Africa’s Private Company Data Tool, THEBASE Crosses 4000 Subscribers

What was launched as a free tool for investors, corporates and the startup ecosystem has now become a 4300+ strong subscribers product.

From Govt. organisations to giant research houses, THEBASE sees an average of 200 subscribed users scouting the platform every day to search for information on African startups, Venture Capital Deals and Africa focussed investors portfolios.

For the uninitiated, THEBASE is an Africa focussed market intelligence platform powered by a team of analysts, and intelligent crawlers searching for startups, private companies & VC information.

The SaaS product focusses mainly on financial and information data on African private market and delivers data, research and technology covering the private capital markets, including venture capital, private equity & Mergers & Acquisition.

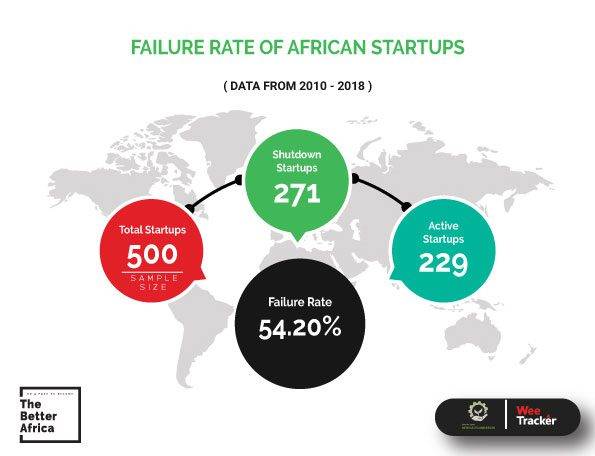

Data from THEBASE is the backbone of WT’s annual reports on the state of venture capital in Africa, WT report on the failure rate of startups in Africa and a plethora of articles on WT, Quartz, DW and TechCrunch amongst others.

The information on THEBASE is becoming a reference check for many international researchers, and data is becoming part of everyday conversation in our ecosystem. Apart from the regular compilations, deal tracking and market mapping of companies, THEBASE has been able to generate insights on key & specific topics.

The failure rates of startups being an important aspect of data tracking could be uncovered using data of startups from 2010 onwards.

For the ease of navigation, THEBASE platform currently displays data under two primary categories:

Startups – The startup section on THEBASE contains detailed and all-inclusive profiles of active/inactive startups & SME businesses in Africa, virtually looking across 45 industries. A typical profile provides detailed information of the company, its founder(s), founding year, funding history, acquisitions (where applicable), team members, similar companies and the company’s social links.

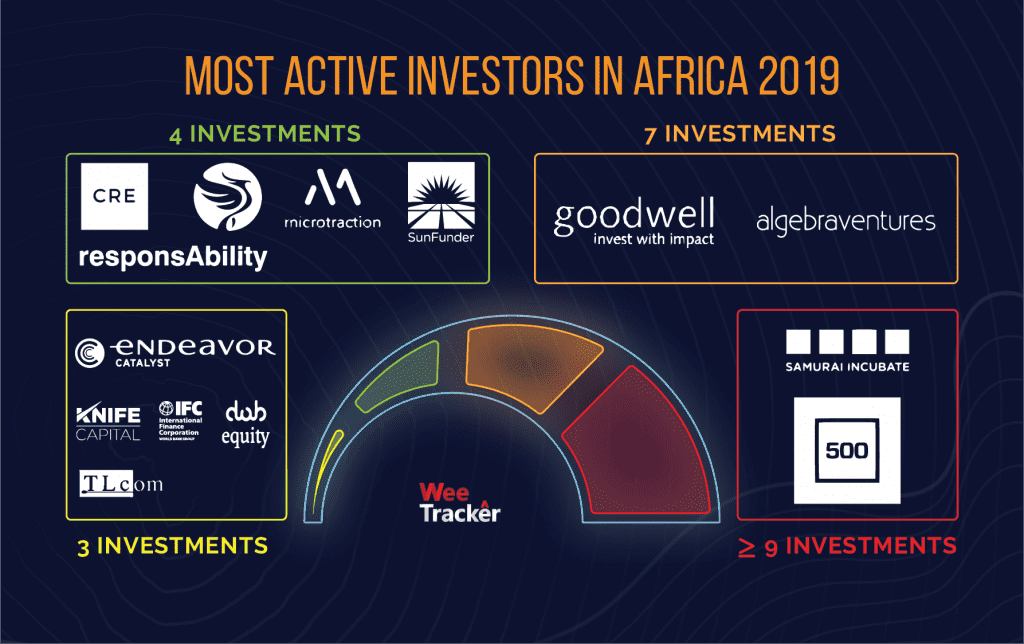

Investors – The Investors is a well-researched section of the profiles of VCs/PEs/Incubators/Funds/Angel Investors active on the continent. From finding the investment thesis, focussed sectors and a list of verified investment transactions, we’re doing all the work so that you don’t have to.

Next Milestone

Today, we are aggregating millions of datapoints from thousands of sources and are building up on our machine learning algorithms and data visualization tools to help corporations see where Africa is going tomorrow, today.

If you still haven’t signed up, Maybe its time to subscribe now.