Deal-Street Africa [April 12-16]: Finnfund Commits USD 26 Mn Investment in African Development Partners III

![Deal-Street Africa [April 12-16]: Finnfund Commits USD 26 Mn Investment in African Development Partners III](https://weetracker.com/wp-content/uploads/2021/04/April-12-16-2021.png)

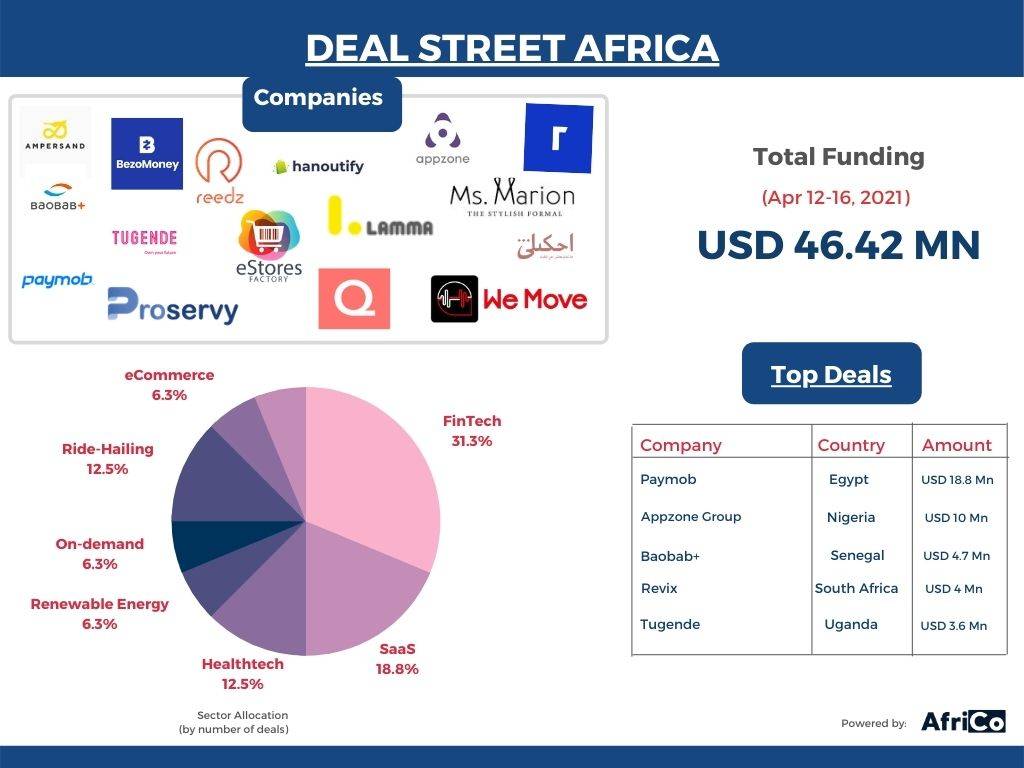

Here is a recap of last week’s notable deals on the African continent.

Algebra Ventures Launches USD 900 Mn Second Fund For Investment in Egypt Startups

Egypt’s venture capitalist firm, Algebra Ventures, announced the launch of its second investment fund that will be used to support Egypt startups in the fields of fintech, logistics, health tech, and agri-tech, among other technology sectors.

Ampersand Rwanda Ltd Secures USD 3.5 Mn From Ecosystem Integrity Fund

Kigali-based electric motorcycle company Ampersand Rwanda Ltd secured a USD 3.5 Mn investment from the Ecosystem Integrity Fund (EIF) to expand its network and operations in Rwanda. The investment is one of the largest ever made in e-mobility by a venture capital fund in Sub-Saharan Africa.

Appzone Raises USD 10Mn For Expansion and Proprietary Technology

Nigeria-based fintech, Appzone, raised USD 10 Mn in its recently closed Series A round to boost investment in its technologies and support external expansion.CardinalStone Capital Advisers led the round with V8 Capital Lateral Investment Partners, Constant Capital, and Itanna Capital Ventures.

Baobab+ Raises EUR 4 Mn For Regional Expansion

Baobab+, the French West African solar distributor, raised EUR 4 Mn (USD 4.7 Mn) from two investors; The Energy Entrepreneurs Growth Fund and Facility for Energy Inclusion Off-Grid Energy Access Fund (FEI-OGEF) invested EUR 2 Mn each, bringing the total to EUR 4 Mn. The funds will be used to support its growth and expansion in Senegal and Côte d’Ivoire.

Ghanaian Startup BezoMoney Raises USD 200 K Seed Capital For Continued Expansion

BezoMoney, a Ghanaian digital savings startup, raised USD 200 K in seed funding from GOODsoil, a venture capital firm based in London, to scale its expansion and development.

