Deal Street

African Startup Funding Tracker

USD 370,103,999+

*Data updated daily at 18:00 EAT

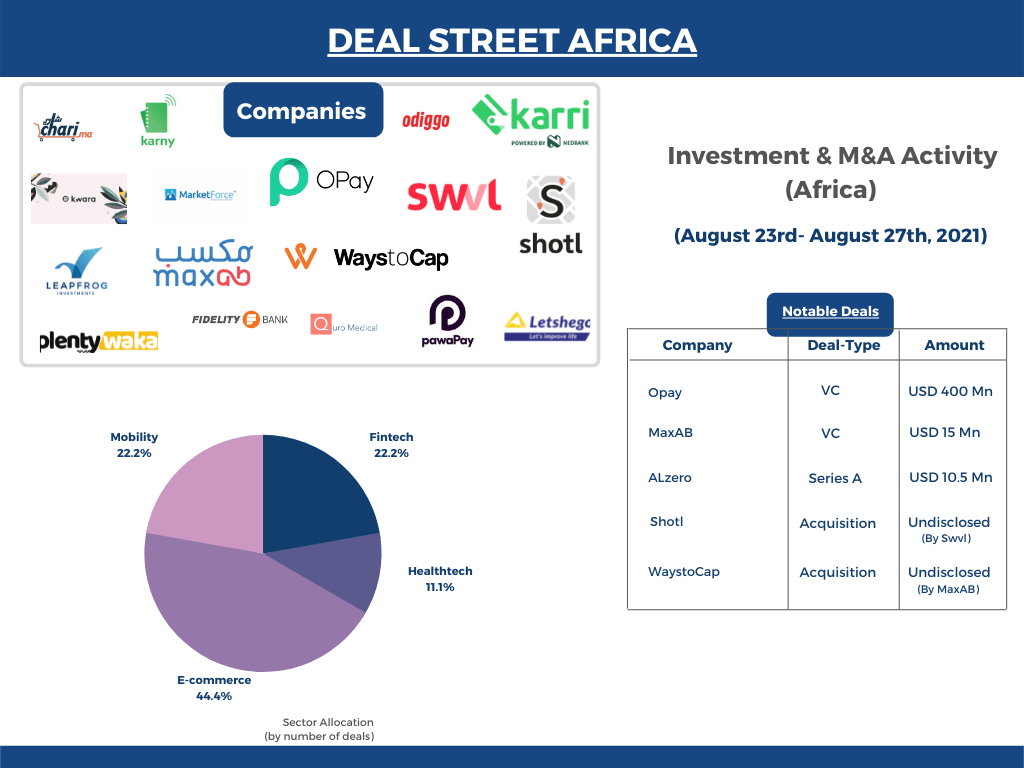

Here is a recap of last week’s notable deals on the African continent, E-commerce startups led with 44% of last week’s total funding deals.

Mobility Startup Plentywaka Raises USD 1.2 Mn Seed, Acquires Stabus Ghana

Plentywaka, a mobility business based in Lagos and Toronto, raised a USD 1.2 Mn seed round to expand its operations after graduating from the Techstars Toronto Accelerator Program last month. In addition, the startup has acquired Stabus Ghana to expand into Accra. The funding round was led by Canadian-based VC firm The Xchange. The round also included SOSV, Shock Ventures, Techstars Toronto, Argentil Capital Partners, and ODBA & Co Ventures. Some angel investors from Canada, other parts of Africa, and the U.S also participated in the seed round.

Nigerian E-commerce Startup Alerzo Raises USD 10.5 Mn Series A Round

Alerzo, a Nigerian B2B e-commerce retail startup, raised USD 10.5 Mn in a Series A round led by London-based Nosara Capital. The round also included FJ Labs and various family offices from the United States, Europe, and Asia, including Michael Novogratz’s. The funds raised in this Series A round will go into expansion to northern Nigeria. Alerzo also plans to roll out AlerzoPay, its cashless payments and financing platform, as well as a portfolio of additional business support services.

Autotech Startup Odiggo Raises USD 2.2 Mn Seed round

Odiggo, an auto-tech app based in Egypt and Dubai, secured USD 2.2 Mn in a Seed round led by Y Combinator, 500 Startups, and PlugAndPlay. The startup plans to use the newly acquired investment to expand its team and enhance its growth in the region, especially in the UAE, Saudi Arabia, and Egypt.

Bus-Hailing Startup Swvl Acquires Mass Transit Platform Shotl

Swvl, an Egyptian bus-hailing startup, purchased a majority stake in Shotl, a Spanish mass transportation network that partners with municipalities and enterprises to deliver on-demand bus and van services across Europe, Latin America, and Asia. Shotl will now be able to take advantage of Swvl’s unique technologies to increase route optimization and vehicle load while reducing traffic congestion.

