Kenya’s Biggest Source Of Foreign Currency Is Bleeding Dangerously

Kenyans abroad are sending a lot less money back home

Like many low- and middle-income countries, remittances — which are basically funds sent home by nationals living/working abroad — play a significant role in supporting families, improving living standards, and generally bolstering the local economy.

But remittances have nosedived since COVID-19 went from outbreak to pandemic, and in Kenya where funds repatriated from abroad are the biggest source of foreign currency, things may be going very south.

Data from the Central Bank of Kenya (CBK) indicates that the country’s biggest source of foreign capital inflows is shrinking. Last month, Kenyans living outside the country sent home all of USD 208 Mn, some 9 percent less than the amount sent home in March.

The dip in remittances is not unconnected to the shocks caused by the global pandemic and the situation might yet worsen. The country’s apex bank expects funds sent back home to shrink by as much as 15 percent for the whole of this year. The plunge is also expected to have a broader impact on the economy for the rest of the year.

The CBK’s remittance data reflects a dip in transfers from Europe, the Middle East, and some other regions, though inflows from the U.S. and Canada sort of held their own, contributing about 58 percent of the total sum for May.

By contrast, remittances from the U.K., Germany, South Africa, U.A.E., Saudi Arabia, and other Eastern Africa countries, contracted.

Remittances, together with exports, and foreign investment flows (direct investment and portfolio investment), make up the sources of foreign currency for most developing economies.

However, with the world still reeling from the impact of COVID-19, inflows have shrunk following the stalling of trade and the crippling of many businesses.

With jobs at risk and pay cuts in play across industries all over the globe, financial stability and disposable income have been hit. And so too have remittances, which appear to be plummeting in Kenya and pretty much everywhere else too.

Examining the remittance situation across Africa

Remittances are the means through which much-needed cash get to millions of families in Africa directly. They also make up one of the continent’s main sources of foreign currency. In 2018, officially recorded remittances were worth USD 46 Bn in Sub-Saharan Africa, easily eclipsing the USD 32 Bn that came in via foreign direct investment (FDI) that year.

The Organisation for Economic Co-operation and Development (OECD), a club of mostly rich countries, reckons undeclared remittances could be worth between USD 16 Bn to USD 35 Bn extra a year.

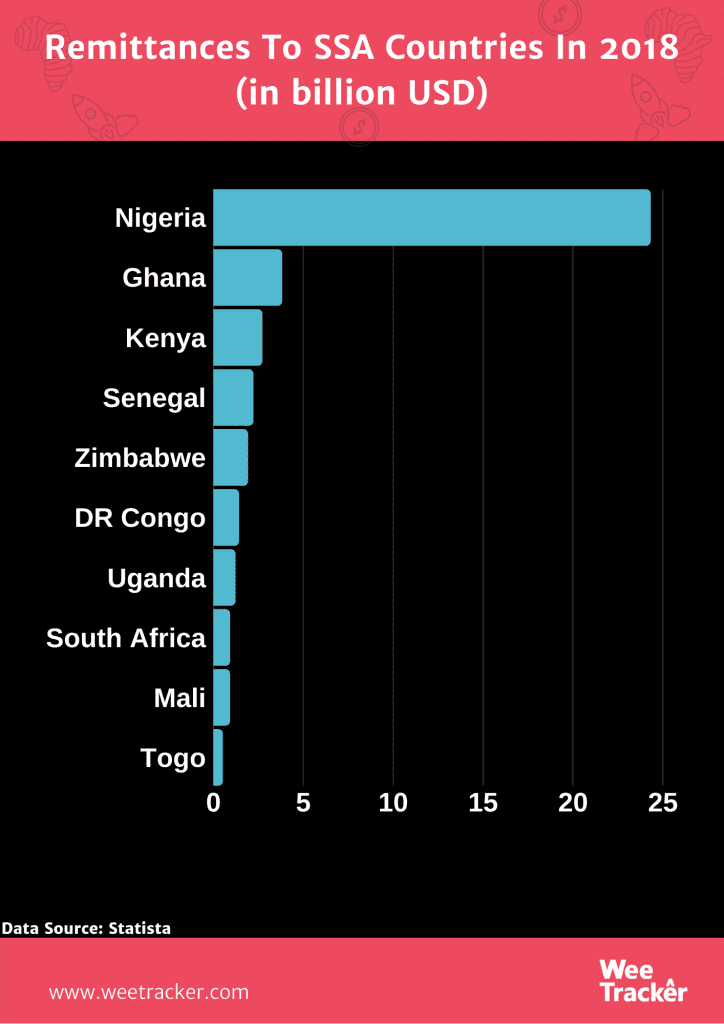

With a sizeable diaspora spread throughout the world, Nigeria is, by some distance, the largest recipient of remittance flows in Sub-Saharan Africa, recording USD 23.8 Bn in 2019. Ghana comes second with USD 3.5 Bn and Kenya is third with USD 2.8 Bn.

