Deal Street

African Startup Funding Tracker

USD 370,103,999+

*Data updated daily at 18:00 EAT

Nigerian Startup GetEquity Secures Funding From GreenHouse Capital

GetEquity, a Lagos-based venture-funding platform that connects entrepreneurs and investors, closed a six-figure pre-seed fundraising round led by GreenHouse Capital as it launches its first product, a venture-funding platform.

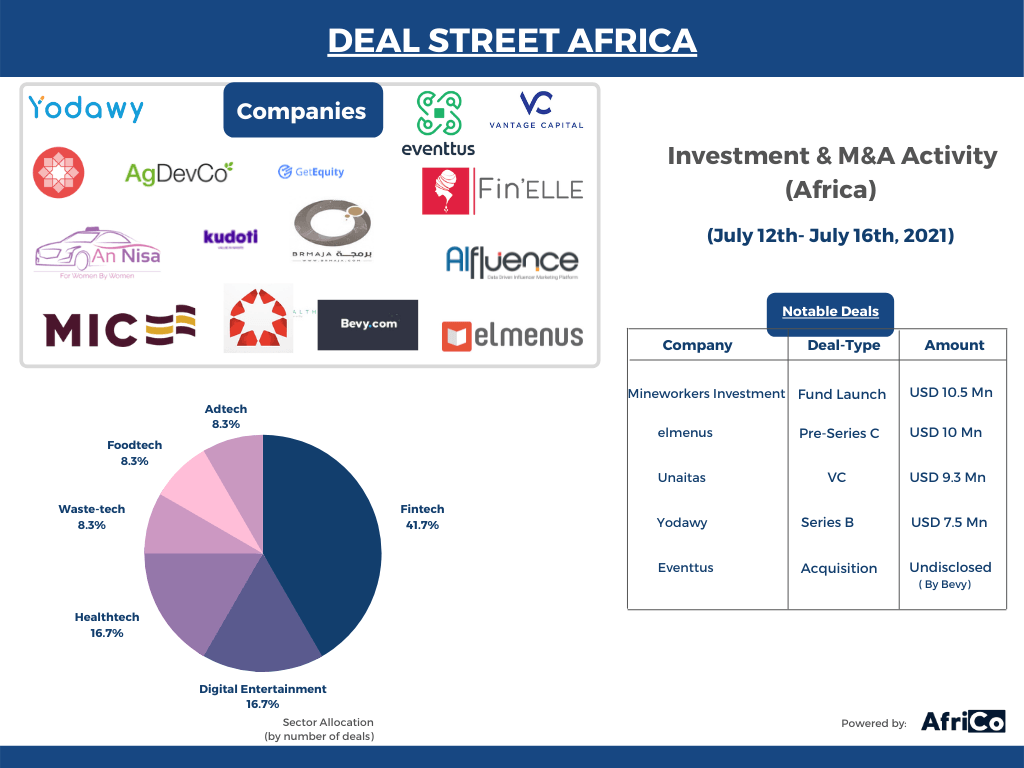

Mineworkers Investment Company Launches USD 10.5 Mn Early-stage Investment Vehicle

The Johannesburg-based Mineworkers Investment Company (MIC) announced the launch of MIC Khulisani Ventures, a ZAR150 million (USD 10.5 Mn) early-stage investment vehicle targeting black-owned innovative, high-growth businesses in South Africa.

South African Healthtech Startup iNNOHEALTH Raises Funding

iNNOHEALTH, a Cape Town-based startup, received an undisclosed seven-figure investment from a Hong Kong-based venture capital firm. The funding will be used to expand the startup’s doctor-led app, MyPocketHealth, which will be available to the general public later this year.

Vantage Capital Launches Fourth Mezzanine Fund

Vantage Capital, one of Africa’s largest mezzanine fund managers, announced the first close of its fourth mezzanine fund, with USD 207 Mn commitments from commercial investors in Europe and the United States, as well as development finance institutions (DFIs) such as the International Finance Corporation (IFC), the CDC Group, and SIFEM. The fund will provide flexible funding to mid-sized African enterprises, boosting job creation and facilitating much-needed economic possibilities and growth, particularly for post-Covid-19 recovery.

Waste-Tech Startup Kudoti Receives USD 40 K Cash Prize

Kudoti, a digital recycling platform based in Johannesburg, was named one of five winners of Nestlé’s CSV Prize for creative recycling effect through technology in 2021. The startup was awarded a cash prize of USD 40 K to help it expand its unique digital trash solutions. The startup will also have access to Ashoka’s online tools and workshops and a mentoring program, and the possibility of collaborating with Nestlé.

Egyptian Healthtech Yodawy Raises USD 7.5 Mn Series B Funding

Yodawy, an Egyptian healthtech startup, raised USD 7.5 Mn in a Series B fundraising round to expand its product offering and reach new markets. The round was led by Middle East Venture Partners, Global Ventures, and Algebra Ventures, with the participation of CVentures, P1 Ventures, and Athaal Angel Investors Group. The startup plans to use the funding to introduce additional offerings for its growing network of benefactors and expand into new markets.