Investment Firm LeapFrog Acquires Stake In Fidelity Bank Ghana

LeapFrog Investments, a Profit with a Purpose investment firm, acquired a 16.94% stake in one of Ghana’s largest privately-owned banks, Fidelity Bank Ghana Limited. LeapFrog has acquired the stake from Amethis, an investment fund manager dedicated to the African continent, and Edmond de Rothschild Equity Strategies (ERES), a mid-cap growth and buy-out franchise affiliated with Edmond de Rothschild Group, with a global investment mandate.

Fintech Startup Opay Raises USD 400 Mn Funding Round

Africa-focused fintech company OPay raised USD 400 Mn in new financing led by SoftBank Vision Fund 2. The round also included Sequoia Capital China, Redpoint China, Source Code Capital, Softbank Ventures Asia, DragonBall Capital, and 3W Capital.

Kenyan Startup MarketForce Secures USD 100 K Funding

Kenyan B2B retail startup, MarketForce, secured an additional USD 100 K in funding from the Harambeans Prosperity Fund to the USD 2 Mn pre-Series A round it announced last month. The Harambeans Prosperity Fund is a donor-advised investment vehicle formed through the Harambe Entrepreneur Alliance’s network of prominent families and corporations.

Morocco’s Chari.ma Acquires Fintech App Karny.ma

Chari.ma, a Moroccan B2B e-commerce platform, acquired Karny.ma, a Moroccan fintech app, to enable mobile payment transactions for its customers. The deal followed Chari.ma’s most recent fundraising round. Chari.ma hopes to use Karny.ma to acquire new users at a lower price.

Mobility Startup Kai Senegal Secures Seed Investment

YEEG SAS, a company that operates ride-hailing startup Kai Senegal, secured a seed investment from Mobility 54 Investment SAS, the corporate venture capital subsidiary of Toyota Tsusho Corporation and CFAO SAS. Through Mobility 54’s engagement, the Toyota Tsusho/CFAO collaboration seeks to aid local imaginative solutions to the many challenges that public transportation in West African countries encounters, such as low service quality, insecurity, and traffic congestion.

Egypt’s MaxAB Secures USD 15 Mn Funding, Acquires Morocco’s WaystoCap

MaxAB, an Egyptian retail-tech startup, acquired Moroccan counterpart WaystoCap as it plans to expand across the Maghreb area after raising an additional USD 15 Mn. The acquisition will see MaxAB accelerate its expansion into the Maghreb market, empowered by WaystoCap’s expertise in the region. MaxAB’s technology, enhanced end-to-end supply chain solutions, and business intelligence tools, and WaystoCap’s experience and skills will now benefit the retailers and suppliers supplied by both firms.

Two African Fintech Startups Selected For Mastercard Start Path Program

Karri Payments from South Africa and Kenya’s Kwara are among 11 fintech startups selected to join the Mastercard Start Path global network to scale innovation. The six-month Start Path program from Mastercard is designed to help the best and brightest entrepreneurs maximize their chances of success by learning from Mastercard experts and exploring co-innovation opportunities.

South Africa’s Quro Medical Secures Investment From Life Healthcare

Quro Medical, a healthcare startup based in Johannesburg that leverages technology to make healthcare more accessible and inexpensive, received undisclosed investment funding from Life Healthcare (LHC). This deal will help Quro Medical’s expansion plan as it can now move into other markets where LHC is present. LHC seeks to provide onsite and remote care to its patients, creating a hybrid healthcare model that will maintain relevance in local and worldwide markets.

Pan-African Fintech Startup PawaPay Raises USD 9 Mn Seed Round

PawaPay, an African fintech company, has raised USD 9 Mn in seed funding to expand its mobile money payment solutions team, scale operations, and enter new markets. The round was led by 88mph, a UK-based company that invests in web and mobile-centric technology solutions, and MSA Capital, a Chinese venture capital firm. Other investors include African venture capital firm Kepple Ventures, South African Vunani Capital, and Zagadat Capital.

Micro-lender Letshego Secures USD 50 Mn Loan From IFC To Boost Affordable Housing In Namibia

Pan African microlender Letshego received a USD 50 Mn loan from the International Finance Corporation (IFC) to boost affordable housing lending in Namibia with the potential to expand the partnership to other countries, including Kenya. According to the firm, the lender’s new loan will help it finance up to 4,000 home developers in Namibia.

Paid Members Are Reading

-

February 13, 2026

Nigeria’s New Tax Law Is Forcing Remote Workers To Get Clever (Or Pay Dearly) -

December 22, 2025

The Full Basket: How Naivas CEO Andreas von Paleske Stocks Up For Success -

December 5, 2025

African Workers Feel Both Delight & Dread Using AI For Work & Fearing Being Replaced