The 10 Largest African Startup Funding Deals Of 2019 Contributed Over 50% Of Total Amount Raised In 427 Deals

Venture capital investments in the African startup ecosystem hit a record USD 1.340 Bn in 2019!

Yes, we’ve just come through a landmark year that saw startups operating in Africa gobble up over a thousand million dollars in funding! Yes, the one billion dollar mark has been shattered, and it has been a long time coming.

Every year for the last two years, WeeTracker has been first to put out precise and comprehensive reports on the state of venture capital investments in the sizzling startup scene in Africa. And this year is no different.

In the latest report by WeeTracker titled ‘African Venture Capital And Tech Startups Funding Report – 2019’, various dimensions of the African startup ecosystem have been touched upon to capture the movement of venture capital money in 2019.

As part of the findings, a total of USD 1.340 Bn was raised by African startups in 2019 across 427 funding deals. And interestingly, over half of that huge sum was collectively accounted for by only 9 startups who weighed in with the 10 biggest funding rounds in 2019.

In other words, while African startups recorded a total of 427 deals in 2019, the value of only 10 of those deals was even higher than the remaining 417 deals that were recorded.

As a matter of fact, the top 10 African startup funding deals of 2019 contributed as much as USD 677 Mn — slightly higher than half of the USD 1.340 Bn raised in total from the 427 deals recorded overall.

And it gets even more interesting when thought is given to yet another similar statistic which has it that just 26 deals (6 percent) out of the total funding deals drawn in during the year under review contributed a staggering 83 percent of the total amount raised.

