More Mobile Wallets Than People in Kenya

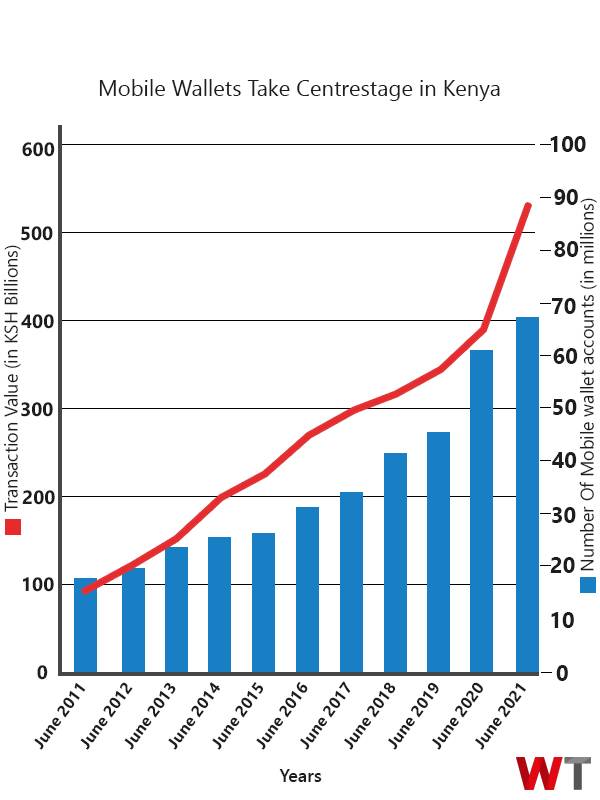

Kenya’s 2020 population is close to touching 54 million but the number of mobile money wallets in the country outnumbers this figure at 67.78 million as of June 2021.

When one takes into account the adult population of Kenya at 30 million – that’s 2.2 money wallets for every mobile user. A phenomena that’s risen with increased usage of double SIM cards and players like M-Pesa, Equitel, Airtel Money, Orange Money, Tangaza Pesa and MobiKash dominating the market.

M-Pesa was launched in 2007; other players like Airtel Money came to the scene much later post 2010. But by 2011, nearly half the adult population of Kenya was using money wallets with the number of money wallet accounts at 18.14 million and handling KSH 92.64 billion in outgoing transactions.

After that year-on-year mobile wallets have been growing at a steady 10-12% as ecommerce and fintech got mainstream in Kenya. But not all players have been growing at the pace M-Pesa, the dominant market player, has. Even in 2012, of 19.79 mobile money accounts in the country 17 million (86%) belonged to M-Pesa.

Currently M-Pesa has 48 million accounts in Kenya; which is 70% of the marketshare. While competition from other players Airtel Money and Equitel is tough – the main reason for some dent in marketshare, customers say is “price consciousness.”

For years, M-Pesa charged 5-10X more than its competitors. And it was only during the pandemic that Safari.com finally heeded consumers and slashed prices. “Ask any Kenyan today and they will tell you how M-pesa is a costly service which they only hang on due to convenience. Should an alternative money transfer system emerge which is convenient but cheaper, there will be a mass exodus from M-Pesa in droves,” says Daniel Wambua, CEO and co-founder of Cultecltd.com.

But some M-Pesa’s marketshare has been coming down over the years — to 70% from earlier near monopoly of 86% in 2012. And this Kenyans say is due to competition and bank-led PesaLink making inroads into M-Pesa territory.

Bankers say Pesalink’s quiet popularity comes as a result of transactions being real-time, cheap with higher limits (upto USD 10,000 per customer per day) compared to competing mobile money solutions. “Before the coming of Pesalink, transactions across the banks were limited to EFT, RTGS or cheques. These solutions have one thing in common, they are highly lagging meaning customers need to wait for days before transactions are settled. They are also expensive,” says Robert Kariuki, digital banker, Sidian Bank Ltd.

But, seeing how mobile wallets outnumber people in Kenya, it is possible Kenyans might decide to stick with M-Pesa, on top of downloading Pesalink, Airtel Money, others – as so far it seems to be a case of “the more, the merrier.”

Image credit: imarc