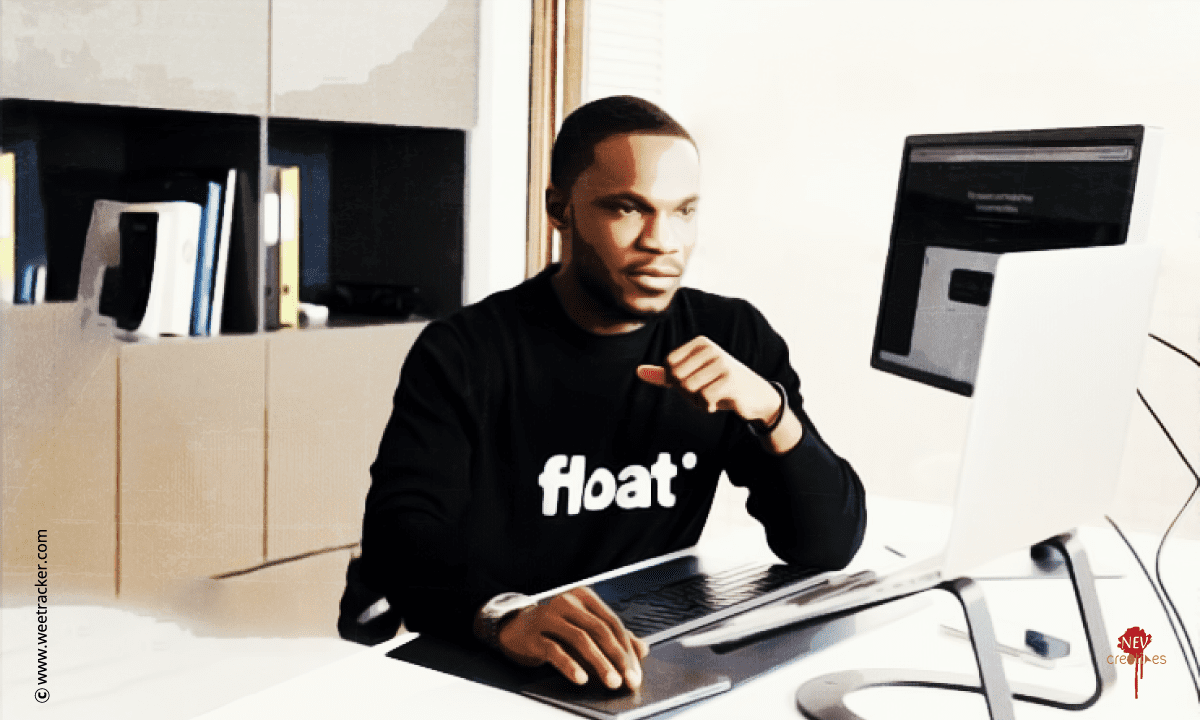

The turmoil at Float; a Ghanaian business banking startup backed by big-name investors such as Tiger Global and Y Combinator, and revelations of questionable handling of funds on the part of its Founder and CEO, Jesse Ghansah, have drawn outrage and commentary across African tech.

As the initial shock wears off for many, aggrieved clients (including at least one fellow YC-backed fintech company) impacted by what some have called “deliberate acts of betrayal”, are seeking recourse in the face of dire consequences.

At least one affected party, WT has learned, has filed a complaint with both the Economic and Financial Crimes Commission and Interpol against Float’s beleaguered CEO, Ghansah, who stands accused of acting in bad faith and perpetrating fraud.

“He[Ghansah] sent fake receipts, lied about transfers, and took money under false pretence,” said one founder who had deposited millions of dollars of company money with Float earlier this year.

“He’s the perpetrator. The reason why he was able to con people for long was because everyone kept quiet,” the founder added, asking not to be identified to eschew negative attention.

The allegations levied against Ghansah, whose current whereabouts are a bit sketchy according to aggrieved clients, are a combination of telex forgery, wire fraud, and misappropriation of funds. Although Float’s struggles only became public last week, the troubles at the startup and the antics of its embattled founder had been known in some circles since last year, two sources said, noting that the silence of stakeholders essentially prolonged the alleged malfeasance.

“Nobody spoke up about it and silence enables bad actors. This is something that needs to change, people need to speak out more. If people had spoken up since last year, none of us would have put money there,” said the founder from earlier who had acknowledged in a prior communication to investors that the startup would lose two years of runway if the funds held with Float go unrecovered.

One other affected company, WT has learned, is unable to make payroll this month and could close shop having lost sight of the bulk of its capital deposited with Float.

The beginning

Initially called Swipe, an invoice factoring platform founded in 2020, Ghansah and co-founder Barima Effah morphed the company, a year later, into Float; a credit provider and cash flow management/spend platform for SMEs.

In last year’s interview with TechCrunch, Ghansah stated that Float “had onboarded hundreds of businesses” across diverse industries, joining a rising crop of fintechs, among which are Prospa, Brass, Payhippo, etc., building business banking solutions for Africa’s vast SME landscape.

Float announced a USD 17 M debt/equity seed in January 2022 led by some notable investors, having graduated from the celebrated YC accelerator prior to that. Interestingly, Float is Ghansah’s second run in the coveted YC alumni, having previously made the cut with media firm OMG Digital in 2016; a company he co-founded with Prince Boakye Boampong who is coincidentally embroiled in scandal and was ousted following allegations of financial misreporting, among other things, at the helm of Ghanaian fintech Dash.

When US-based Mercury Bank, a popular choice for African startups, suddenly restricted accounts of African clients in March last year, Float found something of a boon to accelerate its business banking offerings, taking on treasury management for businesses with global touchpoints.

If your Mercury account got frozen, kindly this form so we add you to our beta for @Floatcash US Bank accounts(real accounts not virtual).

You'll get:

1. Better international banking.

2. Credit in USD.

3. Instant USD to local currency transfers. https://t.co/caz1o58rKD— Jesse Nana Kojo 👨🏾🚀🏁 (@Jessetheranter) March 2, 2022

Float invited deposits from small businesses looking to efficiently manage their capital, offering 5 percent yield and enabling them to borrow and spend globally in 30+ currencies. The subsequent collapse of the startup favourite, Silicon Valley Bank, earlier this year also fed interest in emerging home-grown options like Float.

“We held some of our money with Float because, in addition to other things, it was particularly useful for accessing local currency readily, we have recurring expenses in naira and Float made it easy to access naira unlike foreign banking options,” the founder of one of the affected startups told WT. “There was no reason to be concerned initially, Float came highly recommended and well-backed and its founder well-known.”

Concern would however creep in sometime in June when clients were met with unresponsiveness upon initiating withdrawals. Initially thought to be a temporary liquidity issue, according to two clients, it would later emerge that something untoward was amiss.