Deal Street

African Startup Funding Tracker

USD 219,803,999+

*Data updated daily at 18:00 EAT

Kenya’s Twiga Foods Raises USD 50 Mn To Scale

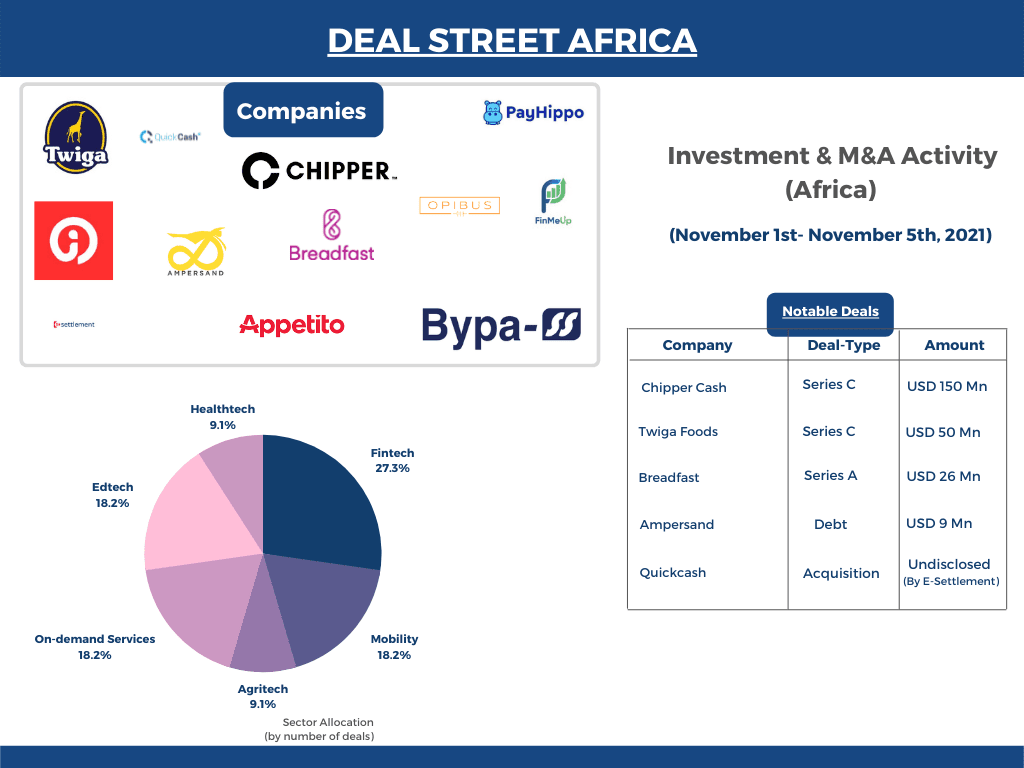

Kenyan Agritech startup, Twiga Foods, raised a USD 50 Mn Series C round to scale its efforts in the East African nation and other neighboring countries. Creadev led the round with participation from Africa-focused firms TLcom, IFC Ventures, DOB Equity, and Goldman Sachs’ spinoff Juven, wrote follow-on checks too. First-time investors OP Finnfund Global and Endeavor Catalyst Fund participated as well. Twiga plans to use part of the funding to roll out low-cost manufactured food and non-food products under its brand before the end of the year.

Rwandan Startup Ampersand Secures USD 9 Mn Debt Facility

Ampersand, a Rwanda-based electric motorcycle startup, received a USD 9 Mn financing facility from the US International Development Finance Corporation (DFC) to expand its operations in Rwanda and Kenya. The loan is part of DFC’s Portfolio for Impact and Innovation (PI²) initiative and contributes to its commitment to the US Energy Compact and its target to address climate change with one-third of its investments by 2023.

Kenyan Mobility Startup Opibus Raises USD 7.5 Mn Funding Round

Opibus, a Kenyan-based electric mobility startup, raised USD 7.5 Mn in equity and grant funding to help it expand its electric motorcycle and bus manufacturing operations. The round was led by Silicon Valley fund At One Ventures, and further supported by Factor[e]Ventures and Ambo Ventures. It consists of USD 5 Mn in equity and USD 2.5 Mn in additional grants.

