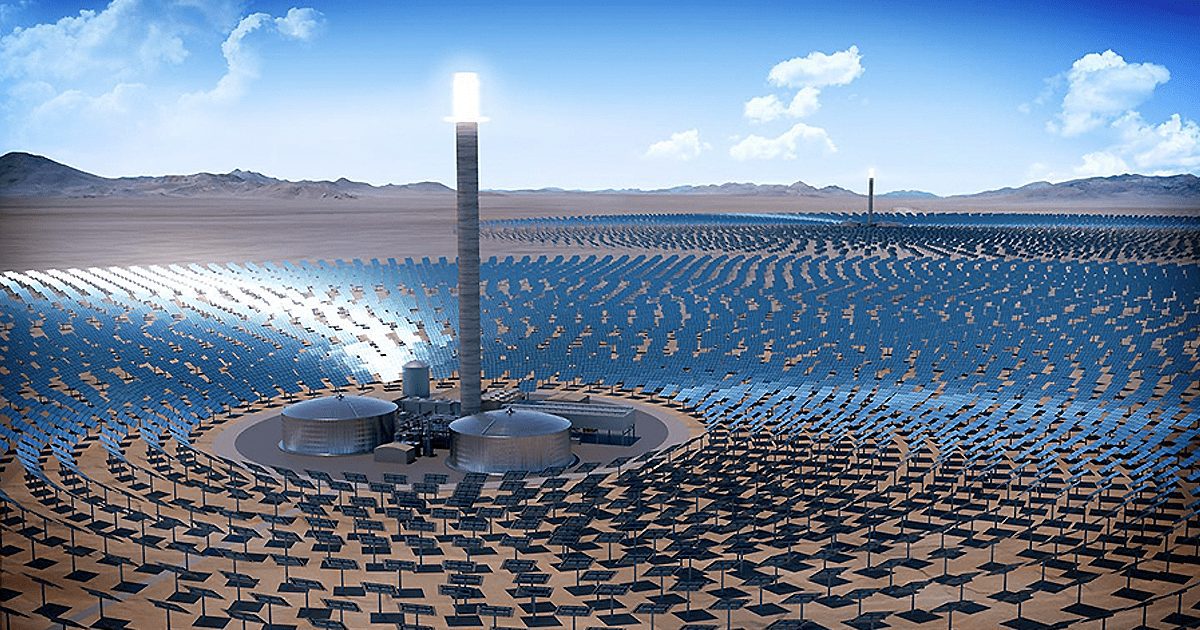

African Cleantech Deals Stand Over Regular VC Funding Like A Familiar Solar Tower

Africa has all the makings of the world’s cleanest economic revolution. By leveraging renewable energy sources to brighten an extensive stretch of urbanization, the continent’s sunshine is not entirely going to waste.

Even though the installations so far are less than half of what’s in place in the UK, cleantech is playing a significant role is supporting the region’s double-swelling populace.

According to the International Energy Agency, renewables form part of what will make industrialization in Africa a reality, over the next two decades.

In a report released last November, the agency predicted a sun-enabled boom in countries across the continent. This forecast could provide hundreds of millions of African homes with clean electricity for the first time.

By now, it is understandable that Africa’s hunger for energy will only continue to grow. But the IEA says it will do so at double the rate of the global average in the next 20 years while it unseats China and India as the world’s most populated region.

The rise of 800 million people from today in 2050, will, for one, bring about a continent where the demand for housing and infrastructure will give birth to a whale-sized crave for energy. On the backs of the by-the-corner industrial revolution, that energy is likely to be renewable.

The IEA report says Africa will lead the way in the global green revolution, an indication that comes with a series of significant deals by both indigenous and global investors.

The volume and calibre of solar deals signed by companies and even governments on the continent stand more significantly above conventional startup deals. Even though tech startup deals shine in numbers, the cash pumped to solarise the continent are units of substantialness, all of which prove the sector’s lucrativity.

Global Attention

Late September 2019, a trio of world powers hatched a USD 350 Mn investment in the renewable industry of Africa. The funds which came from France, Netherlands and the United Kingdom is only a fraction of the USD 1 Bn stash set up to possibly avail 17.5 GW of battery storage capacity by 2025.

The funding, which comes under the auspices of the Climate Investment Funds’ Global Energy Storage Program, is a repeat of the global community’s efforts to step up the power game in Africa.

WeeTracker’s exclusive with Mansoor Hamayun, CEO of Africa-focused utility firm BBOXX revealed that the Series D stage firm’s last USD 50 Mn funding as well came from three intercontinental investors.

Japan’s Mitsubishi (Asia), France’s Engie Rassembleurs d” Energies (Europe) and Canada’s Mackinnon, Bennett & Company (North America), among others participated in the investment.

In August 2019, Africa’s largest banking network Nedbank threw USD 26 Mn into building 40 MW commercial and industrial solar P.V facilities across South Africa. The deal, made possible alongside African Infrastructure Investment Managers, was inked with an English solar project developer known as SOLA Group.

