How Badili Is Powering Africa’s Circular Economy With People, Process & Purpose

Affordability has always been one of the most pressing challenges for emerging economies. Yet, what is often viewed as a problem can also be the biggest opportunity. In many fast-growing African markets, consumers are increasingly mobile-first, seeking digital connectivity but struggling to access it affordably. Here, companies that solve for what people need, rather than what they simply want, can build lasting businesses.

Few products symbolise both aspiration and necessity as much as the smartphone. Around the world, manufacturers launch new generations every few months, leaving behind a flood of older devices. For price-conscious consumers, this growing supply of used phones could be a solution—if only the second-hand market were better organised and trusted.

The Shift Toward Pre-Owned Devices

Buying and trading pre-owned goods is not a new concept. Across developing economies, refurbished items—from electronics to home appliances—are a lifeline for consumers with limited disposable income. What holds many people back, however, is scepticism. The second-hand phone market is often associated with unreliability, poor quality, and a lack of after-sales support. In short, the gap is not about interest, but about trust.

Globally, that gap is narrowing. A GSMA report highlights that roughly 14% of phones currently in use were bought used or refurbished. The market for these devices is growing fast: in 2023, sales of refurbished smartphones rose by 6%, while sales of new phones fell by 4%. Analysts expect this trend to continue, with the secondary market outpacing new device sales over the next decade.

The opportunity is massive. The refurbished device and repair services market is projected to exceed USD 150 B globally by 2027, creating fresh revenue streams not only for resellers but also for operators and manufacturers who are adapting to new consumer realities.

Why Africa is Different

In Sub-Saharan Africa, the stakes go beyond economics. Despite significant mobile coverage, nearly 60% of the population still does not use mobile internet. Affordability remains the biggest roadblock. In Senegal, for example, 61% of women and 46% of men without phones say the main barrier is cost. Similar figures appear across other African markets.

With a young population and fast-rising smartphone penetration, Africa is uniquely positioned to benefit from an organised refurbished market. Millions of unused devices could be brought back to life, offering consumers access to digital tools at a fraction of the price of new ones. In doing so, the continent can reduce its digital divide, increase internet adoption, and accelerate economic participation.

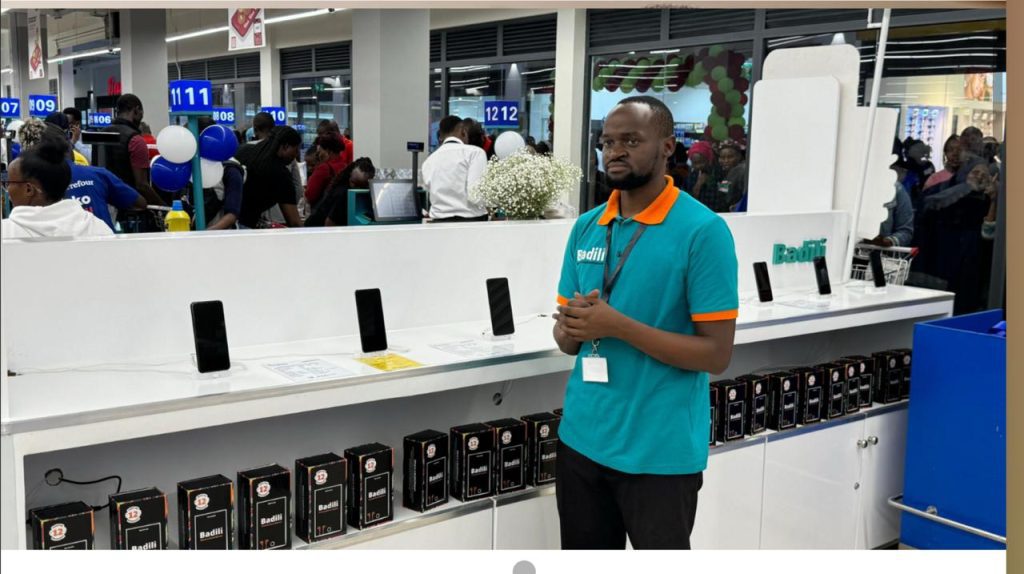

Enter Badili

It is within this context that Badili emerged. Founded in 2022 after firsthand experiences with the challenges of Africa’s second-hand market, Badili set out to formalise and build trust in the refurbished smartphone sector. It has become a recognisable and reliable name in the space in just a few years.

The company’s focus is deliberate: sub-USD 300 smartphones, the sweet spot for a large section of Africa’s young, urban, and cost-conscious consumers. Distribution is equally strategic. While offline retail networks drive significant sales, Badili has been expanding aggressively into online platforms, reaching more customers who want to sell or buy devices.

