Deal Street

African Startup Funding Tracker

USD 219,803,999+

*Data updated daily at 18:00 EAT

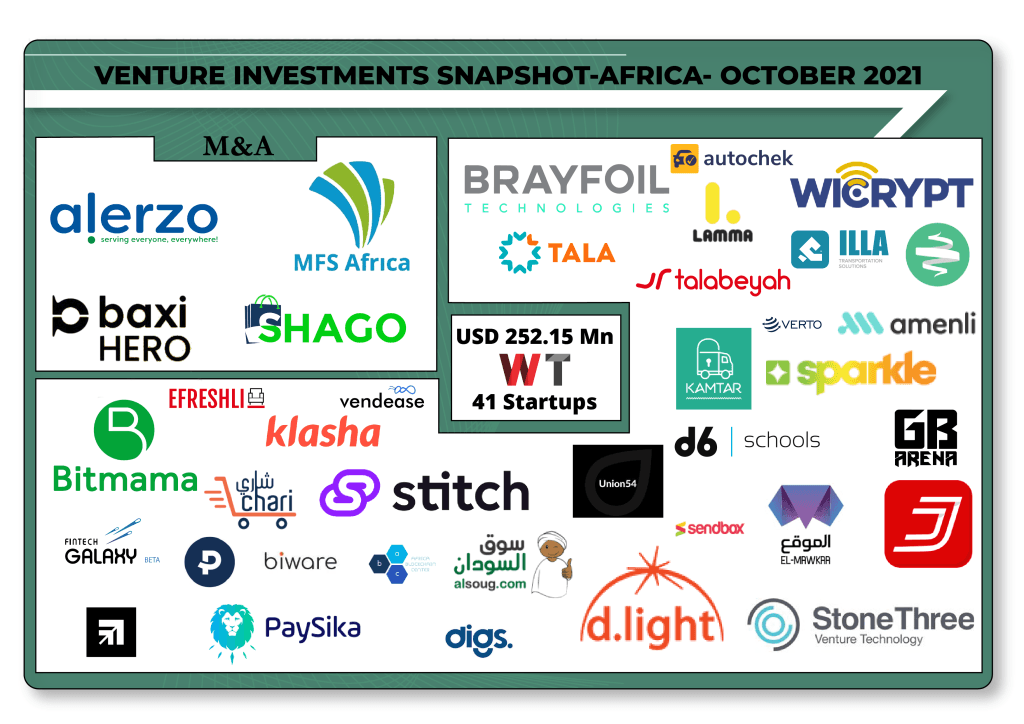

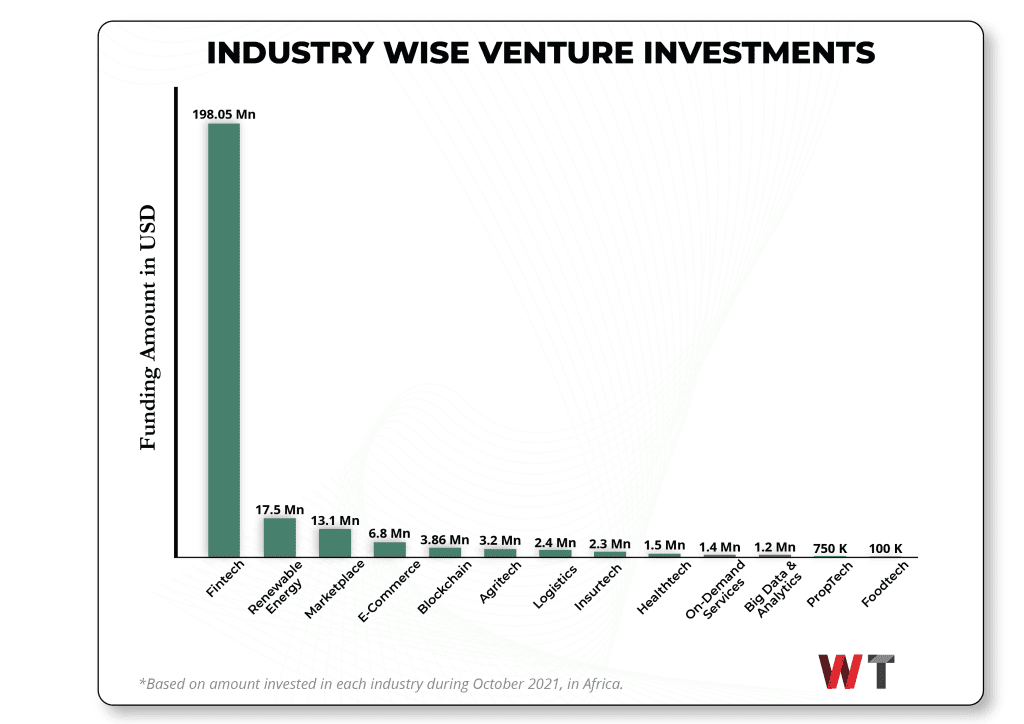

African ventures raised USD 252.15 Mn in October across 41 disclosed deals, a substantial drop from September’s record of USD 782.6 Mn. As is the norm, Fintechs recorded the highest number of funded deals (13) and amount raised (USD 198.5 Mn).

