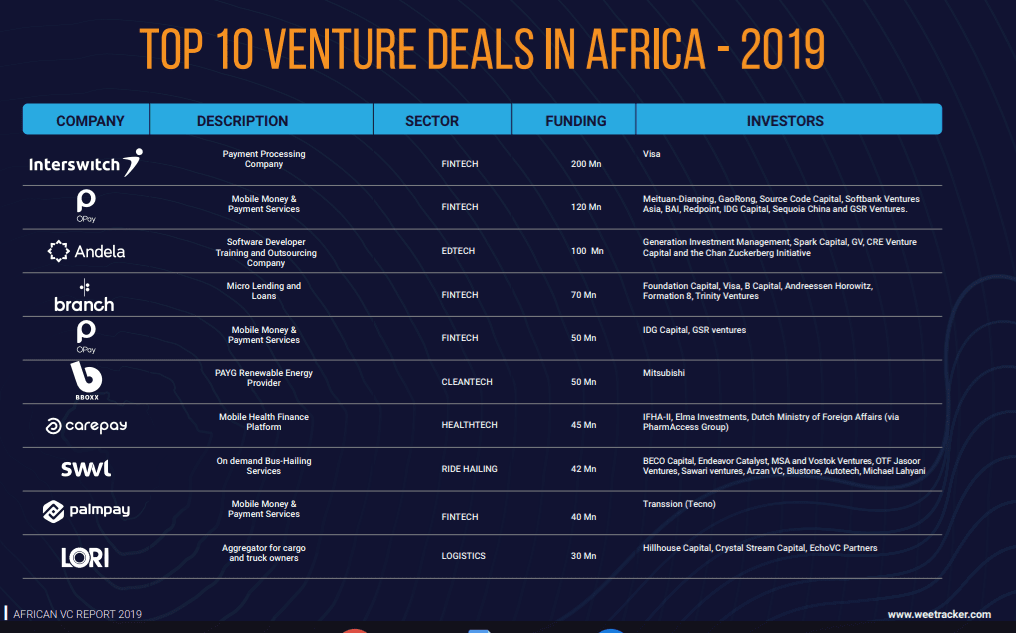

However, it is important to note that the significantly higher figure in Q4 2019 is down to a funding spike recorded between October and December which saw the likes of Interswitch and PalmPay recording big rounds that may have skewed the numbers.

While it cannot be ignored that first quarters are typically slow when it comes to funding, the gap between the two most recent past quarters (Q1 2020 and Q4 2019) is significantly wider.

In Q1 2019, for instance, African startups raised USD 186.09 Mn in total. In the preceding quarter (Q4 2018), the net funding amount was USD 175.86 Mn. The difference between the amounts raised in both quarters was only USD 10.23 Mn, with the bigger funding being recorded in the first quarter of 2019, actually.

But this year things seem somewhat different as the total funding raised in the first quarter of this year compared to the preceding quarter did not only shrink but also went downhill by some margin. For context, the difference between Q4 2019 and Q1 2020 was USD 331.85 Mn.

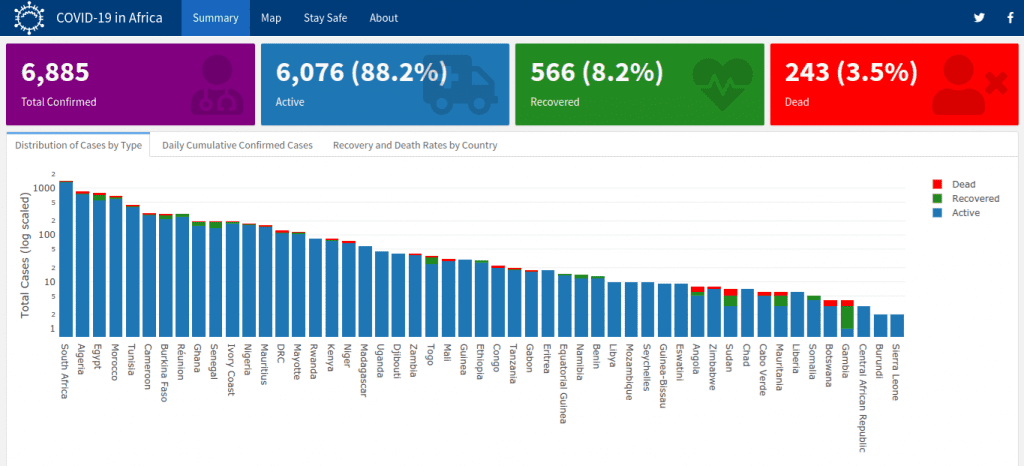

The decline may not be unconnected to concerns that have been rife since the novel coronavirus first hit Africa in the middle of February. At present, Africa’s COVID-19 statistic reads: 6,885 infections, 243 deaths, and 566 recoveries.

Source: COVID-19 In Africa

Since the outbreak, African startup funding has suffered a hard-to-miss slump with funders appearing to be seemingly contented with taking a very cautious approach at this time.

While February 2020 promised much with USD 136.58 Mn raised in total up until COVID-19 struck, March suffered a rather significant malaise with only USD 16.03 Mn raised. For perspective, March accounted for just 7 percent of the funding raised by African startups in the entirety of Q1 2020.

Evidently, the spread of COVID-19 has forced investors and founders to review their funding tables and projections. Thus, deal announcements have clearly declined.

It’s a sentiment shared by serial investor and Ventures Platform founder, Kola Aina.

“COVID-19 has significantly slowed down fundraising activities globally, so it’s safe to say African startups are also affected by this trend, as a significant percentage of investments come from international VCs. Investors are currently re-evaluating how and where they allocate capital,” he told WeeTracker.

Aina added,

“VCs globally are in cash preservation mode, their LPs are asking them to hold off deploying capital, observe the trends or wait it out. However, post-COVID-19 we reckon African startups would have a tougher time fundraising, due to the impending economic downturn/recession that would be more prevalent across Africa.”

On whether the downward trend might be halted sometime soon, Aina said things are unlikely to change any time soon.

“We do not think there will be an improvement any time soon. Africa is headed for a turbulent economic period, a lot of African startups will have to brace themselves for impact and have a prepared mindset and proactive responses for scenarios that might play out,” he remarked.

However, Benjamin Fernandes, founder and CEO of Tanzanian fintech startup, NALA, has a different view of things.

“Funding hasn’t necessarily dried up,” he told us. “For us at NALA, for example, we have had an increase in inbound requests for funding. People know our metrics. So I think people are looking to increase their investment in some companies.”

Last year, African startups raised a total of USD 1.340 Bn as we reported in our annual report. It was the highest ever amount recorded for the African startup ecosystem in a single year. With COVID-19 wreaking havoc all over the globe, it might be hard to get anywhere near that figure this year.

Although it’s rather too early for meaningful analyses, it’s quite obvious that COVID-19 has caused a disruption of commerce on all fronts and this will have a regressive effect on all businesses that require the human element. The ecosystem has clearly seen fewer announcements, though it’s possible companies might have raised quietly.

At the moment, business owners appear to be focused on building runway and making sure their ventures are ready to go through a potential slowdown in sales for a number of months.