Deal Street

African Startup Funding Tracker

USD 370,103,999+

*Data updated daily at 18:00 EAT

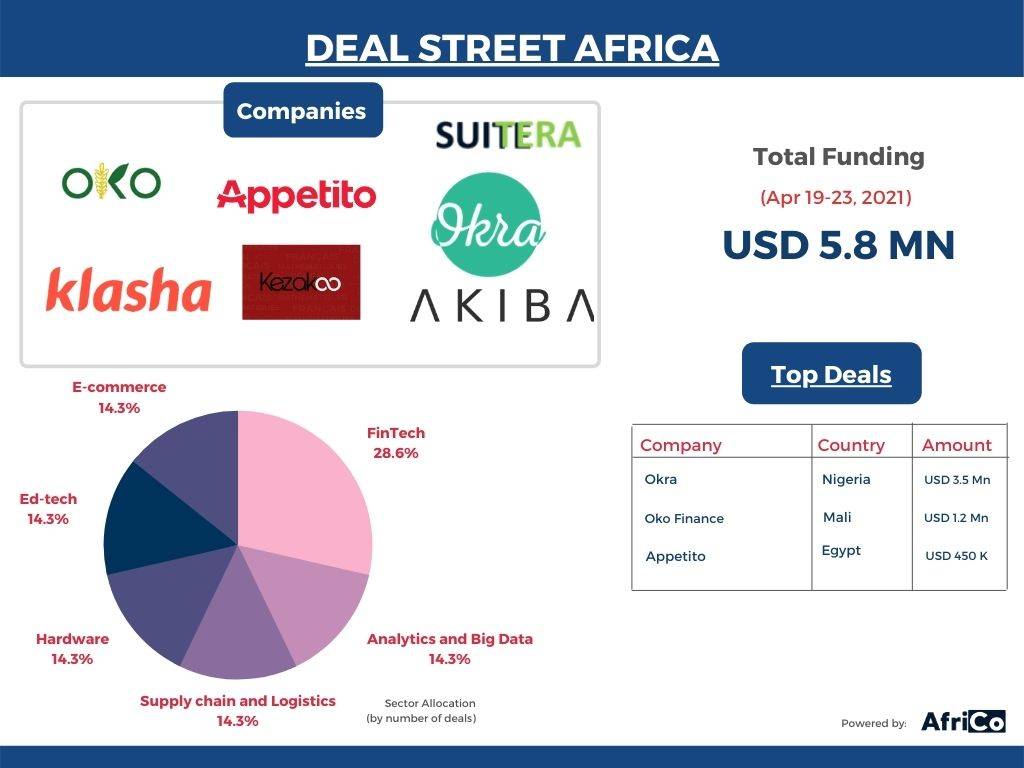

Here is a recap of last week’s notable deals on the African continent.

Kenya Startup Tanda Secures Funding For Regional Expansion

Kenya-based retail tech startup secured Tanda secured an undisclosed amount of funding to scale its operations across East Africa. The investment came from HAVAÍC, Zed Crest Capital, DFS Lab, Victor Asemota, and three other investors.

Egypt Startup Kemitt Raises 6-Figure Seed Round

Kemitt, an Egypt-based e-commerce startup, secured a 6-figure round from Saudi-based angel investors to venture and scale into new markets.

VC Samurai Incubate Closes USD 18.6 Mn Fund For African Startups

Tokyo-based venture capital firm, Samurai Incubate, announced the close of its USD 18.6 Mn Samurai Africa 2nd General Partnership fund. The Japanese VC intends to invest in 30 to 40 new pre-seed and seed-stage firms and pre-Series A and Series A investments in 7 to 10 existing portfolio companies.

Egyptian Startup Appetito Raises USD 450 K Seed Round

Cairo-based grocery startup, Appetito, raised a USD 450 K seed round to help expand its operations in Egypt and beyond. The seed round was led by a group of Saudi Angel investors led by Ahmed Al Alola, an early-stage investor, and Afropreneurs Fund with participation from Jedar Capital.

Ghanaian Fintech Zeepay Acquires Mangwee Mobile Money

Ghanaian fintech Zeepay acquired a 51% stake in Mangwee Mobile Money, a Zambian mobile money transfer platform, becoming the highest stakeholder in the entity. The deal is one of the most notable deals involving two indigenous African fintechs that deal in mobile money operations.

Egyptian Startup Suitera Receives USD 230 K Investment From AUC

Egyptian semiconductor startup, Suitera, became the second spinoff university company from the American University of Cairo (AUC), emerging with USD 230 K in funding. Three private investors have invested USD 130 K following an initial investment of USD 100 K from Walden Rhines, bringing the total to USD 230 K.

Nigerian Fintech Okra Raises USD 3.5 Mn Seed Round

Okra, a Nigerian-based fintech, announced that it closed a USD 3.5 Mn seed round to expand its infrastructure across Nigeria. The funding round was led by Susa Ventures, a US-based VC firm with participation from TLcom Capital, Accenture Ventures, and some angel investors.

IFC To Invest KSH 215 Mn In Nairobi Based Antler EA

The International Finance Corporation (IFC), a subsidiary of the World Bank, announced that it plans to invest KSH 215 Mn (about USD 2 Mn) in Antler East Africa, a Nairobi-based VC firm. IFC intends to invest in USD 1.5 Mn through Catalyst and USD 500 K through the Women Entrepreneurs Finance Initiative (We-Fi).

Klasha and Akiba Digital Accepted Into Expert DOJO International Accelerator Program

South Africa’s Akiba Digital and Nigeria’s Klasha were accepted into Expert DOJO International Accelerator Program, a southern-based California accelerator. The two startups will join Expert Dojo’s Spring 2021 cohort alongside 11 other startups worldwide. Each startup will receive USD 100 K funding from the program.

Kenyan Startup Ecobodaa Secures Funding Round

Ecobodaa, a Kenyan e-mobility startup, has raised a funding round of an undisclosed amount from Persistent Energy Capital to quicken its growth rate. The startup aims to provide commuters in African cities with more accessible, safer, connected, and environmentally sustainable modes of transportation.

Mali Startup Oko Finance Raises USD 1.2 Mn For Regional Expansion

Oko Finance, an insuretech startup for agribusiness in Mali, closed an investment round of USD 1.2 Mn led by Newfund and ResiliAnce with participation from Corps Ventures, Techstars, ImpactAssets, and RaSa. The startup plans to the new funds to expand its services into Ivory Coast to cover relevant stakeholders in the country.

Moroccan Ed-tech Kezakoo Raises USD 221 K In Investment Funding

Morocco-based Ed-tech Kezakoo raised USD 221 K in investment funding to diversify its range of products to continue educating high school students in Morocco and allow the startup to support its organizational development efforts. The investment came from Witmax One, an investment company created in tandem by the Morocco-based investment firms Southbridge A&I and AXXAM Family Office.

Paid Members Are Reading

-

February 13, 2026

Nigeria’s New Tax Law Is Forcing Remote Workers To Get Clever (Or Pay Dearly) -

December 22, 2025

The Full Basket: How Naivas CEO Andreas von Paleske Stocks Up For Success -

December 5, 2025

African Workers Feel Both Delight & Dread Using AI For Work & Fearing Being Replaced