Orange Is Pacing Its African Expansion With The Open RAN Technology

It is hardly newsflash that the French telecommunications giant, Orange, is preparing to further penetrate the African telecoms landscape. About 3 weeks after the Paris-headquartered firm made such intentions public, it has somewhat quietly launched an Open RAN Technology in Central Africa Republic (CAR).

Pacing Something Radical?

The African telecoms industry can be said to have high expectations from Orange, whose African headquarters is Morocco, as it has operations in the Middle East and North Africa (MENA).

There is no shortage of opportunities given the present size of the mobile subscriber market in the continent, which is why it was rumored that Orange was to acquire a stake in 9mobile to justify its ambitions to enter Nigeria, just as it intends making inroads to South Africa.

Away from its potential big markets, Orange’s latest launch is in the Central African Republic where it already has hold.

In a country that appears to be the ideal proving ground for the economic case of Open RAN technology, the telco put the alternative radio access network to work in a place that has a population of only 5 million. The landlocked country’s digital divide is as such that there is only 48 percent unique connections and limited network infrastructure.

Open RAN as a means of checkered, money-saving expansion, is nothing new in Africa. In November 2019, Africa’s largest telecoms provider, MTN, said it was deploying more than 5,000 Open RAN sites across the 21 African countries in which it operates.

Sourced from United States-based Parallel Wireless, the technology basically brings 2G, 3G, and 4G connectivity to areas previously under-connected.

Strong Use Case

Unarguably, Africa is the most digitally divided continent in the world. Traditional generation networks demand expensive and bulky equipment for deployment, operation and expansion.

More so, these hardware-based networks are difficult and pricey to upgrade, not likely the kind of tune majority of telecoms providers would want to dance to given the capital intensiveness of the market. Cutting costs is a major concern, regardless of deep pockets or global footprints.

With equipment from Parallel Wireless, telcos can shift to open, software-based and virtual Open RAN network architectures in order to overcome these drawbacks.

But going for infrastructure with lower maintenance costs does not directly translate to less network agility. With Open RAN, telcos can standardize the design of hardware and software used in masts, antennae and other operation infrastructure.

Central African Republic is the starting point for Orange’s African ambitions with Open RAN. It joined hands with Parallel Wireless and I Engineering Group—an Africa and emerging markets-focused infrastructure group—to make it happen.

The project forms part of the telco’s IDEAL (Include Digital in Every African Life) initiative. In as much as it did not reveal its next country for further deployment, it is certain that Orange will step up to the plate as has other telcos in Africa before.

Orange’s Middle East and Africa (MEA) operations has been a consistent economic growth driver in the recent years. It grew by 6.2 percent year on year in the first quarter of 2020 to USD 1.45 Bn. In terms of subscriber numbers and revenues potential across the continent, there is room for growth.

Orange Group has traditionally concentrated on the francophone African countries. They tried to break into the Kenyan market by investing in Telkom Kenya. This did not work out well, and Orange sold its 70 percent interest in Telkom Kenya in late 2015.

Because 5G Is Taking Over

The Open RAN Technology also allows service providers speed up 5G network development through an open architecture. This way, engineers in the sector are able to design energy-efficient base stations, especially in the lieu of the 5G takeover.

An added use case is the reduction of the research and development costs that could hinder smaller companies from entering the present day telecommunications industry. Speaking of which, the fifth-generation technology is the rave nowadays and it is slowly taking hold in Africa.

For example, MTN’s multi-technology software-defined GPP-based stations allows it to deploy 2G systems with fully virtual 2G technology. It can run 2G, 2G and 4G simultaneously on the same base station, providing commercial data and voice services to African customers, in urban and rural parts of the continent.

The good news is that multi-technology RRUs can be easily upgraded to 5G, with less deployment and maintenance costs of course.

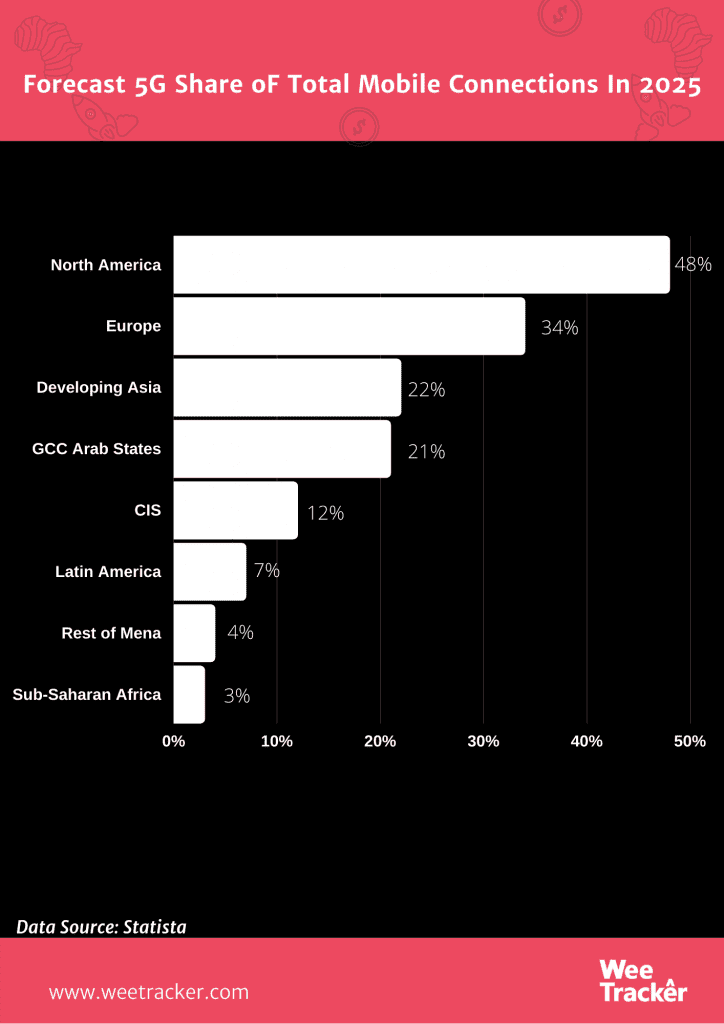

Considering Orange’s 5G achievements in countries like France, Spain and other European markets, there is reason to assume that the fifth-generation technology will form a huge part of its selling point for expansion into Africa, a place where 3G is rampant and 4G isn’t yet at full capacity.

For fact, the telco’s post-Covid-19 strategy revolves around 5G, data, fiber and Artificial Intelligence (AI). Starting from Central Africa Republic, the company obviously intends to scale data speeds, country after country.