Today, the company operates in Kenya, Uganda, Tanzania, and Nigeria, with plans to deepen its presence further. Its devices are available across major e-commerce platforms and through leading mobile network operator (MNO) stores, supermarkets, and the general trade markets, creating visibility and credibility. Crucially, Badili offers warranties and after-sales services—an important trust signal in markets where customers are used to taking risks with second-hand goods.

Matthew Davis, Co- CEO and Managing Partner of Renew Capital & an early investor in Badili, notes, “Africa’s future is young, mobile, and tech-enabled — and Badili is the mobile part of that future. At Renew Capital, we see smartphones as the core infrastructure for tomorrow’s economy, and we’re backing the apps that will become the new banking software.”

Cracking the Expansion Code

Scaling in Africa is rarely straightforward, with each country’s rapidly changing compliance environment and legalities. Many startups struggle with limited capital, fragmented markets, and ambitious revenue targets. For Badili, expansion has meant more than replicating a model—it has required learning and adapting to each country’s unique distribution landscape.

By experimenting with local partnerships, tailoring retail strategies, and carefully managing inventory, Badili has grown device sales steadily. Margins remain in healthy double digits, thanks to an understanding of consumer preferences and disciplined pricing strategies. This balance—between affordability and profitability—is what allows Badili to expand sustainably, rather than chase growth at any cost.

Profitability Over Venture Capital

Affordability and accessibility are notoriously hard to balance in supply chain businesses, especially in Africa. Inter-country trade is expensive, import duties remain high, and sourcing quality devices at scale requires trust and relationships. Badili has invested in building a dependable supplier network while training its in-house team to handle refurbishing with precision.

Every device undergoes a 32-step quality check process before reaching the customer. This ensures not only functionality but also consistency—something consumers in low-trust markets value deeply. Badili understands that customers want reliability above all else; when someone spends their hard-earned money on a phone, it has to work.

That emphasis on reliability feeds directly into Badili’s role in the emerging climate tech landscape, where sustainability and circularity are fast becoming competitive advantages.

The climate tech industry is getting hot with a lot of venture money flowing in globally, but we learnt from Rishabh Lawania, Founder and CEO of Badili, that he is choosing profitability over venture capital, at the moment.

“Our unit economics have strengthened, and all our markets have become profitable. We have been lucky enough to get continuous capital and moral backing from many strategic and smart investors, not only from the continent but from Europe, Asia and the US, over the last 3 years of our operations. Let’s just say that I have a topline number in mind; once we hit that, we’d be back in the venture market, looking for further scale-up capital. Currently, we’re actively working with several debt providers who are backing our working capital requirements, ” says Lawania.

Rishabh laughingly quips, “We are in a multi-billion dollar industry where not one but 50+ organisations are grossing at a billion+ GMV.”

Badili counts PROPARCO (French Development Agency), E3 Capital, Renew Capital, Full Circle Africa, Uncovered Fund, amongst others, as its investors.

More Than Phones: Building Trust and Access

At its core, Badili is not just selling refurbished devices. It is addressing a much larger challenge: creating trust in the second-hand market and bridging the affordability gap for millions of Africans. The company’s success lies in aligning man (skilled teams), machine (technology-driven refurbishing), and money (accessible pricing models) to deliver sustainable solutions.

By formalising a once-fragmented sector, Badili is proving that the circular economy can thrive in Africa—not just as an environmental necessity but as a viable, scalable business model. Each refurbished phone is not only a product sold but also a connection enabled, a barrier lowered, and a digital divide narrowed.

Davis of Renew Capital also says, “Badili’s leadership team is building more than a phone business — they’re creating the rails for digital inclusion, while tackling global e-waste and making mobile access more affordable across the continent.”

The Road Ahead

As smartphone adoption continues to grow across Africa, so too will the demand for affordable, reliable devices. Refurbished smartphones are increasingly becoming the gateway for first-time internet users, entrepreneurs, and young people looking to stay connected. Companies like Badili sit at the centre of this shift, balancing innovation with execution, and proving that trust can indeed be built in spaces where it has long been absent.

Badili’s story is still unfolding. Yet, with its focus on quality, affordability, and consumer trust, it offers a glimpse of how Africa’s future in the digital economy can be both inclusive and sustainable. In marrying man, machine, and money, Badili is doing more than refurbishing phones—it is reshaping access, opportunity, and the very definition of value in Africa’s digital age.

With a lot of conviction, Rishabh adds, “What started in Kenya roughly 3 years ago is now scaling in 4 countries across Africa and 2 ongoing pilots. We want to be one of the fastest-growing companies that goes global, coming from Africa.”