Moroccan Fintech Mosaiclab Raises USD 225 K Funding

Mosaiclab, a Moroccan fintech start-up, raised USD 225 K for its Konta invoice processing platform. The investment came from the investment company WITAMAX, jointly created by Southbridge A&I and Axxam Family Office.

Egyptian Startup Jeel Platform Raises USD 1.2 Mn Seed Round

Jeel Platform, a promising edutainment startup, raised USD 1.2 Mn in seed funding from Kuwaiti and Jordanian angel investors and obtained high-quality animation series, songs, and games for its library. The company plans to use the seed fund to strengthen its technical capabilities, offer more services and content, and expand its team.

Egypt’s elmenus Raises USD 10 Mn Pre-series C Round

elmenus, an Egyptian food discovery and ordering platform secured USD 10 Mn in a pre-Series C round led by digital payments company Fawry and including Marakez and Luxor Capital, a New York-based hedge fund. elmenus and Fawry will co-develop innovative solutions for restaurants and customers.

Kenya’s Unaitas Secures USD 9.3 Mn Funding From Oikocredit

Unaitas Sacco, one of Kenya’s largest progressive Sacco, received KShs1 billion (USD 9.3 Mn) in capital from Oikocredit International, a Dutch private equity firm, for onward lending to small and medium firms. (SMEs). According to the Sacco, the funds will be repaid over six years, allowing the Sacco to provide loans to approximately 5,000 farmer groups and cooperatives, individual farmers, farm input dealers, and transportation companies.

AgDevCo Invests In Kenyan Aquaculture Company Victory Farms

AgDevCo, a social impact investor in the African agriculture sector, announced a multi-million dollar mezzanine debt investment in Victory Farms, a fast-growing aquaculture company in Kenya. AgDevCo’s investment will help the company continue to grow and impact, including constructing a feed mill and expanding into additional East African countries.

Egypt’s Brmaja Acquires 50% Stake In Kenya’s An-Nisa Taxi.

Egypt’s Brmaja acquired a 50% investment in An-Nisa, a Kenyan transportation app created by women for women. This acquisition is a strategic step in Brmaja’s plan to strengthen its core business in Africa.

Kenyan Startup AIfluence Raises USD 1 Mn Seed Funding Round

AIfluence, a Kenyan ad-tech startup, raised USD 1 Mn in seed funding to help it expand its AI-powered marketing platform. Antler East Africa, Nigerian VC Oui Capital, ArabyAds, and a European family office participated in the round led by Dubai-based EQ2 Ventures. The startup intends to use the funds to expand into the rest of Africa, the Middle East, and Asia by the end of 2021 and further invest in its tech and SaaS platform.

US-based Bevy Acquires Egypt’s Eventtus

US-based events company Bevy acquired the Egyptian event management software company Eventtus for an undisclosed amount. Eventtus’ founders and the team will join Bevy’s engineering team. The acquisition will enable Eventtus to benefit from Bevy’s end-to-end event management solutions to scale its event programs.

Fin’Elle Receives USD 2.72 Mn Loan From Oikocredit

Fin’Elle, a microfinance institution (MFI) focusing on empowering women entrepreneurs by offering microfinance and mesofinance loans to women-owned small to medium companies (SMEs) in Côte d’Ivoire, received a loan of EUR 2.3 million (USD 2.72 Mn) from Oikocredit, a social impact investor. In addition to the loan, Oikocredit plans on further supporting Fin’Elle with technical assistance to help them improve women’s financial literacy and increase financial inclusion in Côte d’Ivoire.

Ada Animation Receives Pre-seed Investment From Unicorn Group

Ada Animation, a Nairobi-based entertainment company, secured pre-seed funding from Unicorn Group, which is the technology vehicle of Platform Capital – a Nigerian growth markets-focused sector agnostic, investment, and advisory firm. The funds will go into coming up with exciting animation opportunities that will grow the company.

Senegalese Fintech InTouch Secures Funding To Scale Operations

InTouch, a Senegalese fintech startup, announced a strategic financing round led by CFAO. The startup did not disclose the financial details of the deal. The round also included Mobility54.and existing partners TotalEnergies and Worldline. InTouch currently operates in West Africa, East Africa, South Africa, and Central Africa, with plans to expand in five additional nations by the end of the year.

Paid Members Are Reading

-

February 13, 2026

Nigeria’s New Tax Law Is Forcing Remote Workers To Get Clever (Or Pay Dearly) -

December 22, 2025

The Full Basket: How Naivas CEO Andreas von Paleske Stocks Up For Success -

December 5, 2025

African Workers Feel Both Delight & Dread Using AI For Work & Fearing Being Replaced