Nigerian Fintech E-Settlement Acquires Ivory Coast’s QuickCash

E-Settlement (E-SL), a Nigerian fintech group of companies, acquired QuickCash, an Ivorian electronic payment, and money transfer company, to expand and boost last-mile access to financial services in Francophone African countries like Côte d’Ivoire, Burkina Faso, Niger, Togo, and more.

Fintech Company Chipper Cash Secures USD 150 Mn Series C Extension

Chipper Cash, an African cross-border payments company, secured USD 150 Mn in a Series C extension round valuing the company at USD 2 Bn. The round was led by Sam Bankman-Fried’s cryptocurrency exchange platform FTX. SVB Capital, and other previous investors such as Deciens Capital, Ribbit Capital, Bezos Expeditions, One Way Ventures, and Tribe Capital, reinvested in this extension round.

Fintech Startup Lemonade Finance Raises pre-Seed Funding Round

Lemonade Finance, a Y Combinator-backed Nigerian fintech startup, announced a USD 725 K pre-seed funding raise. The funding round included Y Combinator and VC firms, Microtraction, Ventures Platform, and Acuity Venture Partners. The round was also backed by involvement from several other individual investors.

Edtech Startup Semicolon Africa Raises USD 1.2 Mn Seed Funding

Semicolon Africa, an edtech startup creating employment and economic opportunities by training software engineers and techpreneurs, closed a USD 1.2 Mn seed round of funding. The oversubscribed round included angels and VCs like Launch Africa Ventures and Consonance Investment Managers. The startup plans to use the new funding to increase its training, talent management, and project delivery capacity.

South African Financial Edtech FinMeUp Secures Seed Funding

FinMeUp, a financial education startup, secured an undisclosed amount in funding from ZAQ Ventures (Venture Studio). The startup plans to use the funds to develop and expand its platform and product offerings. This includes launching new features and establishing partnerships along with the implementation and launch of FinMeUp wealth.

Egyptian HealthTech Bypa-ss Raises USD 1 Mn Funding Round

Bypa-ss, an Egypt-based healthTech and health information management company, raised USD 1 Mn in its newest fundraising round from Egyptian and foreign investors. The round included investors like Magic Fund, Acuity Ventures, Launch Africa, Plug and Play, and other regional and international VCs and angel investors. The company intends to use the funds to fuel expansion, perfect a high-end tech mobile app for patients to engulf and facilitate the information exchange between the stakeholders from different levels and sizes and capitalize on the company’s rapid growth.

Egyptian Delivery Startup Appetito Raises USD 2 Mn Pre-Series A Round

Appetito, a Cairo-based grocery delivery startup, raised USD 2 Mn in a pre-Series A funding round as it plans to rapidly scale. The round was led by Jedar Capital, a US-based early-stage VC focusing on MENA and Emerging Asia, with participation from Golden Palm Investments, DFS Lab, and a group of prominent angel investors and family offices.

Nigerian Fintech Startup Payhippo Closes USD 3 Mn Seed Funding Round

Payhippo, a Nigerian SME lending startup closed a USD 3 Mn seed funding round to enhance its technology capabilities to support small businesses in Nigeria with innovative solutions to unlock sources of capital for their customers. The round was led by influential African fintech founders and financial leaders Ham Serunjogi and Maijid Moujaled, co-founders of Chipper Cash, Olugbenga Agboola, co-founder of Flutterwave; Bolaji Balogun, CEO of Chapel Hill Denham, and Hakeem Belo-Osagie, founder of Metis Capital Partners. Other angel investors include management from Paystack, Brex, and Tala, and several LPs from Payhippo’s pre-seed investors. Institutional investors include TEN13, VentureSouq, and Prodigio Capital.

Egyptian Delivery Startup Breadfast Secures USD 26 Mn Series A Round

Egyptian grocery delivery startup Breadfast raised a USD 26 Mn Series A funding round to expand into new cities, scale its technology, and move into Sub-Saharan African markets. The round was co-led by Vostok New Ventures and Endure Capital and included participation from JAM Fund (led by Tinder co-founder Justin Mateen), YC Continuity Fund, Shorooq Partners, 4DX Ventures, and Flexport.

Paid Members Are Reading

-

December 22, 2025

The Full Basket: How Naivas CEO Andreas von Paleske Stocks Up For Success -

December 5, 2025

African Workers Feel Both Delight & Dread Using AI For Work & Fearing Being Replaced -

November 21, 2025

Nigeria’s Top Telcos Struggle To Sell Mobile Money In Crowded Market