Nigerian Banks Set To Gain From CBN Ban on Forex Money Changers? Or not…

The Nigerian regulator’s decision to ban money changers from forex has caused quite a ripple in financial circles. To take the place of Bureau De Change (BDC) Operators, The Central Bank of Nigeria (CBN) has now instructed banks to set up teller points at branches for forex sales to meet customer demand.

CBN Governor Godwin Emefiele made the announcement on Tuesday last week causing some amount of panic – as there are some 5,500 licensed BDC operators across the country, employing thousands of dealers. CBN said it trades USD 110 million weekly FX of USD 20,000 each with total annual sales of about USD 7.2 billion. CBN also added that it sees about 500 plus fresh license applications for BDCs every month; clearly indicating there is roaring appetite for BDCs, despite it being a crowded space.

Impact On Black Money Market

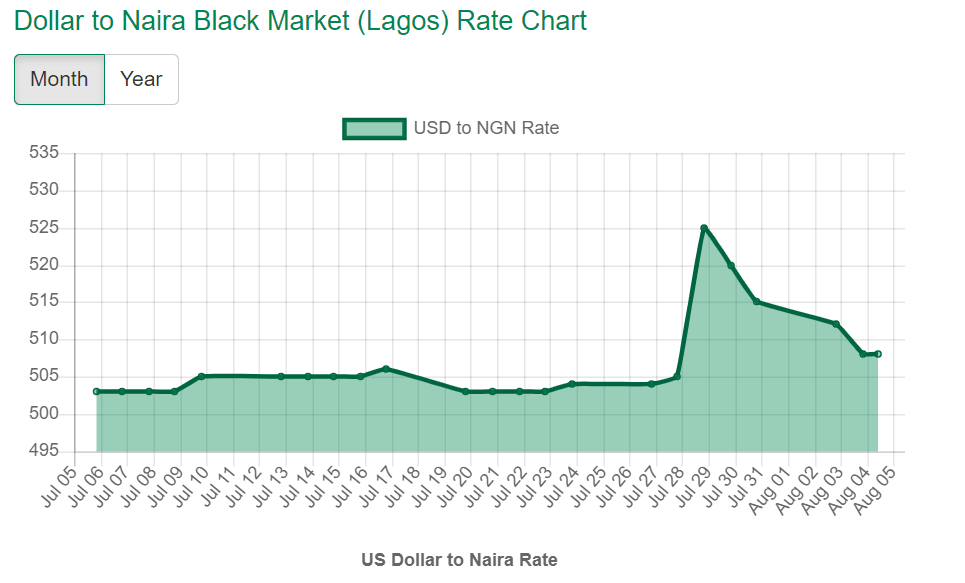

Meanwhile, the Naira has not suffered as badly as might have been expected — and actually rose 508 per $1 in the unofficial market window. The CBN made the announcement on July 27. Financial pundits predicted that with the existing BDCs barred – the only source of foreign exchange would be from the parallel market; leading to a spike in foreign exchange rate. And like they anticipated there was panic buying for a few days following the announcement.

But this week the black money exchange rate has been falling. So has some of the panic disappeared? Or are customers playing wait and watch?

The reason for the black money market trying to stabilise could have an explanation in history. Industry sources point to the CBN’s decision in 2016 to shut down the inter bank forex trading. “There was an initial panic then – as it will happen with any government announcement. But then we saw the market revert to status quo within a few weeks,” says Issac Udoka, financial planner, Lagos.

Another reason why there hasn’t been much panic could be because for many years, now, CBN has not been the only source of forex for BDCs. “They have independent sources. The only reason BDCs continued to latch onto CBN’s supply was because the cost of buying was the lowest with them,” says Udoka. A view that the Association of Bureau De Change Operators concur with as in their statement they voiced their “intention to meet customer demand from independent sources.”

Another viewpoint is that the official – government-controlled exchanges form only a fraction of the real money exchange market. “The truth is there is an insufficient inflow and supply to the CBN,” tweeted Kalu Aja, financial planner. Market observers say this move by the Central Bank may not prove a positive for liquidity.

