Africa Is Paying Covid-19’s Price In Gold

Over the years, huge mining operations in Africa have generated significant profits for foreign companies. Seeing the potential, the continent’s governments are looking for ways to harness more revenues from the sector in to aid economic development.

With coronavirus affecting a lot of industries around the world and nearly crippling economies in its wake, there’s reason to believe that the pandemic will as well mar Africa’s mining, especially the sector of gold.

The Ashanti Conundrum

AngloGold Ashanti is the third largest gold producer in the world, and the largest in Africa. The company, with 21 operation bases in 4 continents, produced 3.3 Moz and employs 34,263 people in 2019.

2020, however, now proves uncertain for the mining firm as the effects of coronavirus have sent shockwaves throughout the industry.

After South Africa started easing its lockdown, AngloGold resumed operations at a capacity of approximately 50 percent. But 164 of its workers tested positive for the novel coronavirus infection, forcing the company to temporarily close its Mponeng mine in South Africa.

At the site, the firm carried out tests for 650 workers after detecting its first case last week. Tests were called for by the Association of Mineworkers and Construction Union, as other companies like Harmony Gold Mining and Impala Platinum reported coronavirus cases. The body warned that failure to detect the virus could lead to “a crisis of epic proportions”.

The well-documented national lockdown of South Africa shifted to level four restrictions this month (May), giving room for open-pit mines to reopen at 100 percent capacity, while underground operations could resume at 50 percent capacity.

President Cyril Ramaphosa did warn that coronavirus cases could increase as people went back to work in a bid to reopen the nation’s economy.

According to African Business Magazine, JSE-listed AngloGold is one of Africa’s top companies, with market capitalisation of USD 8.8 Bn. The company which was formed in 2004 by the fusion of the South African AngloGold and the Ghanaian Ashanti Goldfields Corporation, generated some USD 3.5 Bn of revenue in 2019.

It Adds To Problems On Ground

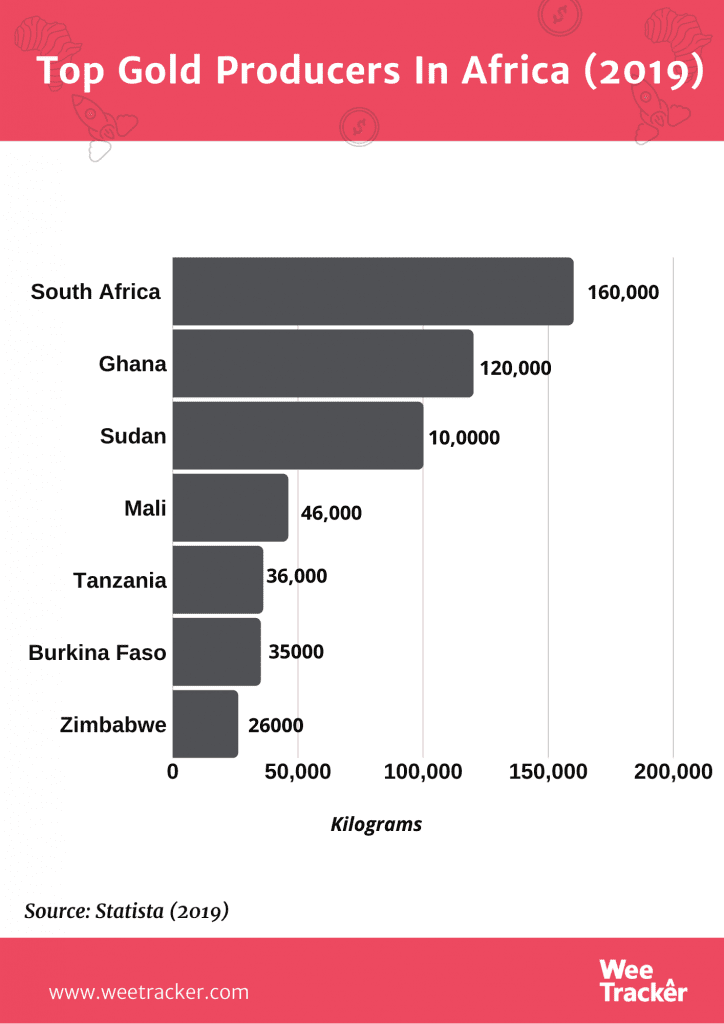

South Africa is the headquarters of gold in Africa, mining up to 160,000 kilograms of the lustrous metal in 2019 alone. According to the CEO of the mining industry’s body, Mineral’s Council, coronavirus is likely to cause an 8 to 10 percent fall in mining production in 2020.