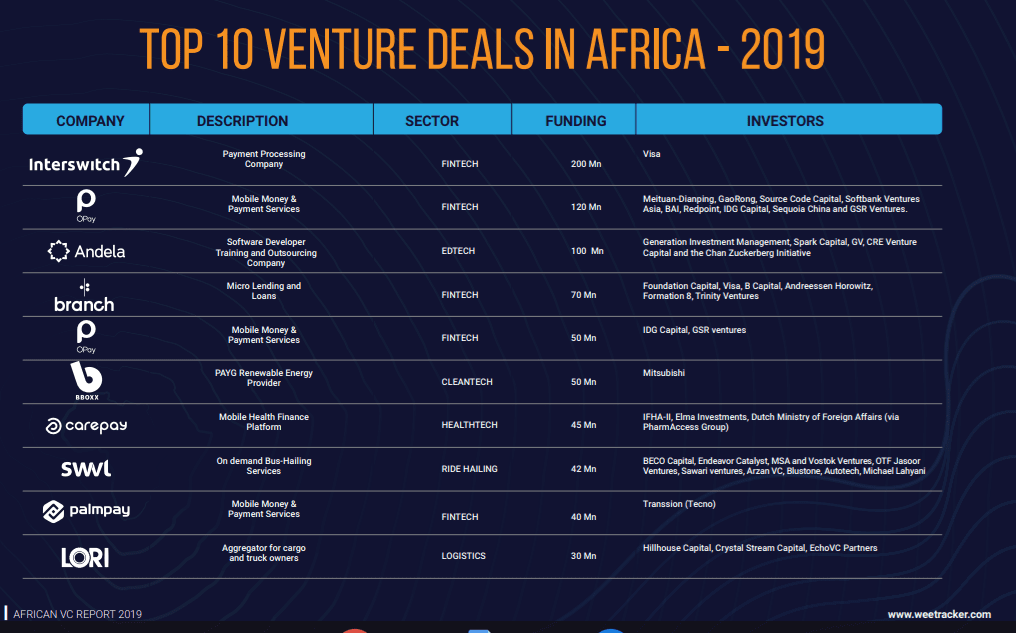

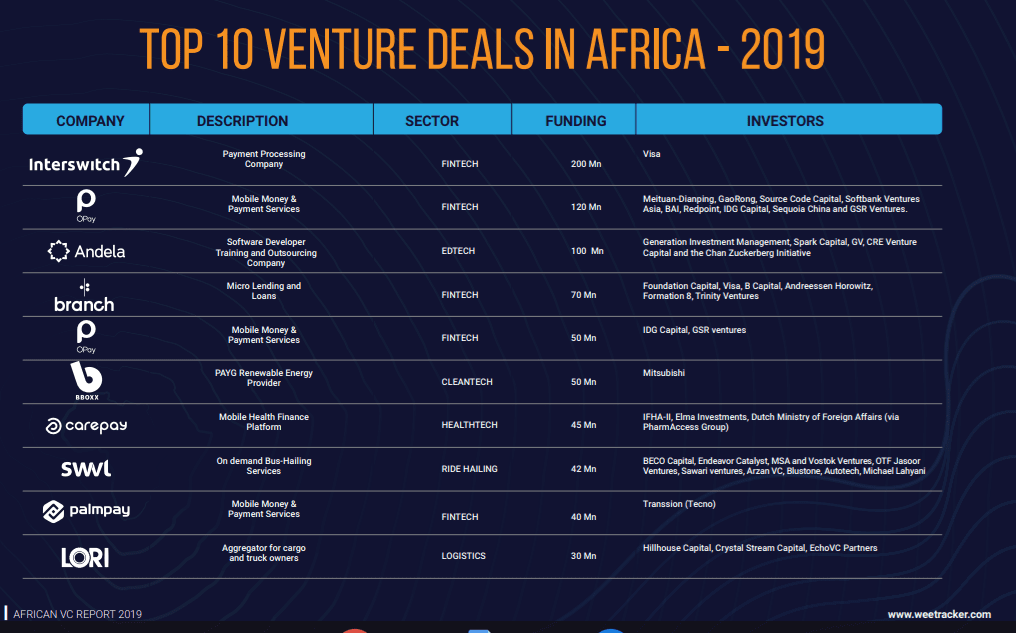

Among the top 10 funding rounds which accounted for over 50 percent of the total amount raised in 2019 are Interswitch’s mega USD 200 Mn equity round led by Visa, OPay’s USD 120 Mn and USD 50 Mn cash splash led by a consortium of Chinese investors, as well as Andela’s USD 100 Mn round which pretty much kicked off 2019.

Other big rounds which make up the 2019 African startup funding top 10 are Africa-focused lending startup, Branch, which raised USD 70 Mn in a Series C round, renewable energy startup, BBOXX, which raised USD 50 Mn in a round led by Japanese automaker, Mitsubishi, and Kenya-based healthtech startup, CarePay, which roped in USD 45 Mn from a group of investors that included Dutch firms.

Egyptian ride-hailing startup, Swvl, also has a place in the top 10 having raised USD 42 Mn in a funding round that is touted as the largest ever for a startup in the country. In Q4, PalmPay — a Chinese-backed fintech that is based in Nigeria — caused ripples with its USD 40 Mn seed round while a pair of logistics startups, Nigeria’s Kobo360 and Kenya’s Lori Systems, both had their time in the sun with raises of USD 30 Mn apiece.

These investments are among the biggest single funding rounds of 2019 and they collectively account for over 50 percent of the total amount raised during the year in review.

WeeTracker’s latest VC report also dove into the countries that were the top investment destinations in Africa while exposing the most-sought-after sectors; the tech startup sectors that appear to be magnets for VC money. And there were some surprises too.

On the whole, the report highlighted the continued rise in venture capital investments in Africa. As recently as only five years ago, the net amount raised throughout the startup ecosystem in a calendar year was just USD 185 Mn — not even up to the amount recently raised by Interswitch in a single round.

In 2016, African startup funding actually dropped to USD 153 Mn before enjoying a resurgence which saw it climb to USD 203 Mn in 2017. That figure tripled to USD 725.6 Mn in 2018 and the latest figure has now gone north of a billion dollars. That’s an increase of over 1000 percent since 2015. That’s as close to a startup ecosystem on steroids as one can get!

The 2019 African VC ecosystem report offers a detailed overview of the state of ventures and venture capital in Africa.

Get it by clicking here.