What Sparked The Decline That Dumped Kenya’s Mobile Payments To A 13-Year Low?

It’s the year 2007 and the month is March. Nothing to see there, only that it signals the time when East Africa’s largest telco, Safaricom, put Kenya on the road to solving the financial inclusion puzzle.

That was the year M-Pesa came to life. Co-owned by Safaricom, the popular mobile money transfer service kickstarted Kenya’s journey to becoming the capital of financial technology innovation in Africa.

Kenya’s fintech revolution has helped the country achieve near-total financial inclusion, currently at 82.9 percent; the highest on the continent. Buoyed by M-Pesa which commands a 98.8 percent market share as of last December, mobile payments are commonplace in Kenya, growing in leaps and bounds through the years.

But that’s not what this gist is about, there’s a shocker in the works.

Mobile payments suffer spectacular slump in Kenya

It’s the year 2020 and a terrible viral outbreak is upending everything. And for the first time since M-Pesa came into existence (fun fact; it’s been 13 years), mobile payments have underwhelmed in Kenya.

To state it clearly, payments made through mobile phones and tablets have registered its lowest year-on-year Q1 growth in the 13 years since Kenya witnessed the arrival of the first mobile money platform in the country.

Official statistics from the Central Bank of Kenya (CBK) indicate that mobile payments in Kenya for Q1 2020 (January to March) amounted to about KES 1.087 Tn (USD 10.17 Bn). It’s an increase, alright. But not as much as what’s typical.

Before now, the lowest Q1 growth rate recorded was 6.9 percent in 2017/2018. The highest-ever mobile payments growth recorded was in Q1 2009 which saw an astonishing 459 percent growth compared to Q1 2008.

On paper, it seems like a decent sum. After all, it’s a KES 22.3 Bn (USD 208.66 Mn) rise and it does represent a growth of 2.1 percent compared to the same period last year which saw KES 1.065 Tn (USD 9.96 Bn) in transactions.

But the devil is in the details. The mind-boggling bit is found in the fact that the latest year-on-year Q1 growth in mobile money deals is the lowest in Kenya since Safaricom co-launched M-Pesa. And this decline was anything but expected.

