In 2001, Jacqueline Novogratz had a bold vision—to rethink how the world tackles poverty. She believed in the power of markets but knew that profit alone wouldn’t lift millions out of hardship. That belief became Acumen, an impact investment fund rewriting the rules of economic development with one simple yet radical idea: patient capital.

This was not just about making investments; it was about proving that capital, when deployed with purpose, could do more than generate financial returns. It could empower communities, build resilience, and create long-term economic transformation.

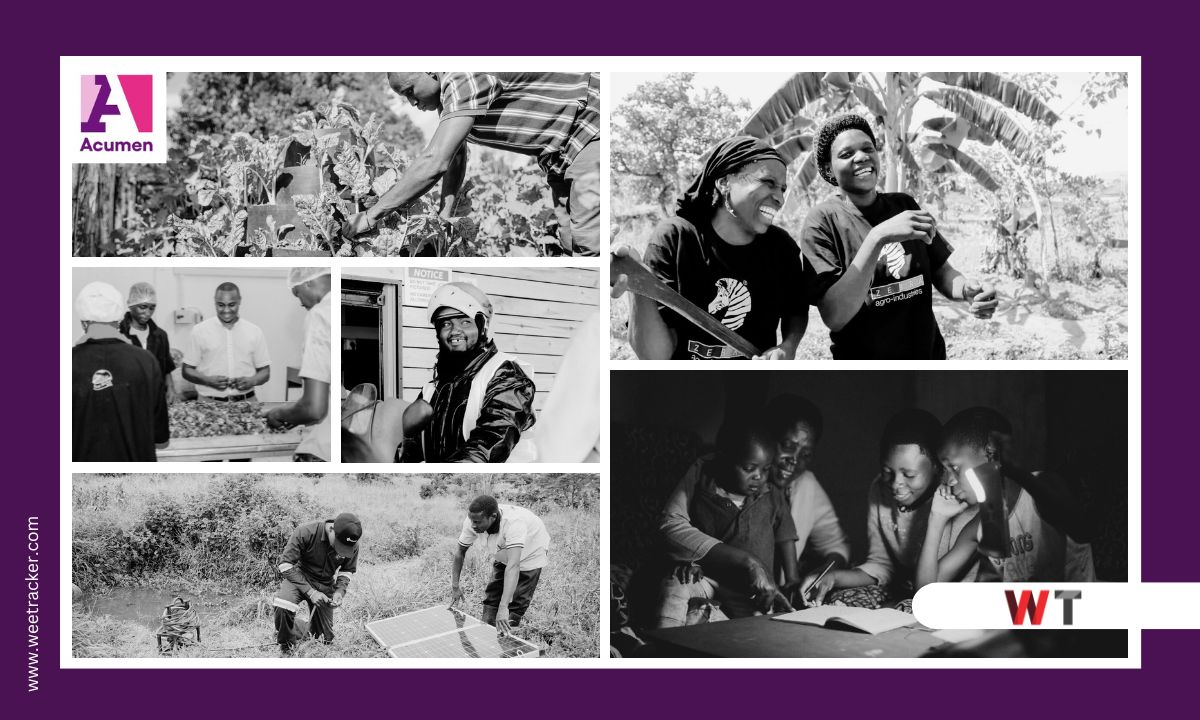

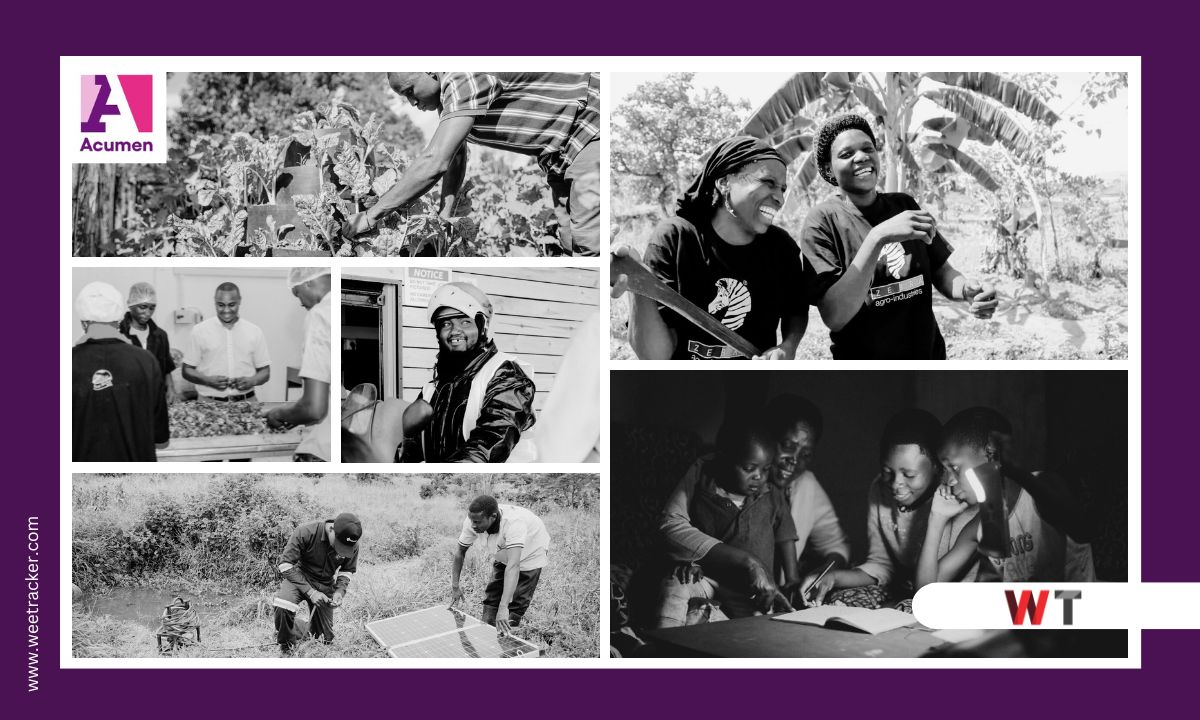

Picture this: a smallholder farmer in rural Kenya battling unpredictable rainfall. Or a child in Ghana struggling to study under a kerosene lamp's dim, toxic glow. Traditional investments wouldn’t reach them—too risky, too remote. But that’s precisely where Acumen thrives.

Acumen’s story is woven with the lives it touches. Since its founding, Acumen has grown from an ambitious experiment to a global force in impact investing, deploying over USD 260 M into 215 companies across Africa, South Asia, Latin America, and the United States. These investments have directly impacted over 648 million lives. But numbers only tell part of the tale. The real story lives in the communities where access to clean energy, resilient agriculture, and quality education isn’t just a statistic—it’s hope.

Strategic Focus on Africa

While Acumen has a broad international presence, Africa has emerged as one of its most significant focus areas, accounting for 30% of its global footprint, according to its 2023 financial report.

Unlike conventional venture capital in Africa, which is drawn to fintech’s fast-moving, high-return potential, Acumen focuses on the sectors that form the foundation of economic stability for the region.

To drive this agenda, Acumen has been actively investing in early-stage enterprises across East and West Africa, focusing on sectors that are critical for poverty alleviation and long-term economic stability, including off-grid energy, climate-resilient agriculture, affordable healthcare, and education access in the region.

Since 2006, the Impact fund has invested over USD 80 M in the region, reshaping the landscape of social entrepreneurship and financing companies that traditional venture investors often ignore—those tackling challenges in agriculture, education, healthcare, clean energy and financial Inclusion.

A Regional Focus: Transforming Africa Through Targeted Investments