The Appointment Of An Ambassador To The U.S After 23 Years May End Sudan’s Hunger For Debt Relief

For the first time in 23 years, Washington has appointed a Sudanese ambassador to the United States. Sudan announced on Monday May 4th that the U.S has approved Khartoum’s pick of the veteran diplomat, Noureldin Satti.

The development signals the growth of warming ties between the two countries, who have for the most part of the past 2 decades, not been on the same diplomatic page.

Omar al-Bashir

It was in 1993 that Sudan entered the blacklist of the United States government. The country was deemed a sponsor of terrorism, over allegations that the administration of Omar al-Bashir was aiding armed groups.

The situation gave birth to something which has lingered in Sudan for years: being ineligible for badly needed debt relief and financing from the IMF and the Word Bank.

For years, the U.S accused Sudan of training and supporting the attackers, but Sudan repeatedly denied the charges. The country, however, agreed to some settlements in a bid to be removed from the bad books of Washington.

The al-Bashir government was ousted last year to make way for a new transitional administration which came into power in August 2019. Not only has the change in leadership benefitted press freedom in Sudan, but has also paved the way for the country to bolster its international standing.

By mending ties with the United States, it is working to remove itself from the said blacklist and finally plead its own cause on the table of debt relief providers.

Warming Ties

Apart from labelling it as a terrorism sponsor, the 1993 designation by Washington has decimated Sudan’s economy. But things got off to another, better start when Sudan’s Prime Minister, Abdalla Hamdok, visited Washington in December 2019.

One of the results of the visit was the two country’s agreement to exchange envoys. Noureldin Satti has served as Sudan’s ambassador to France in the 1990s. He also worked with the United Nations’ peacekeeping missions in Congo and Rwanda.

Should these recent developments turn out productive, Sudan might finally be delisted from the State Sponsor of Terrorism Designation (SST). The U.S has given no smile towards terrorism, which is why it added more countries to its recent travel ban list.

An immediate impact of the delisting will be the American government’s ability to vote in favor of IMF and World Bank debt relief packages as well as other multilateral loans and financing.

An example can be drawn from the dealings facilitated by U.S. Ambassador to Somalia, Donald Yamamoto, resulting in lined-up plans for the European Union, United Kingdom, and Qatar to cover USD 150 Mn of Somalia’s USD 330 Mn debt to the IMF.

Norway, on its parts, has agreed to pay almost USD 360 Mn to clear Somalia’s debt with the World Bank. All these wouldn’t have been possible without international diplomacy, the like of which Sudan is now after.