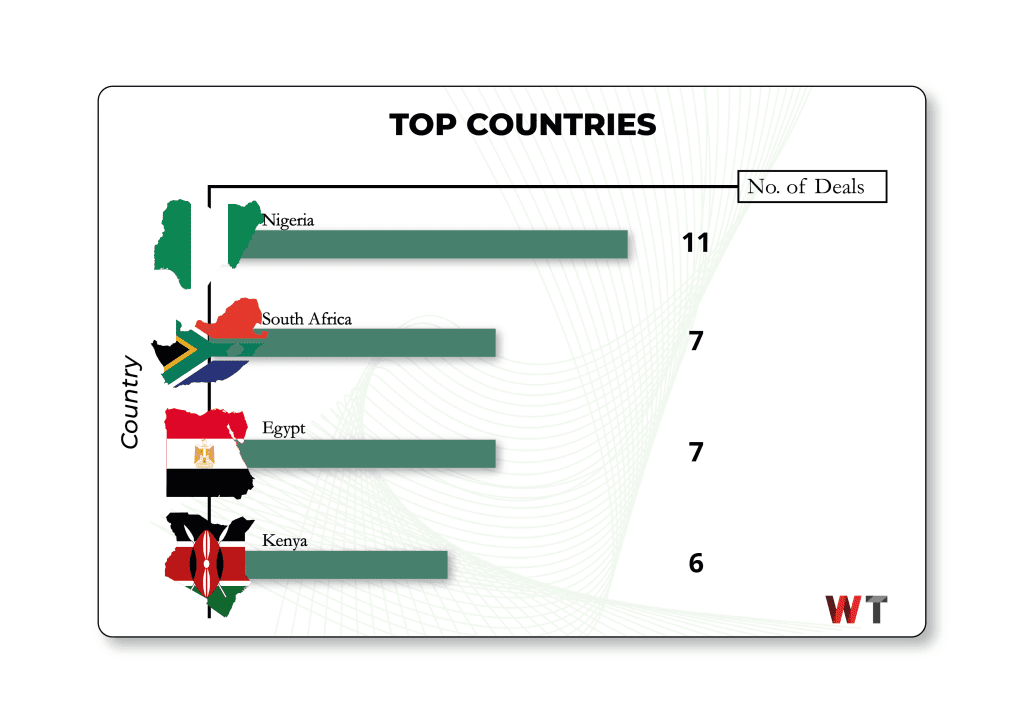

Kenyan startups recorded the highest amount raised of USD 172.4 Mn across 6 deals. Similar to September, Nigeria showed more activity in the number of startups funded (11), with Egypt and South Africa following closely with 7 deals each. October also saw funding activity in underdog regions like Sudan, Zambia, Cameroon, Ivory Coast, and Tunisia.