The London-headquartered firm’s chairperson, Chris Haw, did say the partnership is fed by three expert entities whose hands on deck is coming through for a region in dire need of clean energy.

June last year, Nigeria’s solar solutions firm Arnergy raked in USD 9 Mn in growth capital. The Series A-stage firm got the consideration from Norwegian, French, Belgian and Canadian investors. Paris-based investor-led energy investor Breakthrough Energy Ventures who led the investment is backed some notables.

According to business intelligence platform Crunchbase, Bill Gates, Jack Ma, Jeff Bezos, John Doerr and Vinod Khosla are behind the firm, which ties the African solar sector to entrepreneurial warheads.

In an interview with WeeTracker, Abraham Cambridge, CEO and Founder of The Sun Exchange – a South African blockchain-based solar panel micro-leasing marketplace – admitted and emphasized that there is a lot of evidence that the rest of the world is being tipped by the solar opportunities available in the continent.

“That’s certainly a trend that we are seeing on the Sun Exchange online platform, which is specifically designed to enable people from anywhere in the world to own solar assets that power business and organisations in Africa.

Since launching in 2015, we’ve grown to having a community of 9,000+ members across 140 countries. I would certainly say that’s evidence that the rest of the world is taking note of the solar opportunity in Africa,” Cambridge said.

A Perfect Environment

African solar ventures are much like those anywhere else in the world, but what is spectacular about it? For, Sakki Van Dijk, Co-Founder and Director of Solarise Africa—a pan-African energy leasing company for solar PV and other energy assets—it is because of a group of factors.

“Penetration is still very low, so there is a lot of room to grow. In most of the countries, grid prices are high and the demand is much more than what can be supplied. And, the grid is not reliable in some parts of the continent. All these coupled together makes Africa a perfect environment for solar investments,” Van Dijk told WeeTracker.

Solar companies offering subsistence-level energy to consumers with low means of income have brought about a vital basis for the development of the industry.

Investors are putting their money into the off-grid rural market, and they are not wrong about the transformative impact of models that enables customers to repay the cost of a USD 200 entry-level solar system for example, over time.

Such systems provide electricity for children to study at night and can better household health by significantly reducing the reliance on dirty fuels such as kerosene.

BBOXX’s Mansor Hamayun says the key driver of the rise of African solar energy alongside investments is the falling price of solar batteries and storage methods in combination with the uptake of mobile money.

“This has made Africa the first market in the world where solar is now cheaper than other forms of energy for customers at a local level. The market has huge potential which has been recognised in recent months by the entry of strategic investors in the space, including Engie, EDF, Shell and Mitsubishi, which have all invested in BBOXX,” Hamayun explained.

Africa is one of the sunniest continents in the world, as 85 percent of its land received more than 2,0000 KW hours of solar energy per square kilometre every year.

Also, up to 60 percent of the countries’ populated reside in the Sahara, and the neighbouring regions have little or no grid access. Many governments, like that of Mali, Egypt, Morocco, Senegal and even Nigeria are setting up millions of dollars in investments and energy as a basic necessity.

This is at the front of the line. In Morocco, for example, there is a solar project worth USD 780 Mn that will have a total installed capacity of 800 MW -m and be the world’s first advanced hybridization of concentrated solar power (CSP) and photovoltaic (PV) technologies.

Mobile Money

The mobile money factor pointed out by Hamayun is not out of place. Digital loans, challenger banks and payments solutions are literally flooding the continent.

From M-Pesa in Kenya to Fawry in Egypt, PayFast in South Africa and to OPay in Nigeria, the mobile money revolution is a cosmic reaction waiting to complete. In fact, it crossed the 1 billion user mark last year.

With more Africans ditching cash, telcos becoming banks and online payments becoming the thing nowadays, solar firms are able to sell their products quickly and conveniently.

Nowhere else in the world moves more money in mobile phones than Sub-Saharan Africa, where solar is most dominant. SSA currently boasts on 45.6 percent of mobile money activity in the world, whose transaction estimate is at least USD 26.8 Bn in value for 2019 alone.

Sustainability

The Millenium Development Goals of the United Nations promise to bring universal access to electricity by 2030. Nevertheless, half of Africans lack access to energy, which is why Sub-Saharan Africa has the lowest energy access rate in the world as electricity.

According to the IEA, clean cooking is done by only one-third of Africa, while about 890 million people rely on traditional fuels. Of the 1.2 billion people on the continent, 600 million lack access to electricity to the World Bank.

Due to the inconsistency or non-existence of access to the grid, solar services in Africa have taken off as almost 10 percent of African now rely on off-grid energy to light their living spaces.

The prices for solar panels and proper battery technologies are skateboarding downhill, prompting PAYG system pioneers like as M-KOPA, Rensource Energy and Series C-stage PEG Africa to become the darlings of solar development in the region.