Debt Overload

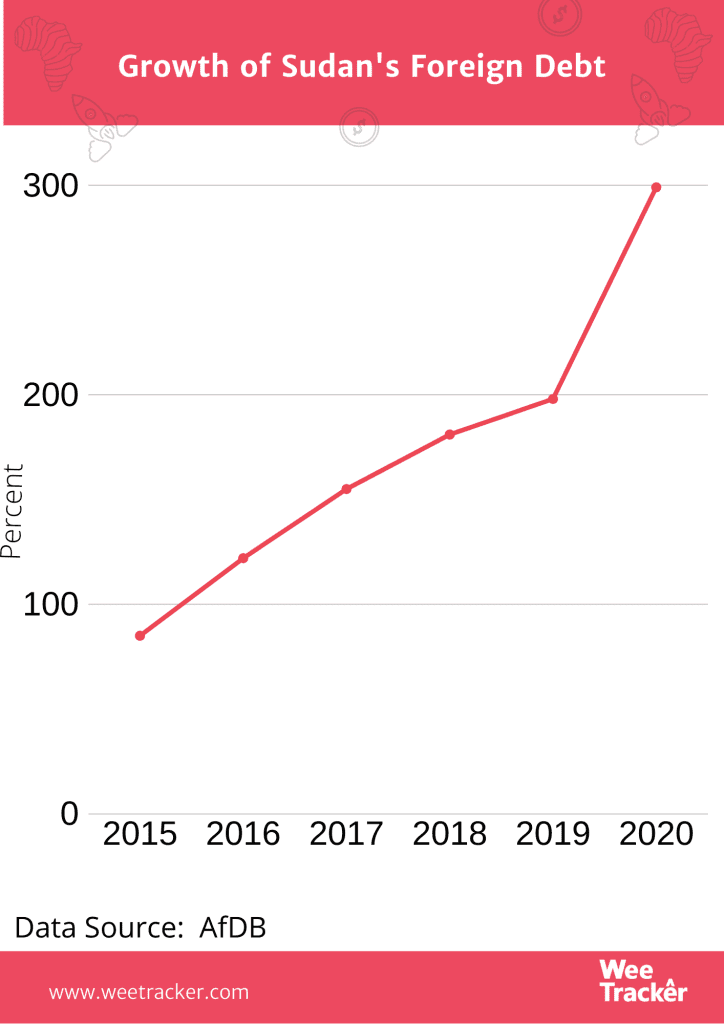

The ouster of al-Bashir, for one, rekindled interest in long-defaulted Sudan loans. Sudan’s debt has been proven troublesome for the best part of the decades before the fall of this African strongman. It is part of a highly opaque market of legacy debts of countries which have been cut off from the rest of the international community.

Much of the country’s distressed debt trading revolves around a state-guaranteed loan issued in 1981 as part of a debt restructuring agreement with a principal of USD 1.64 Bn.

It was not long after that the government defaulted again on its obligations on the loan. Previous estimates are that the almost 4 decades of unpaid debt interest amounts to USD 7.99 Bn.

However, being an SST designate does not stop other countries or country groups to provide Sudan with debt relief. Should the terrorism designation be eventually lifted, IMF and World Bank loans can move forward. In fact, Sudan is eligible for debt relief under the Heavily Indebted Poor Countries (HIPC) Initiative.

By some complex bureaucratic maneuvering, the United States would be able to write off Sudan’s debt, essentially by having the State Department pay a fraction of the debt back to Treasury on its behalf.

That requires congressional authorization through spending bills. Arrears, nonetheless, may still prevent multilateral lenders from assisting Sudan financially.

Papering The Cracks

Several steps have been taken by Sudan to show the U.S that it is ready to be removed from its bad books. Not only has it magnified counterterrorism cooperation with the U.S, it is also looking to negotiate settlement with the families of the victims of the terrorist attacks executed with alleged Sudanese-supported materials.

Money laundering is also being looked into to counter the funding of terrorism regime. Sudan looks to establish a strong anti-money laundering body which will make it possibly Herculean to finance armed groups with the aid of financial institutions such as banks.

Sudan will also need to go in many ways to show the global community that its present government prioritizes counterterrorism in a bid to safeguard its financial sector from the threat of abuse. Reforming the banking sector is also important to encourage private investments.

In this country, banking supervision remains weak, and the Central Bank’s ability to crack down on and expose the corrupt practices of banks remains largely untested.

Favor For A Favor

Being delisted means Sudan will be able to position itself as an investment destination, especially for American companies. The more important thing presently, nevertheless, is being able to access debt relief. And, the World Bank does have some conditions.

Carolyn Turk—the World Bank’s Country Director for Ethiopia, Eritrea, Sudan and South Sudan—said in Khartoum last year, that Sudan needs to show commitment to the reduction of poverty by an over-time policy change.

“For debt clearance and access to international financing, IFI’s need to be convinced that Sudan will not become further indebted and that the Sudanese economy is on a defined a sustainable pathway to reform a arrears clearance,” Turk told the meeting which was attended by government senior officials.

Getting the U.S to finally appoint a Sudanese ambassador is a critical step in the right direction. There is now reason to believe that, with the experience and help of Noureldin Satti, Sudan will be able to go one better and meet the requirements for debt relief.

Indeed, it so happens that Sudan is one of the most indebted countries in Africa. It would be interesting to see how this may change in the coming years, now that it is grooming to have the U.S as a diplomatic ally.

Photo by Randy Faith via Unsplash