Nigeria’s 434 Fully Approved Digital Lenders — And The Delisted Ones To Avoid

For millions of Nigerians, digital loan apps have become a financial lifeline. But for just as many, they’ve been a source of harassment and data privacy nightmares. But some good news might be on the cards as the regulatory fog is finally clearing.

In a major crackdown, the Federal Competition and Consumer Protection Commission (FCCPC) has drawn a hard line in the sand. With a looming penalty of NGN 100 M or more for non-compliance, the reign of rogue loan apps is being curtailed. As a result, there has been a surge in registrations, leading to a definitive list of players who are officially approved to operate.

For anyone who has ever wondered which loan apps in Nigeria are actually legal, the FCCPC has made it easier to know.

As of October 2025, there are 434 fully approved digital lenders officially cleared to operate in Nigeria. These companies have met the stringent requirements of the new 2025 regulations, which explicitly ban the infamous practices of contact list shaming, unclear terms, and unethical debt recovery. For borrowers, this list is a first port of call for a safer lending experience.

Another 36 are still under conditional approval, 22 hold Central Bank waivers, and 103 are under regulatory watch. Meanwhile, 47 apps have been delisted.

The new Digital, Electronic, Online, or Non-Traditional Consumer Lending Regulations (2025) reshaped the game. Lenders must register, show transparent loan terms, respect data privacy, and, crucially, stop accessing users’ contact lists.

So yes, the era of “loan sharks with spreadsheets” might be ending, and the FCCPC wants consumers to know exactly who’s playing by the rules.

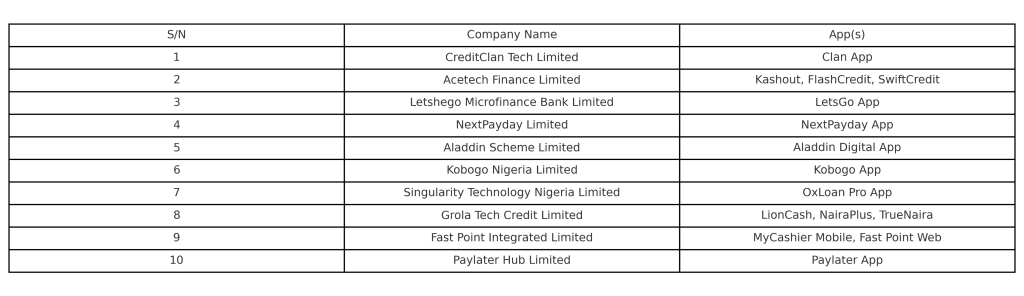

Below is a snapshot of some of the fully approved lenders. This is just a glimpse; the full ecosystem of approved lenders is vast and diverse, from well-known players like Carbon and FairMoney to a host of innovative newcomers.

The Players to Avoid

The FCCPC’s cleanup doesn’t stop with the approved list. To borrow safely, it’s just as crucial to know who isn’t on it. The Commission is actively tracking:

103 Companies on its Watchlist: These are under scrutiny for potential unethical practices or operating without registration. Steer clear.

47 Delisted Lenders: These apps have been removed from official app stores for violations. Do not engage with them.

36 Lenders with Conditional Approval: They are on their way to compliance but haven’t yet met all requirements. Borrow with caution.

Meanwhile, the FCCPC recommends that before intending borrowers download any loan app or input their personal data, they should verify its status by always cross-referencing any loan app with the official FCCPC lists.

Borrowing should be a tool, not a trap. Now, with a clear regulatory framework and transparent lists, Nigerians can finally tell the difference.

Featured Image Credits: Ralph Tathagata/Marketing Edge