IROKO Outfought 2020 By Not Competing And Now It’s Going Public

As of January 2020, IROKO was a team of 642 people globally. Fast-forward to January 2021, the team had shrunk to 83 people. How and why did that happen? Simple, 2020 happened.

But contrary to fears that the company is in a bad spot, IROKO has steadied itself with some shrewd calls (some of which were tough but necessary) and is now targeting an initial public offering (IPO) on the London Stock Exchange (LSE) Alternative Investment Market in 12 months’ time.

The IPO would aim to raise between USD 20 Mn and USD 30 Mn, and would value the whole business at between USD 80 Mn and USD 100 Mn, IROKO co-founder and CEO, Jason Njoku, told The Africa Report recently.

When the pandemic forced everyone indoors for several months last year, it was a no-brainer that entertainment platforms would see more interest than usual. And what’s more indoor entertainment than some good TV? Before long, pay-TV, as well as streaming video-on-demand (SVoD) platforms (like iROKOtv, Netflix, Showmax, etc.) were eating good.

However, the purple patch didn’t last long for IROKO. The Nigeria-based media company which runs a streaming platform that claims to be the largest online catalogue of Nollywood film content globally, was actually flying high during the early stages of the lockdown that was forced by Covid.

Njoku had mentioned in May 2020 that iROKOtv hit its highest daily addition within the first few days of the lockdown, as users seemed to be allowing themselves to enjoy what seemed like a holiday at first.

Nigeria, in particular, had posted the strongest numbers (it was the strongest the company had ever recorded for Nigeria). But the surge sort of died down as quickly as it had happened, though iROKO’s outside-of-Africa subscribers surged 200 percent during the lockdown, per his words.

As the decline continued on the local front (spotting a 70 percent drop in subscription numbers), Njoku announced the company had been forced to place 28 percent of its staff on unpaid leave, and pay cuts also happened. That was the sign of things to come.

Eventually, the company shuttered its offices in New York and London to cut costs, and another 150 jobs were cut because of the sour cocktail that is the economic impact of Covid, currency devaluation in its base (Nigeria), and the hostile regulatory environment from local regulators in the country.

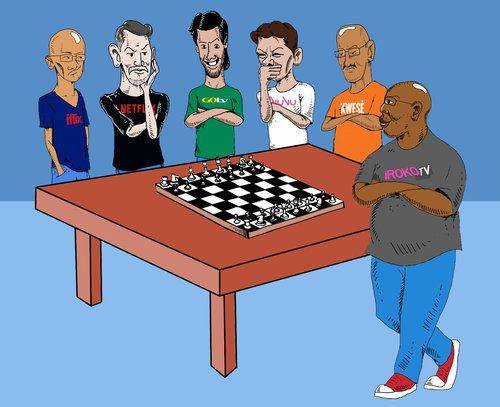

To outsiders, it seemed like the company was reeling, but in reality, IROKO was looking to play a different game which was about not competing in the so-called streaming wars that is still more like an exaggerated small brawl in Africa, but rather keeping a firm grip on a niche that it has always owned. By boasting the biggest repository of Nollywood content, there was a bigger fish to fry in the diaspora.

In August 2020, Njoku announced IROKO had put its Africa growth/scaling plans on hold and was instead going to double down on its efforts in foreign markets, like the U.K., and the U.S., where it had higher paying customers.

It was the classic case of picking shrewdness over sentiments since 80 percent of the company’s revenue came from its business outside of Africa. Njoku claimed at the time IROKO’s international annual average revenue per unit (ARPU) is around USD 25.00 to USD 30.00 while in Africa, the annual ARPU value is between USD 7.00 to USD 8.00.

By simply refusing to compete for African viewers where it was reportedly spending USD 300 K monthly on growth without much to show for it, IROKO availed itself of the option that makes more economic sense: foreign business.

“The costs of pursuing Africa growth is what was really resized dramatically. We were so focused on defending Africa and basically ended up doing nothing. Zero marketing or anything to drive that,” Njoku told TechCrunch. “We pulled back to focus on where our economics actually makes sense. Our international business organically grew double-digit in 2020 and we expect it to continue this way for the foreseeable future.”

Now the company has channeled most of its efforts into selling a rich mix of African movie content to a diaspora audience with more discretionary income, higher spending power, and a good appreciation of its offerings.

That last point is reflected in the quip that despite implementing a 150 percent price increase recently, IROKO’s international subscriptions remain on the up. All the metrics point to the fact that an international subscriber base is much more reasonable and sustainable for the company at this time.

In the past, Njoku has mentioned that iROKOtv has accumulated net operating losses of more than USD 30 Mn over its lifetime while investing in African content starting with Nollywood (Nigeria’s coveted movie industry), and has been bleeding millions of dollars annually trying to build Internet TV in Africa.

But just as e-commerce, classifieds, e-hailing, edtech, and even freemium models have fallen short due to market constraints, it appears the market is still not optimised for the streaming business at the moment.

IROKO seems to have read the handwriting on the wall. And by doubling down on its diaspora play, which Njoku says puts the company in a stronger financial position than it had been for years, a successful 2022 IPO seems well within reach.

Featured Image Courtesy: 36 States