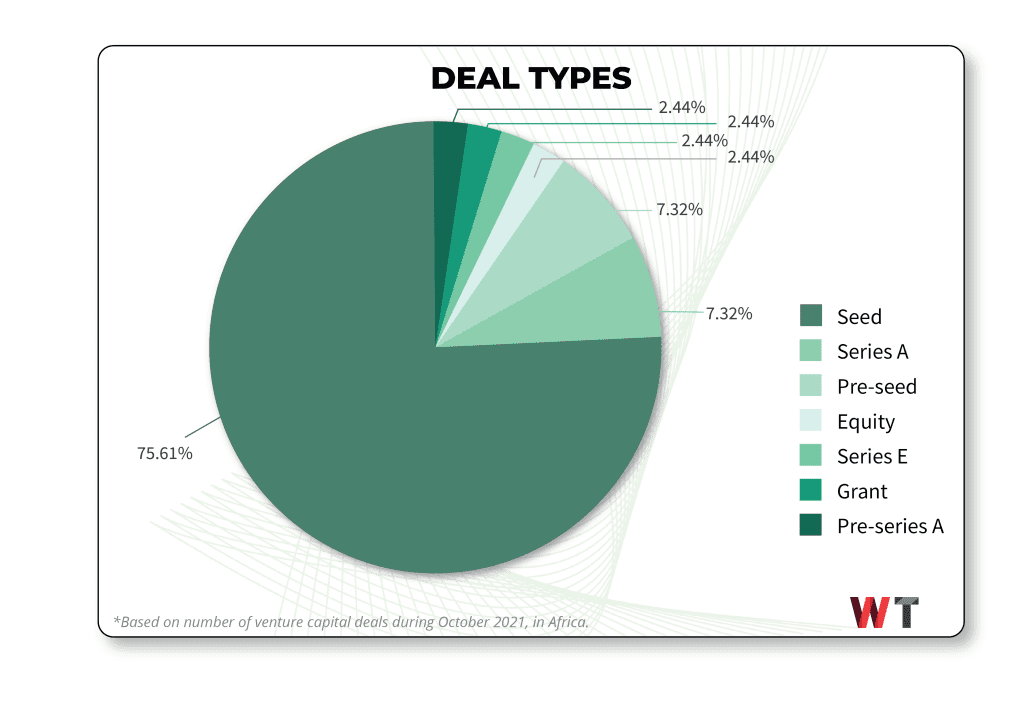

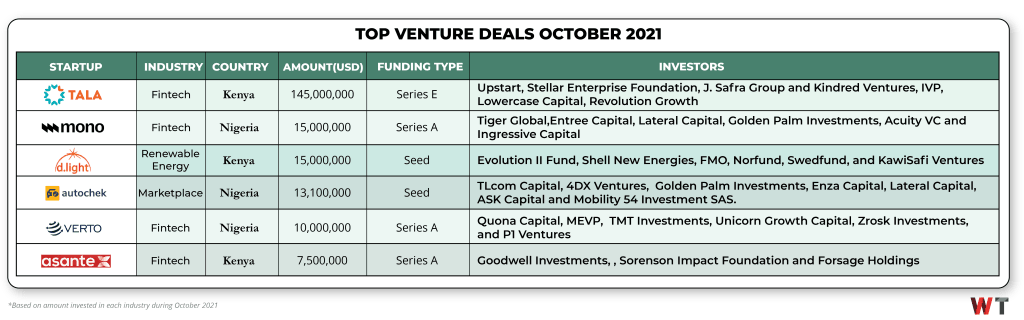

31 startups raised money in seed funding, representing 75.61% of the total number of startups funded. Fintechs Asante (Kenya), Verto (Nigeria), and Mono (Nigeria) all raised Series A funding rounds totaling USD 32.5 Mn. Top investors in these rounds include Goodwell Investments, Quona Capital, Tiger Global, MEVP, and Lateral Capital. Tala’s funding round placed Series E as the highest-funded deal type.

The Renewable Energy and Marketplace sectors both raised more than USD 10 Mn each in October. Other notable industries that showed potential and are worth mentioning this month include, PropTech (4 deals), Logistics (4 deals), and Blockchain (4 deals).

Tala’s USD 145 Mn Series E round accounts for 73% of the total amount raised among fintechs and 58% of the overall amount raised within the month. The digital microlender seeks to expand and grow its team in its current markets and the USA. Notable investors in this hefty round included Upstart, Stellar Enterprise Foundation, IVP, and Revolution Growth.

Kenya’s d.light raised an additional USD 15 Mn in October months after raising USD 10 Mn in May this year. The seed round included key investors such as Evolution II Fund, Shell New Energies, FMO, Norfund, Swedfund, and Kawasaki Ventures.

Nigerian Automotive tech startup Autochek raised USD 13.1 Mn from TLcom Capital, 4DX Ventures, Golden Palm Investments, Enza Capital, Lateral Capital, ASK Capital, and Mobility 54 Investment SAS. The funding comes after the startup acquired Cheki Kenya and Uganda in September in a deal to facilitate its expansion into East Africa.

MERGERS AND ACQUISITIONS

Merger and Acquisition activities in October were less compared to September. Pan-African payments company MFS Africa acquired Baxi, one of Nigeria’s largest super-agent networks, to enable its growth into the country.

Alerzo, a Nigerian retail-tech startup, acquired Shago Payments, a fintech company, to accelerate its growth. With Shago’s integration into AlerzoPay, Alerzo now provides informal retail stores with a portfolio of new digital services such as mobile airtime top-up, bill payments, and peer-to-peer transfers.

FUND LAUNCHES

October saw the launch of four major funds; Google announced that it plans to invest up to USD 50 Mn in African early and growth-stage startups via its Africa Investment Fund in a bid to support more businesses on the continent. Each will receive up to USD 100 K in equity-free capital along with credits from Google Cloud, Google.org ads grants, and additional support. Africa50, an investment bank for infrastructure in Africa, launched Africa50 Infrastructure Acceleration Fund, a new fund aimed at catalyzing further investment flows into African infrastructure.

Adiwale Partners, an SME investment fund, closed its first USD 69 Mn West African investment fund, Adiwale Fund I. The fund plans to invest between EUR 3 and EUR 8 Mn per transaction in medium-sized companies that are well established in their markets and capable of rapidly growing, focusing on Côte d’Ivoire, Senegal, Mali, and Burkina Faso.

Development Partners International (DPI), an African investment firm, raised USD 900 Mn in its third round of funding. The ADP III fund will invest in established and growing companies in industries that benefit from Africa’s fast-growing middle class and the increasing digital transformation of the continent. The Algerian Startup Financing Fund raised DA1 billion (USD 7.2 Mn) to fund startups in Algeria. The funding will be utilized to support the non-established startups, aiming to develop financial inclusion for a better mobilization of financial resources.

Paid Members Are Reading

-

December 22, 2025

The Full Basket: How Naivas CEO Andreas von Paleske Stocks Up For Success -

December 5, 2025

African Workers Feel Both Delight & Dread Using AI For Work & Fearing Being Replaced -

November 21, 2025

Nigeria’s Top Telcos Struggle To Sell Mobile Money In Crowded Market