Duplo Sees Boon For Cross-Border B2B Payments In Africa Amid Struggles

Africa’s cross-border business-to-business (B2B) payments landscape is in line for a transformative shift, predicts a new report by Duplo, a provider of payment solutions for African businesses. These findings suggest evolving global trade dynamics and the advent of innovative payment technologies will catalyse substantial growth in cross-border B2B transactions.

The report, titled “The State of Cross-Border B2B Payments in Africa and its Impact on Trade,” underscores the immense potential of intra-African trade. Despite an estimated value of USD 193 B in 2022, accounting for 13.8% of total African trade, the report suggests this figure significantly understates the true scale of commerce due to prevalent informal and underreported transactions.

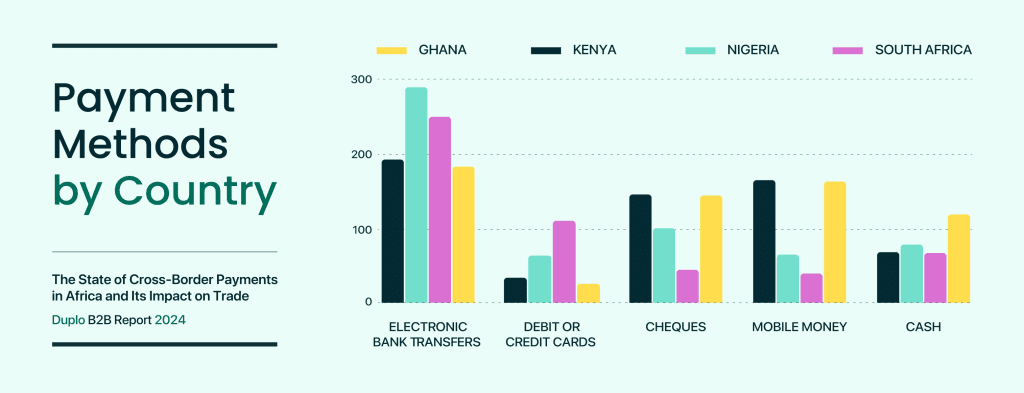

A striking revelation is that 40% of cross-border trade payments between East and West African countries are conducted in cash, with underreporting rates ranging from 12 to 76%.

This cash-heavy ecosystem, coupled with the dominance of traditional banking channels for large-value transactions, is characterised by exorbitant fees and protracted processing times.

“These realities underscore the critical need for B2B cross-border payment solutions that can accurately capture and efficiently facilitate these transactions,” emphasises the report.

Interoperability between different payment systems, particularly in cross-border transactions, remains a formidable challenge. The report highlights that less than half of the 32 instant payment systems across Africa can seamlessly collaborate. Initiatives like the Pan-African Payment and Settlement System (PAPSS), albeit in its nascent stages, are crucial for streamlining and formalizing trade across the continent.

While Africa’s share of global trade value has stagnated at 3%, the report identifies emerging trends such as the rise of Asian economic powerhouses and a new global order as potential catalysts for a shift in trade patterns. This presents a golden opportunity for robust B2B cross-border payment solutions to enhance transparency, efficiency, and cost-effectiveness.

“As businesses navigate new opportunities and challenges that come with changing global trade patterns, there is an increasing need for efficient and cost-effective cross-border payment solutions,” said Yele Oyekola, CEO and co-founder of Duplo. “Our report highlights the critical role technology can play in overcoming traditional banking limitations. We believe that by embracing these new technologies, businesses can unlock the full potential of intra- and extra-African trade, driving economic growth across the continent.”

The report’s findings spotlight the urgent need for innovative payment solutions that can address the inefficiencies and obstacles hindering Africa’s cross-border trade.