Kenya Turns The Screw On Digital Lenders While “Costly” Telco Lending Gets Free Pass

By now, it must have become clear that the controversy surrounding digital lending in Kenya is a never-ending matter that has been over-flogged. But the matter just keeps getting more complicated.

Yet again, the ball has been set rolling on a plan to check digital lending, but this time, the plan is to put quick loan startups completely under the thumb of Kenya’s banking regulator.

Not exactly a bad idea, just that there’s another type of ‘expensive’ lending that seems to be progressing unchecked in Kenya: The lending of non-convertible virtual currencies such as Okoa Jahazi (airtime currency lending by leading telco, Safaricom) and Okoa Stima (prepaid electricity tokens lending by the same telco and the utility company, Kenya Power).

So far, Kenyan authorities have not displayed any willingness to include all those products in the lending regulations even though they can technically be classified as digital lending that is not exactly cheap.

Due to increased demand for quick loans, unregulated microlending platforms have flooded Kenya in the last few years. Currently, there are up to 49 such lending startups in the country, some of which have since formed an association.

As a side-effect, the proliferation of digital lenders has produced a surge in predatory lending practices; from sky-high interest rates and unreasonable loan tenures to privacy infringements.

Kenyan authorities have been keeping an eye on the situation, announcing a raft of regulatory measures while attempting to clampdown on predatory lenders.

And after barring digital lenders from blacklisting loan defaulters with Credit Reference Bureaus (CRBs) back in April, it was reported on Monday, July 20, that a new bill in parliament seeks to give the Central Bank of Kenya (CBK) the power to regulate monthly interest rates charged by the digital mobile lenders.

Payday lenders will, among other things, be compelled to seek the CBK’s approval before they can increase lending rates and other loan charges. Essentially, the digital lenders will be compelled to play by the same rules as commercial banks, including having to seek the CBK’s nod for new products and pricing.

It’s the latest attempt at putting a leash on quick loans in Kenya, some of which have spiraled out of control. The plan is fair enough, but oddly no one seems to be talking about airtime currency lending and electricity token lending by the telco that has a near-monopoly in Kenya’s telecom and mobile money markets.

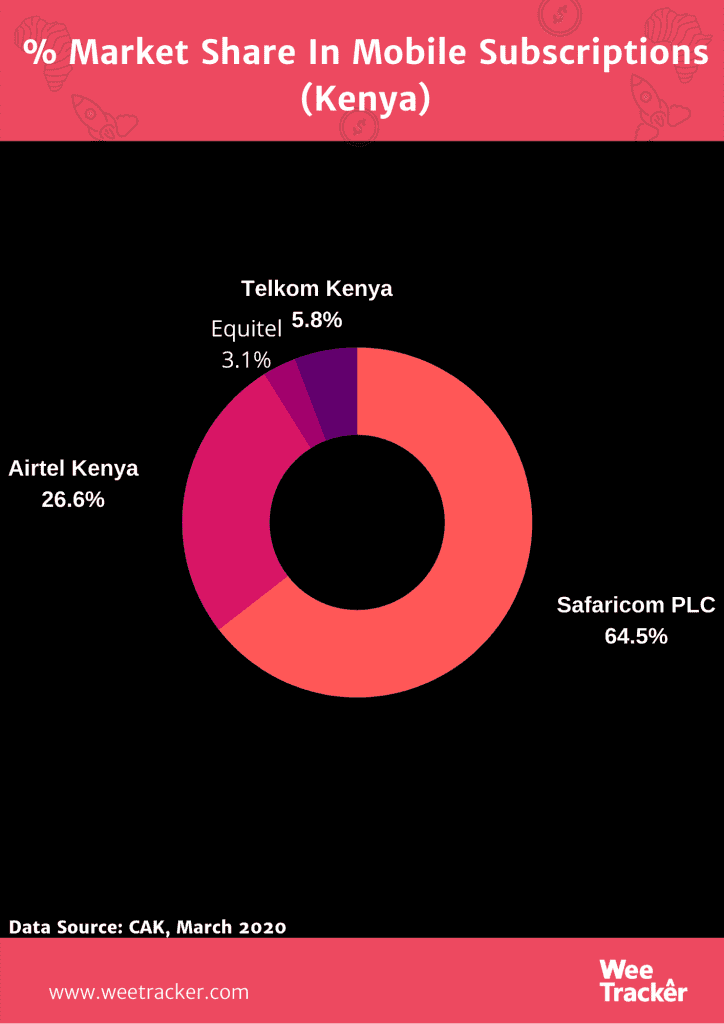

With 35.6 million subscribers as of March 2020 (Kenya’s population is around 51 million), Safaricom is Kenya’s leading telco with 64.5 percent of market share, according to the Communications Authority of Kenya.

It’s widely popular M-Pesa mobile money service accounts for up to 98 percent share of the country’s burgeoning mobile money scene.

Among its numerous products and services, it offers the Okoa Jahazi service which enables Safaricom subscribers to get an advance of mobile airtime. For providing the credit advance, Safaricom charges an advance fee of 10 percent (used to be higher) for each request.

Simply put, For a credit advance of KES 1 K (USD 9.23), Safaricom charges a fee of KES 100.00 (USD 0.92); it’s like 10 percent interest on a loan of KES 1 K which oddly has a tenure of just 4 days. Users get barred for defaulting.

“You will be required to repay the Credit Advance within a period of 96 hours from when the Credit Advance amount was credited to your account,” reads an explainer from Safaricom.

“If you do not repay the Credit Advance within the said period you will not be entitled to utilise the Okoa Jahazi Service for a period of seven (7) days following the expiry of the 96 hours,” says the telco.

As one Safaricom subscriber told us, “If you actually think about it, 10 percent is on the higher side but because there’s no one regulating, then there’s nothing that can be done.”

Similarly, the telco offers the Okoa Stima service which basically allows Kenyans to get electricity on credit and then pay later. The service allows users to borrow any amount based on their predetermined credit limit. This limit is based on their historical relationship with Kenya Power. The loan comes at a facility fee of 10 percent and is payable in 7 days.

Currently, not even the costliest of lending platforms in Kenya have anything near 10 percent interest on a loan with a duration of 7 days or less. But that’s the case with these services, both of which are found to be technically expensive, and perhaps, exploitative lending offers with a free pass.

Featured Image Courtesy: CARE Kenya