Lest one forgets, most mining firms in the continent operate in South Africa, which is now the epicenter of Covid-19, economic recession and business uncertainty in the entire continent.

South Africa is not just the leading producer in Africa, but also the largest platinum, chrome and diamonds producer in the world. The lockdown is, actually, not the only thing that is affecting mining production in the country. South Africa’s gold mines have been slowing every year since 2008, with 2013 as an exception when production went up by a few tonnes.

Despite being home to the world’s deepest gold mine, Mponeng, it struggles with increasing electricity and labor costs. This has forced many mines to close operations in the last couple of years.

In 2019, there was a fall-off in diamond, iron ore and coal production in South Africa, all of which pulled the industry down by 10,8 percent. This marked the mining sector’s biggest decline since the first quarter of 2016.

Despite a positive showing from both copper and manganese, a slump in gold and diamond production in 2019 dragged overall mining down.

Gold Prices Aren’t Stable Either

Gold prices are not spared in the coronavirus crisis. Yesterday (May 26th), the commodity fell by 1 percent as major economies eased their movement restrictions to fuel hopes of economic recovery.

As an effect, dealers in China, a top global consumer, sold gold at discounts of between USD 50 to USD 70 an ounce (USD 1.61 to USD 2.25 a gramme).

China, currently, is the prime driver of the mineral prices in the world. A number of African countries have become key beneficiaries of the process. The country, being unable to meets it annual demand for major minerals, imports more than USD 100 Bn worth of base metals on a yearly basis, consuming over 25 percent of the planet’s supplies.

China’s gold imports via Hong Kong in April fell short of its exports for the first time since at least 2011, as measures to contain the spread of coronavirus hammered demand in the top consumer. When it comes to the provision of key minerals for China’s economy, Africa plays a substantial role.

More importantly, China has shown a growing interest in the mining belt of central part of Southern Africa, comprising Zambia, Tanzania, and Mozambique. The area is well endowed with copper,iron, gold, manganese, and other base metals.

European countries sold the most gold exports in 2019 with shipments valued at USD 109.4 Bn or over a third (37 percent) of the worldwide total. Asian exporters generated 30.8 percent worth of gold exports, while 12.1 percent worth was shipped from North America.

Gold suppliers in Latin America excluding Mexico but including the Caribbean came in at 7.1 percent. It was trailed by Oceania (6.5 percent) led by Australia and Papua New Guinea. For the same period, Africa had 6.5 percent. It is too early to be able to determine how things would turn out, especially as Covid-19 has disrupted one too many things in a variety of ways.

Further Complications

South African gold mines already have some of the world’s highest production costs, averaging about USD 1,000 an ounce, according to RMB Morgan Stanley. This goes in many ways to make the industry more vulnerable to emergencies such as coronavirus.

While thorough transparency in currently lacking in the industry, there are uncertainties plaguing gold mining and export in Africa. Covid-19, logically, is expected to make things worse.

For instance, the 2019 Mining in Africa Country Investment Guide (MACIG), Ghana’s high tax burden has stalled exploration projects and deterred new investors, leading to a dearth of greenfield exploration.

Gold is becoming a safer option for investors, a sign that there will always be demand for the commodity. In Uganda, for example, gold shipments stood negligibly under USD 10 Mn about a decade ago. But, in 2018, gold shipments came in front of coffee for the first time in the East African country’s economic history.

In South Africa, it may be possible for some mines to achieve a quarter of their normal productions with half their staff capacities. Cutting costs to restructure might also work, but a substantial impact of Covid-19 is inevitable.

Photo by Shane McLendon via Unsplash