Small-scale solar providers focus on the rural off-grid market and have generated ample amount of electricity to power more than just TVs and lightbulbs.

Undoubtedly, such improvements are noteworthy, but there is room for them to embrace more comprehensive and robust potentials. The centrepiece of the powering Africa agenda is improving the quality of light, which requires a sustainable vision.

SDGs

BBOX CEO, Mansoor Hamayun, reminds us that overcoming energy poverty by providing access to affordable and clean energy is Sustainable Development Goal 7. In his opinion, this is the key to solving a host of goals which countries across the world have pledged to advance.

He told WeeTracker that BBOXX has scaled rapidly into new markets and geographies by forging strategic partnerships with global companies, investors and governments from developed as well as developing countries.

“The transition to clean energy is crucial if we are to tackle climate change (SDG 13), thanks to the offset of thousands of tons of carbon emissions.

Electricity enables local businesses to take off and acts as a trigger for economic growth and poverty alleviation, SDG 1. It is equally the entry point to other basic needs, such as clean water and cooking, SDG 6.

Further, as the cost of storing and generating power at home comes down in comparison with the cost of transmitting and distributing electricity through traditional grid networks, we believe that developed countries will also want to diversify their distribution-mix.

The on-grid sector will have a lot to learn from Africa’s off-grid market which is leapfrogging into this new reality.

The Best Does Not Come Without Challenges

According to Solarise Africa’s Van Dijk, there are more challenges in Africa’s solar space than there are in other continents. To explain, he points some of them out:

- A legal framework is non – existant or very unfriendly towards solar.

- Political will from governments are relatively low.

- Skills to design and implement are mostly lacking.

- Costs still very high relative to other countries outside Africa.

- Governments see solar as competition to the grid, i.e. income streams decreasing to government.

The Sun Exchange’s Abe Cambridge says it is hard to quantify challenges in terms of fewer or more. There’s no question that it can be tricky to navigate the policy and economic uncertainty of Africa and other emerging markets.

But on the other hand, the high levels of solar irradiation across the continent make weather conditions much more consistently ideal for solar power than many other parts of the world.

“It’s safe to say, however, that the challenges to solar deployment in Africa and other developing regions are unique and different from those of more developed economies, and require innovative solutions designed to address those specific challenges.

Finance

For example, the main obstacle to deploying small-to-medium solar plants for businesses and organisations in Africa is access to affordable and appropriate finance.

Debt finance from banks is either not available or not an attractive option because the cost of the debt is high. Additionally, getting investments and payments into and out of emerging markets like Africa has historically been costly, time-consuming and high-risk.

At Sun Exchange, our technology solution and business model are built to solve these specific issues, enabling us to facilitate access to extremely affordable solar power for business and organisations, as well as fast and secure cross-border transactions,” he added.

Overcoming energy poverty through access to affordable and clean energy is Sustainable Development Goal 7 and is the key to solving a host of goals which countries across the world have pledged to advance, says Mansoor Hamayun.

“BBOXX has scaled rapidly into new markets and geographies by forging strategic partnerships with global companies, investors and governments from developed as well as developing countries.

The transition to clean energy is crucial if we are to tackle climate change (SDG 13), thanks to the offset of thousands of tons of carbon emissions. Electricity enables local businesses to take off and acts as a trigger for economic growth and poverty alleviation, SDG 1. It is equally the entry point to other basic needs, such as clean water and cooking, SDG 6.

Further, as the cost of storing and generating power at home comes down in comparison with the cost of transmitting and distributing electricity through traditional grid networks, we believe that developed countries will also want to diversify their distribution-mix. The on-grid sector will have a lot to learn from Africa’s off-grid market which is leapfrogging into this new reality,” he concludes.

Go Urban, Think Local

Research shows that innovation in urban areas grows at the same pace as populations. This is because it increased more opportunities for personal interaction and leads the way to the fortress of new ideas.

As a result, urbanities are ideal testing grounds, and directing investments towards them can improve local resilience. There would be a balancing of the overstretched power grids found in many African countries. It would also facilitate nationwide energy efficiency.

In Africa’s most populous nation, the commercial nerve Lagos received 86 entrants every minute. The rate, which is 10 times that of New York, makes new settlements crop up. The rid is yet to pace with the scale of development, and that is almost the same case in other metropolitan hotspots across the continent.

In Lagos, for example, the cost of solar has gone down by 80 percent since 2010, making cleantech options become increasingly appealing to adopt and expand. When the expansion is doubled down on, it leads to a more commercially sustainable approach to achieving universal and reliable power for more Africans.

It would be easier to test solar solutions at a larger scale in urban areas, albeit their innovation hub status. It is hard to imagine a scalable power system being tested in a remote village. To distribute and maintain these systems would be expensive, no thanks to infrastructural issues.

In such areas where the population is limited, piloting scalable systems would be cumbersome Nevertheless, the expansion of solar services in urban and peri-urban areas can subsidize the cost of expansion of such power in rural communities.