Deal Street

African Startup Funding Tracker

USD 219,803,999+

*Data updated daily at 18:00 EAT

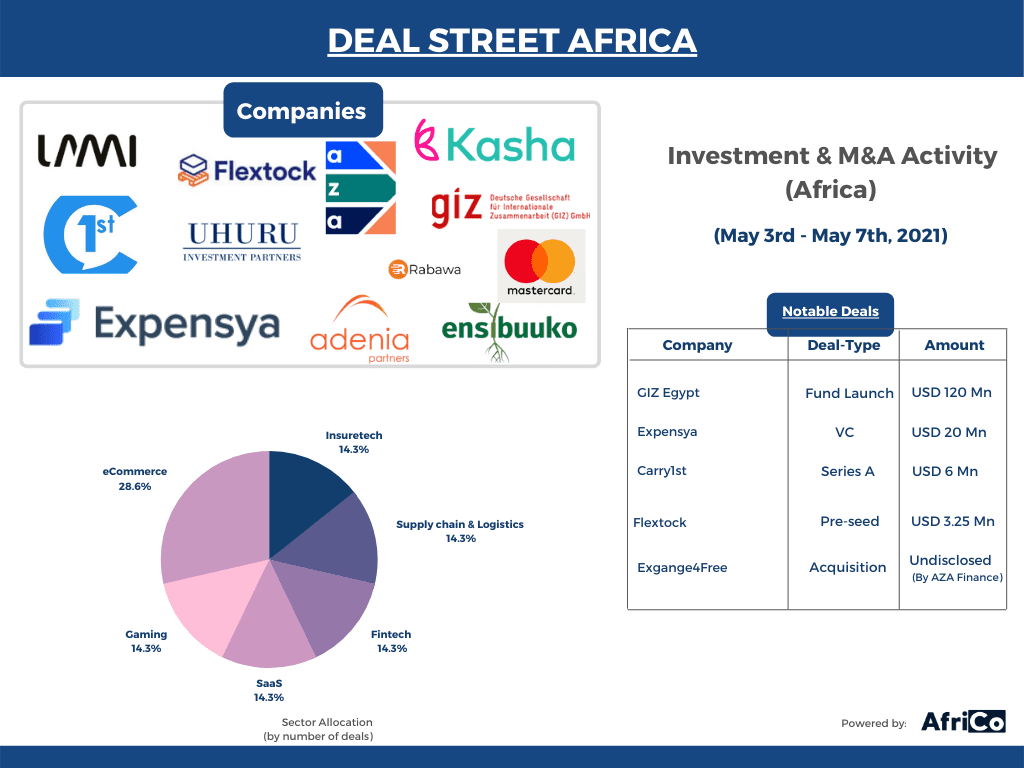

Here is a recap of this week’s notable deals on the African continent. Rwandan Startup Kasha secured two funding deals this week!

Expensya Raises USD 20 Mn To Grow Expense Management Software

Expensya, a Tunisian B2B expense management solution, raised USD 20 Mn from MAIF Avenir and Silicon Badia to expand its R&D and international expansion. The round also included French investors ISAI and Seventure Partners.

Uhuru Investment Partners Close Uhuru Growth Fund At USD 113 Mn

Lagos and Abidjan-based middle-market private equity company Uhuru Investments Partners announced the first close of its Uhuru Growth Fund I at USD 113 Mn with capital support from CDC Group and other DFI partners, commercial and impact investors. The fund is also backed by AfricaGrow, Kuramo Capital, European Investment Bank, SIFEM, and Finfunnd.

Rwandan E-commerce Platform Kasha Secures USD 1 Mn Funding

Rwandan female-focused e-commerce platform Kasha secured a USD 1 Mn investment from Finnfund, a Finnish development financier and impact investor, to expand further across Africa.

Kenyan Insurtech Lami Raises USD 1.8 Mn To Scale Insurance Platform

Lami Technologies, a Kenyan B2B and B2B2C insurance-as-a-service platform and API provider, raised USD 1.8 Mn in seed funding to grow across Africa and improve its capabilities. Accion Venture Lab led the round with participation from AAIC, Consonance, P1 Ventures, Acuity Ventures, The Continent Venture Partners, and Future Africa.

Games Publisher Carry1st Raises USD 6 Mn In Series A Funding

New York and Cape Town-based mobile game publisher Carry1st raised USD 6 Mn in Series A funding. The round was led by Konvoy Ventures, with participation from Riot Games, Raine Ventures, AET Fund Akatsuki, and TTV Capital.

Ugandan Fintech Ensibuuko Raises USD 1 Mn Funding Round

Kampala-based fintech company Ensibuuko raised a USD 1 Mn funding round from global impact investor FCA Investments to help it grow both domestically and internationally.

Egypt’s Flextock Closes USD 3.25 Mn Pre-seed Investment

Egyptian startup Flextock, which assists customers and companies with e-commerce and fulfillment operations from warehousing and logistics to shipping and cash collection, closed a USD 3.25 Mn pre-seed investment.

GIZ Launches USD 120 Mn Funding Program For New Fund Managers

In collaboration with the Egyptian Micro Small and Medium Enterprises Development Agency (MSMEDA), Endure Finance, and Changelabs, GIZ Egypt launched a USD 120 Mn funding initiative called ‘VC University’ for first-time venture capital (VC) funds. The VC University program is open to funds based in Egypt and those based elsewhere in MENA who have a strong mandate to invest in Egyptian startups and looks to onboard three to four fund managers, who will receive USD 30-36 Mn each.

Kenyan Fintech AZA Acquires Exchange4Free To Expand Into South Africa

Kenya-based fintech startup AZA Finance has now expanded into South Africa with the acquisition of cross-border payments specialist Exchange4Free. The acquisition will enable AZA Finance to use Exchange4Free’s platform for its services, including its APIs, which provide companies with the FX, treasury, and regulatory enforcement services they need to make cross-border payments into South Africa from over 100 countries.

Mastercard Invests in Rwanda E-commerce Platform Kasha

Mastercard Foundation announced a new investment in Kasha, a Rwandan female-focused e-commerce platform. Since 2019, Mastercard has partnered with Kasha to incorporate digital payment acceptance through its eCommerce platform. This is after Kasha joined Mastercard StartPath in 2019. The investment will help Kasha expand its current platform offering, reaching more women, communities, and small businesses than before.

Nigerian Social Commerce Platform Rabawa Raises USD 163 K Funding

Rabawa, a Nigerian social and video commerce website, raised USD 163 K in funding from US-based VC firm Aptive Capital to scale its operations. The new investment will help the company achieve its goal of being a major player in Africa’s e-commerce space by leveraging social and video commerce.

Paid Members Are Reading

-

December 22, 2025

The Full Basket: How Naivas CEO Andreas von Paleske Stocks Up For Success -

December 5, 2025

African Workers Feel Both Delight & Dread Using AI For Work & Fearing Being Replaced -

November 21, 2025

Nigeria’s Top Telcos Struggle To Sell Mobile Money In Crowded Market