And there’s more data

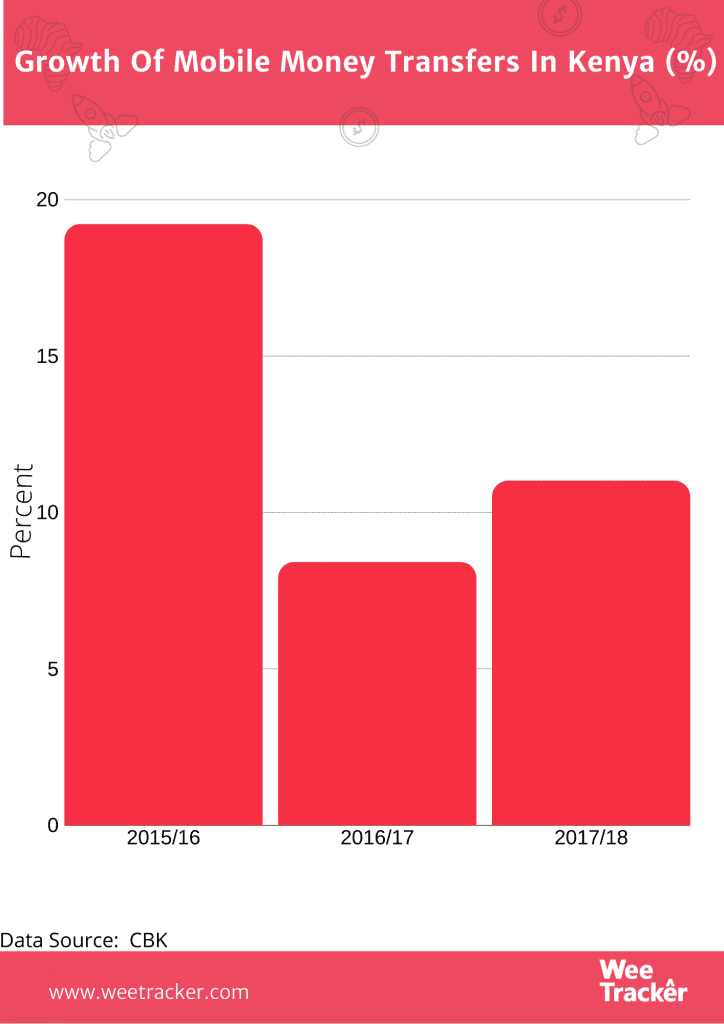

Mobile money transactions are the most common form of payment in Kenya. Total mobile money transfers have recorded strong growth every year since 2007, even more so in recent years at 19.2 percent, 8.4 percent and 11 percent in 2015/16, 2016/17 and 2017/18, respectively.

Peer-to-peer (P2P) transfers have exhibited even sharper rates of expansion at 35.8 percent, 21 percent, and 10.57 percent over the same periods. The latest figures, thus, signal a significant deviation from what has always been the norm.

The CBK’s latest data further showed that total mobile money transactions in the January-March 2020 period stood at 449.21 million, slightly reduced from 460.11 million to the same period in 2019.

The average value per transaction in the first three months of the year was approximately KES 2.4 K (USD 22.46) compared to KES 2.3 K (USD 21.52) previously. This would imply that Kenyans are transacting more value via mobile channels while doing fewer transactions.

Also, daily transactions rose marginally, averaging KES 11.94 Bn (USD 111.72 Mn) in Q1 2020 compared with KES 11.83 Bn (USD 110.68 Mn) the year before, while agents numbered 240,261 in March. This implies that an additional 13,304 outlets have been rolled out compared to the same period last year.

Did the waivers on mobile money fees backfire?

The oddity of this unexpected slump is made even more baffling by the fact that mobile payments had been tipped to soar like never before in the country after the COVID-19 outbreak forced certain measures, some of which were “pro-digital payments.”

On Monday, March 16, Kenyan authorities reached an agreement with mobile money operators to waive charges for person-to-person transfers of less than KES 1 K to encourage cashless payments. This was part of sanitary measures aimed at preventing the spread of the virus which is thought to also spread through cash (however contestable).

Apart from the waivers on mobile money fees, the CBK also more than doubled the daily mobile money transfer limit to KES 150 K from KES 70 K. Also, the cap on daily transaction was lifted to KES 300 K from KES 140 K. Plus mobile money users are now allowed a maximum stash of KES 300 K in their wallets; 3X the former amount.

There were early indications that the revisions mentioned above were encouraging Kenyans to do bigger but fewer transactions. But that bit is understood to have been rendered moot by the fact that it has been explained that the impact of the measures to boost digital payments in the face of the contagious coronavirus pandemic was not to be felt until April. And that’s beyond the scope of the just-released Q1 data.

Or was it COVID-19?

Kenya’s first COVID-19 case was recorded on Friday, March 13, a full one month after the first COVID-19 patient in Africa was announced in Egypt.

Since then, the case count has risen to just over 1,000 and economic activity has been stalled by the regressive impact of the public health guidelines. In Kenya, various forms of containment measures including partial trade lockdowns and travel restrictions have been in place since March.

This has undoubtedly impacted trade. Stanbic Bank Kenya’s Purchasing Managers Index (PMI) survey recently found that business deals in the private sector had hit its lowest levels in more than two years.

The slump has meant that it is no longer business as usual for many businesses. The biting economic hardship is thought to have cut consumer spending.

However, the timing of the slump suggests that the decline in mobile money spends may have even begun much earlier in the year. This is because COVID-19 and the consequent trade-limiting restrictions did not happen until the middle of the final month of Q1 2020.

Else, it would imply that those final two weeks of March 2020 were particularly damaging. And that, perhaps, the three fewer days in February 2020 knocked a sizeable chunk off of the figure, as has been the case in certain years.

While it remains unclear what exactly caused mobile payments to register its slowest ever growth pace in Kenya, there are many who, in the meantime, would put it down to the notion that nothing’s staying the same in what has, so far, been a rocky year for the world.

Featured Image Courtesy: AviationBusinessMiddleEast