Banks Get Into Act

Meanwhile, some of the top banks in Nigeria like Access Bank, Guaranty Trust Bank and First Bank of Nigeria have been sending emails and SMSes to customers that they can avail of forex services at their bank branches. The Central Bank has also instructed banks to set up teller points at bank branches.

The Body of Bank CEOs has said that banks will ensure full compliance with the CBN directives.

Some banks say while the CBN’s action might send more business their way, they don’t expect to be overrun. “It is early days to see how much demand we will have. But whatever be the demand, we do have the capacity to handle it,” said a banker with a global MNC. “The more key concern is that the new policy should not help boost the black markets.”

Another issue is that “although the CBN’s reallocation of funds to the commercial banks is intended to curb scarcity, it is unlikely that the commercial banks will be able to fulfil all customers’ obligations in due time,” said Aderonke Alex Adedipe, partner, Pavestones Legal, in a report.

Many businesses, since the 2018 CBN directive that businesses can obtain foreign exchange from autonomous sources, rely on BDCs and keep the official Nigerian Foreign Exchange Market only as a backup option. “CBN has with its decision shut another window for businesses to obtain foreign currency,” said Adedipe.

The Rational For Ban?

Over the last decade, there have been many upheavals in the markets and the Nigerian regulator has struggled to ensure adequate forex liquidity. With a rich Nigerian diaspora based in America, Canada, UK and Europe – the need for forex becomes predominant. The CBN’s recent statement that they were getting 500 applications for BDC licenses itself points to the high demand for these entities. And what does the license entitle? It allows BDCs to supply foreign currency for business and personal travel, school fees, medical bills, utility bills, life insurance premiums, etc, to upwardly-mobile Nigerians and non-residents.

Justifying its ban, the CBN has stated that BDCs have been serving as fronts for money-laundering activities. Accusing them of corruption, the CBN has said that they have been handling money over and above the permitted limit. As per the CBN’s 2015 Operational Guidelines for Bureau Du Change – the maximum amount the BDC can give one customer for business or personal travel is USD 5,000. The CBN also requires BDCs to sell customers dollars within their specified profit margin. “For years BDCs didn’t bother about the rules on limits or profit margins. And everyone knew they weren’t complying – including the regulator. It is quite a puzzle as to why they chose to make this crackdown now. Because banks were not lobbying for this change. No banker or bank association went up to the regulator saying they wanted this particular chunk of business,” says a banker, who did not want to be identified.

But even if they did not ask for this change, banks will now find themselves at the centre of this as CBN has said its weekly allocation will now be given to authorised dealers i.e. commercial banks.

Licensing Fee, Trust Issues

Earlier, the CBN required every BDC to maintain NGN 1 Million (USD 2,424) with it as a caution money for the purpose of paying bonafide claimants in the event of default or liquidation of the Bureau De Change. After its ban, CBN has said that it will return the deposits and licensing fees of existing BDCs and applicants.

“Now this deposit amount might not be much. But it has a bigger implication. As long as they were regulated entities with the deposit guaranteed by CBN – a customer had more recourse to law if he gets cheated. Now, it will become more difficult for customers if they get cheated; particularly if they chose to go to a lesser known BDC,” says Udoka.

The Association of Bureau De Change Operators also voiced concerns over customer trust. “We have been providing good service to customers for years together. Now if there are a few fraudulent entities – how will the average customer know the difference between them and us? For customers it was a point of reassurance if they could look us up on the CBN’s site as proper licensed entities,” said a member. “We hope to engage with the CBN on this issue in talks.”

BDCs also make the point that they would have never come into existence had banks been providing decent service to customers. “Banks aren’t saints either. For years banks used Know-Your-Customer (KYC) forms to bind their customers in endless bureaucratic red tape. They’d disqualify customers on the flimsiest reasons. We even had scams with bank officials engaging in forex roundtripping. If banks were providing such great service – why did BDCs grow from less than a 100 to 5,000+ in a decade?” asks a BDC operator.

Image: Wikipedia