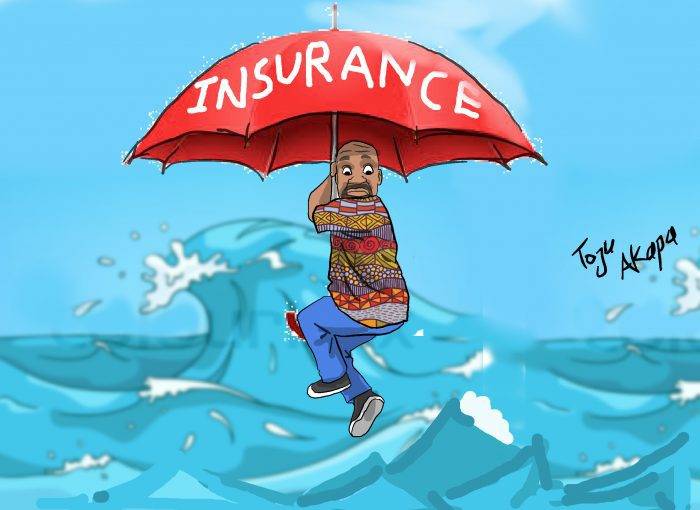

SA Multinationals Are Retreating Home But An Insurer Is Expanding Across Africa

In the wake of a new trend that has seen African multinational businesses retreat to their home markets, a certain 102-year old insurer wants to put its eggs in many baskets. Sanlam, a South African insurance firm, is devising an international diversification strategy through acquisitions and new market expansions.

Odd One Out?

The seemingly new reality is that multi-country lustre is no longer an asset for a crop of African firms. Moreover, the turn in tide mostly upsets South African businesses who have at some point in time expanded outside their home markets. Currency devaluations, weak logistics and political tensions have led to these new developments.

For instance, an international retail chain like ShopRite has since announced that operating outside Southern Africa is no longer considered viable. In Sanlam’s case, expanding across Africa will help it make up for the troubles experienced in the South African market.

Indeed, pressure on new business volumes have persisted for the insurer as movement restrictions remain in place in some markets. As a result of these constrictions, Sanlam expects growth in its new business volumes to further diminish.

Sanlam’s half-year operating profit fell by a whopping 39 percent near the middle range of its own prediction. The economic storm enraged by the coronavirus pandemic has weighed heavily on the business’ performance.

The Cape Town-based insurer might also be dragged down by South Africa’s grave pandemic-regulated recession, one which has made it the third most miserable economy in the world.

Meanwhile, Sanlam’s shares on the Johannesburg Stock Exchange (JSE) slumped by 2.4 percent, making the company the worst performer in the bourse’s five-member FTSE/JSE Africa Life Assurance Index.

The repercussions of Covid-19 “on claims and persistency experience” in Sanlam’s life businesses was muted in the first half the year. “But this situation is expected to deteriorate in the second half of 2020,” the company says.

Virus-backed Choke

Even Africa’s largest telecommunications service provider, MTN, has decided that operating in non-African markets isn’t bring much value to its wireless carrier business. The telco has been upfront with its intentions to burn the bridges that connects its business with the Middle East.

But back home, virus-related upturns and the lack of business confidence has made the insurance service niche a challenge for Sanlam. For example, its intermediate distribution channels were not labelled as essential services during South Africa’s severe lockdown.

The situation hackneyed the group’s sales forces who mostly rely of face-to-face interactions to win clients over. Sanlam’s life insurance sales was the first on the chopping block. In April, May and June (2020), sales volumes nosedived by between 50 percent and 90 percent across multiple business lines.

2020 is the most challenging year in Salams’ century-old journey. Apart from shrinking earnings, though, the company is in the middle of a court case. Amidst providing relief to clients whose businesses were choked by South Africa’s notorious lockdown, it is among insurers awaiting the results of a judicial development started by customers.

Meanwhile, Sanlam has overhauled its South African operation to spin off a new life and savings unit. The new offshoot will cater for its mass markets-targeted offerings, the affluent segment and the insurer’s corporate unit.

Featured Image: Businessday.