Deal Street

African Startup Funding Tracker

USD 370,103,999+

*Data updated daily at 18:00 EAT

Egyptian Legaltech Hekouky Raises Pre-Seed Funding Round

Hekouky, the Legaltech platform that incorporates companies and registers trademarks for entrepreneurs and business owners, raised an undisclosed amount in a pre-seed funding round by Nama Ventures. The women-led startup will use the funding to expand its business across Egypt.

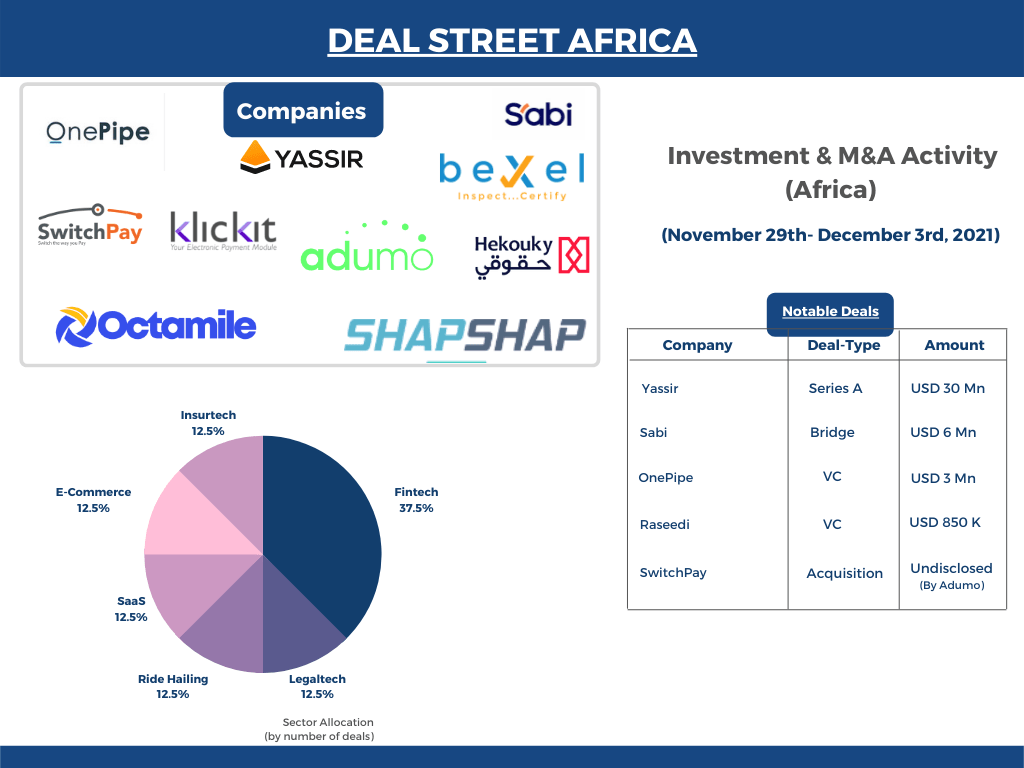

Algerian Transport Startup Yassir Raises USD 30 Mn Series A Funding

Yassir, an Algerian on-demand transport platform, raised a USD 30 Mn Series A funding round to allow it to grow in existing markets and expand into new ones. The round was led by a large network of key strategic investors including, WndrCo, DN Capital, Kismet Capital, Spike Ventures, and Quiet Capital, and also includes Endeavor Catalyst, FJ Labs, VentureSouq, Nellore Capital, Moving Capital, and various notable angel investors.

Nigerian Fintech Startup OnePipe Raises USD 3 Mn Seed Round

Nigerian fintech startup OnePipe raised a USD 3.5 Mn seed funding round as it looks to double down on its embedded finance strategy. The round was co-led by Atlantica Ventures, Tribe Capital, and V&R Associates. It also included Canaan Partners, Saison Capital, Norrsken, The Fund, and Two Culture Capital. Existing investors also participated including, Chris Adelsbach, Techstars, Ingressive Capital, Acquity, P1, Raba, and DFS Lab.

Nigerian B2B Marketplace Sabi Raises USD 6 Mn Bridge Round

B2B marketplace Sabi has announced the close of a USD 6 Mn bridge round to support its continued fast-paced growth in Nigeria and beyond. The round was led by CRE Venture Capital and also included investors including Janngo Capital, Atlantica Ventures, and Waarde Capital.

Nigerian Delivery Platform ShapShap Secures Investment

ShapShap, a delivery platform that specializes in deliveries in Africa’s fragmented logistics industry, received an undisclosed investment sum from GreenTec Capital Partners, an Africa-focused venture capital firm.

Egyptian Fintech KlickIt Closes Seed Funding Round

Egyptian fees management and digital collection platform, KlickIt, announced the closing of their first investment round with commitments from EFG Finance and the venture capital arm of dfin Holding, Camel Ventures. The main purpose of the investment is to build and enhance KlickIt’s tech stack and to build and deploy value-added services to cross-sell new services for the company’s large network of schools and universities as well as their rapidly growing customer base.

Egyptian Fintech Raseedi Raises USD 850 K Pre-Series A Round

Egypt-based fintech Raseedi raised USD 850 K in a pre-series A round from Samurai incubate. The round also included existing investors like 500 Global, EFG-EV, and Falak Startups.

Egyptian Startup beXel Raises Six-Figure Funding Round

Cairo-based cloud-based inspection management software beXel raised a six-figure investment round led by JH Investments Ltd, in addition to follow-on funding from Flat6Labs, UI Investments, and Saudi angel investors. The startup looks to continue expansion within the GCC, starting with KSA with the new funding.

South African Fintech Startup Adumo Acquires SwitchPay

South African fintech group Adumo acquired SwitchPay, a provider of alternative payment solutions for consumers both in-store and online, for an undisclosed amount.

Nigerian Insurtech Startup Octamile Raises USD 500 K Pre-Seed

Nigeria’s Octamile, an insurtech company enabling insurance and non-insurance businesses to protect African consumers from financial loss, came out of stealth mode with USD 500 K in pre-seed funding. The round was led by EchoVC Partners, with participation from Fiat Ventures, Kesho VC, Trade X, Verraki Partners, Dale Mathias, Kyle Daley, and other local and international angels.

Paid Members Are Reading

-

February 13, 2026

Nigeria’s New Tax Law Is Forcing Remote Workers To Get Clever (Or Pay Dearly) -

December 22, 2025

The Full Basket: How Naivas CEO Andreas von Paleske Stocks Up For Success -

December 5, 2025

African Workers Feel Both Delight & Dread Using AI For Work & Fearing Being Replaced