Once Again, Zimbabwe’s Economic Pickle Has Given Birth To A Hike In Fuel Price

In July 2019, fuel prices went up in Zimbabwe because the government felt it was cheap in neighboring countries. Now, however, the Southern African nation has hiked the price of the commodity due to the current state of its economy.

Unending Currency Quandary

For the last few years, Zimbabwe has been on a rollercoaster ride with its currency. From dollarization to a currency auction, the Emmerson-led administration’s efforts to turn things around for the country’s financials have been stained with instability and economic downgrades.

Tuesday (June 23rd, 2020), the country’s central bank introduced forex auctioning for the first time in 16 years. The initiative is hoped to bring relief from the longlasting fight against hyperinflation. Nevertheless, the auction eroded the local currency’s value by more than half: from 1:15 to 1:57.

According to the president, the currency problems are the fault of political critics and avaricious players in the country’s private sector. In Mnangagwa’s stance, the legal tender is being attacked by businesses who raised prices nonstop in what was partly a scheme against his administration.

On the black market, Zimbabwe’s local currency plunged, pushing inflation to as much as 765 percent. As a result, Zimbabweans have become nerved by how things have turned out in the country, especially since Robert Mugabe was ousted in 2017 after a military takeover of power.

A Hike Habit

Well, Zimbabwe is already in the middle of its most severe economic crisis in the past 10 years. The situation is marked by the aforementioned soaring inflation in conjunction with shortages of food and medical supplies. A prominent result is petrol prices going up to USD 1.25 (ZW$ 71.62 ), coming from ZW$ 28.86.

Being that this development is still less than a day old, no demonstrations have resulted from it. But the situation is all too a reminder of what happened in the middle stages of 2019 when fuel price hike unleashed protests. To quell the unrest, the Zimbabwean government resorted to shutting down the country’s social media.

Late last week, there were rumors that Zimbabwe’s apex bank was considering to stop the provision of the foreign currency needed to import fuel. According to these unofficial reports, the central bank wanted to delegate the responsibility to private firms. This always prophesies the removal of fuel subsidy.

When fuel prices went up to make diesel cost ZW$ 21.52 and petrol—way too much for motorists to afford—economists urged the government to eliminate fuel subsidies to ensure sustainability. Nevertheless, economists say that the fuel price in the country remains one of the world’s cheapest.

Economic Muddle

Drought, cyclone Idai and the coronavirus pandemic have all wreaked devastating effects on the economy of Zimbabwe. As a result, starvation is looming large over a significant portion of the country’s population. Recall that Zimbabwe is a landlocked nation. Also, the nation’s public sector faces a number of strikes, especially medics whose pain points are low salaries and poor working conditions.

When President Emmerson assumed office, he came with promises for an economic turnaround. Nonetheless, his attempts to bring the economy to a stable stage have not yielded as much fruits as was initially advertised. For one, consumer inflation is running at 786 percent. Second, its recently rejuvenated currency collapsed.

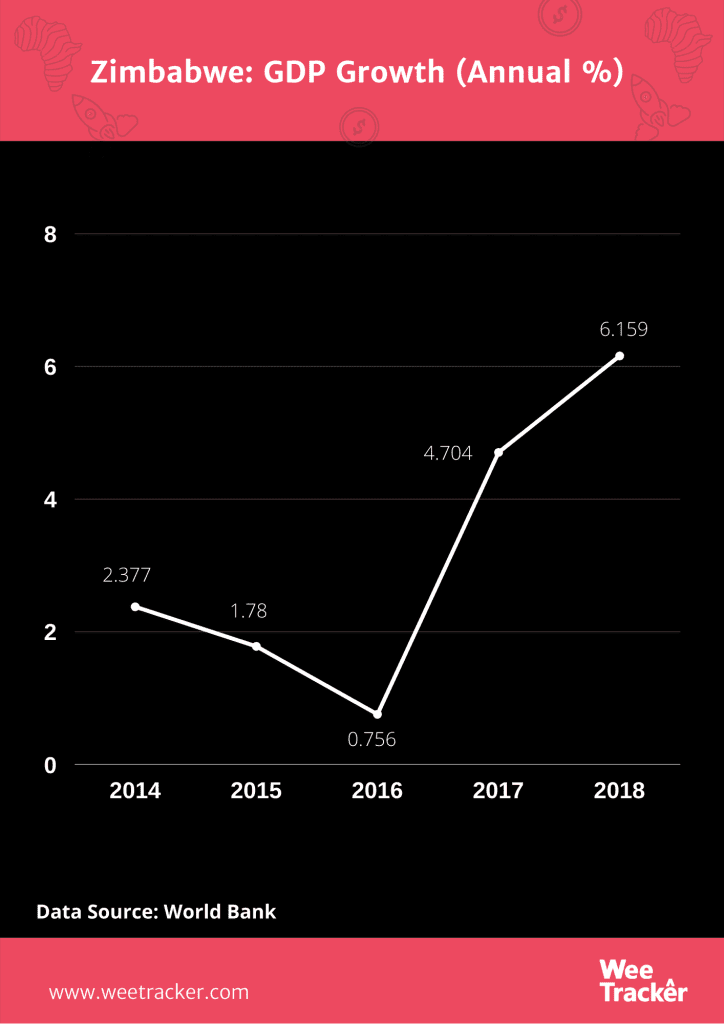

According to the World Bank, the nation’s economy will shrink by up to 10 percent in 2020. Amidst worsening poverty levels, that projection is 12.7 percent lower than what was predicted in January. Zimbabwe’s fall in per capita GDP (Gross Domestic Product) is expected to be deeper, driving millions into extreme poverty.

Companies in the country have been on the chopping block. Old Mutual, a financial giant, posted a loss of ZW$ 2.6 Bn for the financial year, which ended on December 31st, 2019. Meanwhile, telecommunications leader Econet Wireless Zimbabwe recorded a loss of ZW$ 1.28 Bn for the half-year, which ended August 31st, 2019.

Photo: Juan Fernandez Via Unsplash.