Airtel Africa Is Inches Close To Becoming A Billion-Dollar Company

It was not so long ago when the Africa unit of Bharti Airtel’s telecoms business was almost in shads. But now, thanks to a huge revenue boost, Airtel Africa is close to achieving a billion-dollar status.

Walked On Thread

In the December 2019 quarter, Airtel Africa posted an after-tax profit of USD 103 Mn, representing a 21 percent year-on-year decrease from the USD 133 Mn in the corresponding quarter of the previous year.

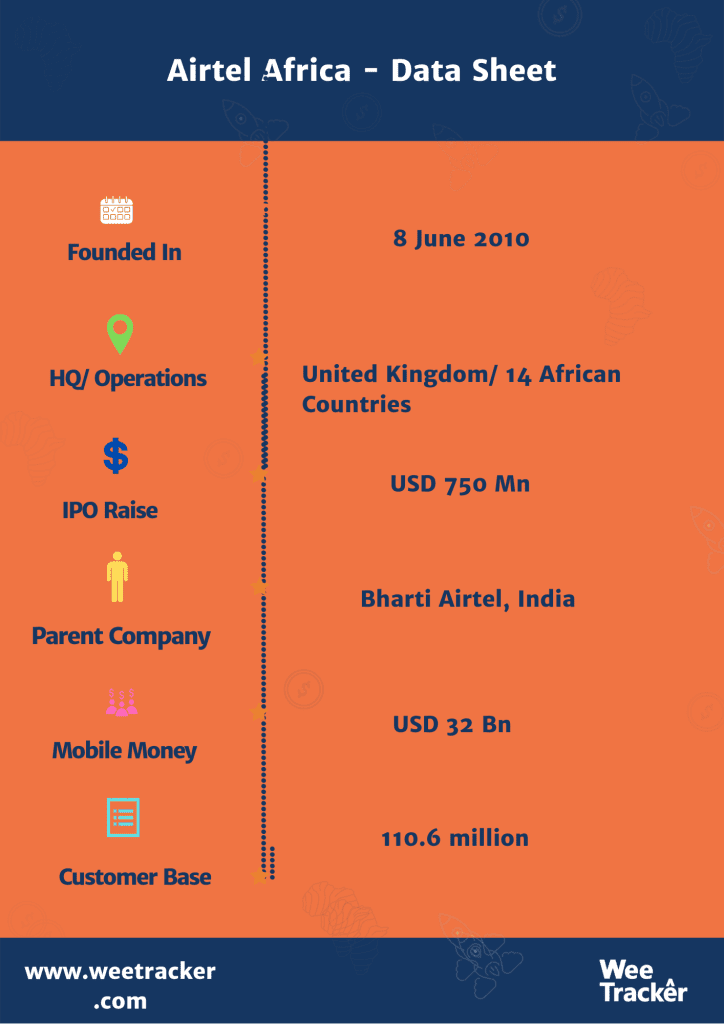

After raising USD 750 Mn through its IPO on the London Stock Exchange in June 2019, the decline came due to a higher tax outgo during the period.

Going public gave the company a share price of 80 pence apiece, landing it a market capitalization of around USD 3.9 Bn. Nonetheless, its Kenyan and Rwandan units recorded a combined loss of USD 30.6 Mn as they struggled in a Vodacom-dominated market.

Only its Ugandan arm maintained profitability in East African operations, posting USD 90.5 Mn profits that mirrored a growth of nearly 40 percent.

In Nigeria, Airtel lost about 100,000 subscribers between December 2019 and January 2020. Despite using top celebrities in its digital media campaigns, Airtel Nigeria accounted for 49.9 million subscribers in the market, a slight decline when compared to the 50.1 million it had in December last year.

Also, Airtel Africa’s London IPO plunged, making it one of the worst debuts on European stock markets in 2019. It dropped as much as 16 percent pence per share, matching the first-day decline for OssDsign AB.

The market performance was backed by Bharti Airtel years of price war and mounting debt back home. Funds from the IPO was to help it pay debt and upgrade its mobile network to 5G. In early 2019, it raised USD 200 Mn from Qatar Investment Authority to address the debt problem.

So, it is no wonder why Airtel Africa, the continent’s second-largest by number of subscribers, was thought be in a fix it might not survive. Based on new records, it is speculated that Airtel is outdoing MTN for a top place in the African market.

New Dawn?

New postings show that the business has witnessed a 72 percent jump in pre-tax profits. In the latest third quarter, the company’s USD 900 Mn revenue is now nearly a fourth compared to the Indian side of the business.

Airtel Africa’s subscribers, according to the latest report, has consistently gone from 1.9 million in March 2019 to more than 3 million in each of the last 3 quarters.

Its latest quarterly report shows that voice services contribute the largest share of its revenue, standing at USD 10 Mn for the first quarter of 2020 that represents a 5.9 percent growth over the previous year.

A huge chunk of that revenue was realized from its Nigerian market where its voice revenue’s growth hit 16 percent, accounting for USD 234 Mn of the company’s voice revenue during the period.

The telco’s total assets also jumped by 2.41 percent from 2019’s value of USD 9.1 Bn to USD 9.3 Bn in 2020. This was primarily as a result of their acquisition of more property, plant, and equipment (PPE). Its total customer base grew by 9.3 percent to 99.7 million for the year ended.

The 10.9 percent growth in revenue was buoyed by double-digit growths in Nigerian and East African operations. Nevertheless, the rest of its African operations experienced a decline in revenue. Its success in Nigeria is remains interesting, considering that the company had lost more than 100,000 subscribers.

In Time

In its market statement, the carrier noted that over the course of April revenue growth was lower due to the Covid-19 pandemic and customer behaviour “being impacted by lower disposable income and restrictions on movements”. However, growth in data and Airtel Money revenues “more than offset revenue declines in voice”.

Airtel Africa’s future investments will focus on expanding distribution to customers; modernising and expanding the network; acquiring new spectrum in Nigeria, Tanzania, Malawi and Chad; and entering into strategic partnerships for the mobile money business.

CEO Raghunath Mandava said: “These results demonstrate the strength and resilience of our business and the effectiveness of our strategy with all three business services, voice, data and mobile money, contributing to revenue growth. We have also continued to invest in future growth opportunities”

Going forward, Airtel plans to double down on this growth. In spite of the crisis offered up by the coronavirus outbreak which could be compounded by revenue challenges, the telco will pump between USD 650 Mn and USD 700 Mn every year into the development of its data infrastructure.

Speaking of billion-dollar companies, French-owned telco Orange is planning a major Initial Public Offering for its Middle East and Africa (MEA) arm.

Meanwhile, under a new partnership, UNICEF and Airtel Africa will use mobile technology to benefit an estimated 133 million school age children currently affected by school closures in 13 countries across sub-Saharan Africa during the COVID-19 pandemic.

Photo by Jeevan Katel Via Unsplash