Five African Startups Get Grant Capital From GSMA Innovation Fund

Five African startups were among the many startups across Africa and Asia that received grant capital from the GSMA as part of its Innovation Fund for Mobile Internet Adoption and Digital Inclusion. They include Ethiopia’s Africa 118, Nigeria’s ScholarX, Uganda’s Ensibuuko, Zambia’s WidEnergy, and Zimbabwe’s Zonful Energy.

Finnfund Commits USD 26 Mn Investment in African Development Partners III

Finish development financier and investor, Finnfund announced a UDS 26 Mn investment commitment in African Development Partners III (ADP III) that will provide companies with capital to grow and the necessary information to create social impact.

Harith General Partners Announces USD 200 Mn Capital Raise

Harith General Partners announced a USD 200 Mn capital raise, a follow-up fund to its Pan-African Infrastructure Development Fund (PAIDF) 2. This short-term infrastructure fund (5-6 years) is established to create a steady pipeline of high-quality infrastructure opportunities for investors.

Fourteen Ghanaian Startups Selected For MEST Express Accelerator

MEST selected 14 Ghanaian startups for the first cohort of its 2021 MEST Express Accelerator in partnership with the MasterCard Foundation. The 20-week program will offer the selected startups free training, tailored mentorship, and an opportunity to receive up to USD 10,000 K in equity-free grant funding.

Kalon Venture Partners Announces Follow-On Investment in Sendmarc

Kalon Venture Partners, a venture capital firm based in South Africa, announced its follow-on investment of an undisclosed amount in Sendmarc that will be geared towards expanding Sendmarc’s team and scaling the company’s operations into global markets.

South Africa’s Mahlako Announces R 1.5B Energy Fund

Mahlako Financial Services announced the launch of its first USD 102 Mn energy fund, which will invest in energy ventures and companies with long-term growth potential across the value chain. Mahlako is a subsidiary of Mahlako a Phahla Investments, a South African alternative investment fund manager.

Eight Startups Selected For 7th Edition of Flat6Labs Tunis Accelerator

Eight startups in Tunisia were selected for the latest edition of Flat6Labs Tunis accelerator that seeks to create a conducive environment for startups to develop their products and develop their skills. Each startup secured USD 65K.

Digital Food Cooperative Pricepally Raises 6-digit Pre-seed Funding Round

Nigerian digital food cooperative, Pricepally raised a 6-digit pre-seed funding round after experiencing significant growth in the past 12 months. Asia-based VC Samurai Incubate and early-stage VC fund Launch Africa Ventures were the two investors in the round.

Egypt’s Paymob Secures Funding of USD 18.8 Mn In Completed Series A Round

Egypt’s digital payments provider, Paymob, raised USD 18.5 Mn in its recently completed Series A led by UAE-based venture capital firm, Global Ventures. A15, a tech investment fund, and FMO, the Dutch entrepreneurial development bank, were also investors in the round.

Fintech Peach Payments Raises Additional Funding To Accelerate Growth

South African fintech startup Peach Payments has raised an additional investment of an undisclosed amount to build on its accelerated growth in the past 12 months. The new round of funding was led by UW Ventures in partnership with Allan Gray, alongside Launch Africa Ventures and other existing investors.

South Africa Startup Revix Raises USD 4 Mn To Launch Mobile Application

South African cryptocurrency investment platform, Revix, raised USD 4 Mn in funding to launch its mobile application and expand to the European Union. The funding came from undisclosed overseas investors and accelerators.

RMB Corvest and Agile Capital Buyout Adcorp Support Services

A consortium consisting of Agile Capital, a South African private equity investment firm, and RMB Corvest Limited, a private equity firm, completed a management buyout of Adcorp Support Services (Pty) Limited.

Quro Medical Secures USD 1.1 Mn Seed Round To Expand Operations

South Africa’s health tech startup, Quro Medical, announced the close of its USD 1.1Mn round led by Enza Capital, based in Kenya, and South African Venture capital firm, Mohau Equity Partners, aimed at expanding operations across the country to meet rising demand.

Troygold Secures Funding From Crossfin Ventures To Scale Operations

South African fintech startup, Troygold, secured an undisclosed round of investment from Crossfin Ventures to scale their operations. Crossfin ventures is an angel investment arm of Crossfin Technology Holdings.

Tunisia’s Vneuron Raises Second Round Funding From Tunisian American Enterprise Fund

Tunis-based SaaS Company, Vneuron, completed its second fundraising of an undisclosed amount of money from Tunisian American Enterprise Fund (TAEF) that will be used to venture into new international markets.

Verdant Capital Raises USD 9.9 Mn Equity Capital For Tugende

Verdant Capital, an investment banking franchise, raised USD 9.9 Mn Series A equity funding for Tugende, a social enterprise that provides asset and SME finance to consumers in Kenya and Uganda. Partech Africa and Enza Capital invested in the USD 3.6 Mn extension round, agreed and structured in 2020, raising the total Series A volume to USD 9.9 Mn.