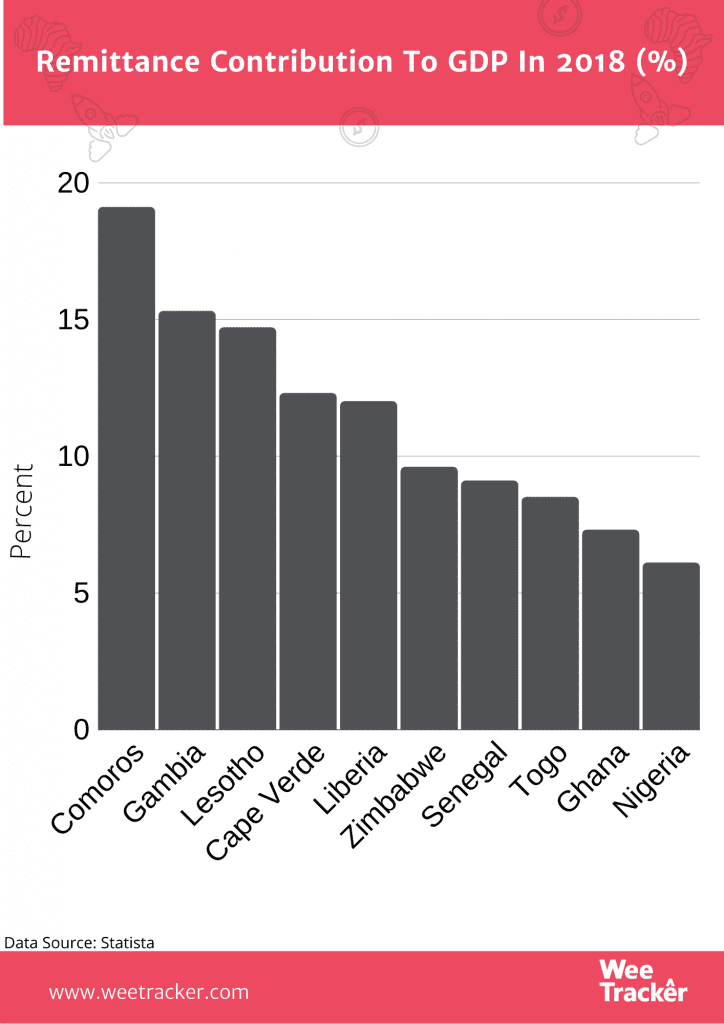

Egypt was the fifth-largest global recipient of inward remittances in 2018 (only behind India, China, Mexico, and the Philippines), at USD 29 Bn and the largest Africa remittance receiver. Kenya is the fourth-largest recipient of remittances in Africa, and this income is the largest source of foreign exchange for the country. though it accounts for only 3 percent of the country’s GDP.

For a better insight into the importance of remittances across Sub-Saharan Africa, look no further than South Sudan where remittances worth USD 1.3 Bn accounted for 34 percent of its GDP in 2019. In Lesotho, remittances are worth almost 16 percent of GDP. In Senegal, they amount to 10 percent of GDP.

However, there may be a storm coming. According to a World Bank forecast, Sub-Saharan African countries will see remittance flows plunge by 23.1 percent to USD 37 Bn in 2020 in the wake of the economic downturn caused by the coronavirus pandemic.

In 2019, remittances to Sub-Saharan African countries dipped by 0.5 percent, amounting to USD 48 Bn. However, the World Bank forecasts there will be a 4 percent recovery to USD 38 Bn in remittances flows next year.

But for now, though, the remittance dip is on. In Nigeria, where remittances make up 6 percent of GDP, inflows dropped by 50 percent in February, according to the country’s apex bank.

As covered by The Economist, remittances are falling sharply across Africa. Per the comments from one payments company, transfers from Britain to East Africa may have fallen by 80 percent in April. Another remittance company saw flows from Italy to Africa drop by 90 percent during the same period.

Featured Image Courtesy: Quartz