Deal Street

African Startup Funding Tracker

USD 219,803,999+

*Data updated daily at 18:00 EAT

Kenyan E-commerce Startup Sky. Garden Raises USD 4 Mn Funding

Sky.Garden, a Kenyan e-commerce startup, raised USD 4 Mn in Series A funding to help it expand. The funding round included SANAD Fund for MSME, Aavishkaar, UNCOVERED FUND, and KSK Angel Fund, founded by Japanese former AC Milan footballer Keisuke Honda.

Egypt’s Fatura Raises USD 3 Mn In Pre-series A Round

Egypt-based B2B marketplace Fatura closed its USD 3 Mn pre-series A funding round led by Sawari Ventures, Arzan VC, Egypt Ventures, EFG-EV, The Cairo Angels, and Khwarizmi Ventures. The startup intends to use the funds to launch new services, launch several digitization efforts emphasizing digital payments, and expand to other nations in the area.

New South African Partnership Secures USD 3 Mn Plans To Launch Healthcare App

Webrock, Stockholm-based venture capital, and private equity firm, collaborated with Healthforce, a digital health startup majority-owned by Dis-Chem, South Africa’s largest retail pharmacy chain, to create a new digital primary care platform. The launch of the platform in Africa follows a pre-series A round of USD 3 Mn in funding secured. According to sources, the platform will debut in South Africa first and expand throughout the continent.

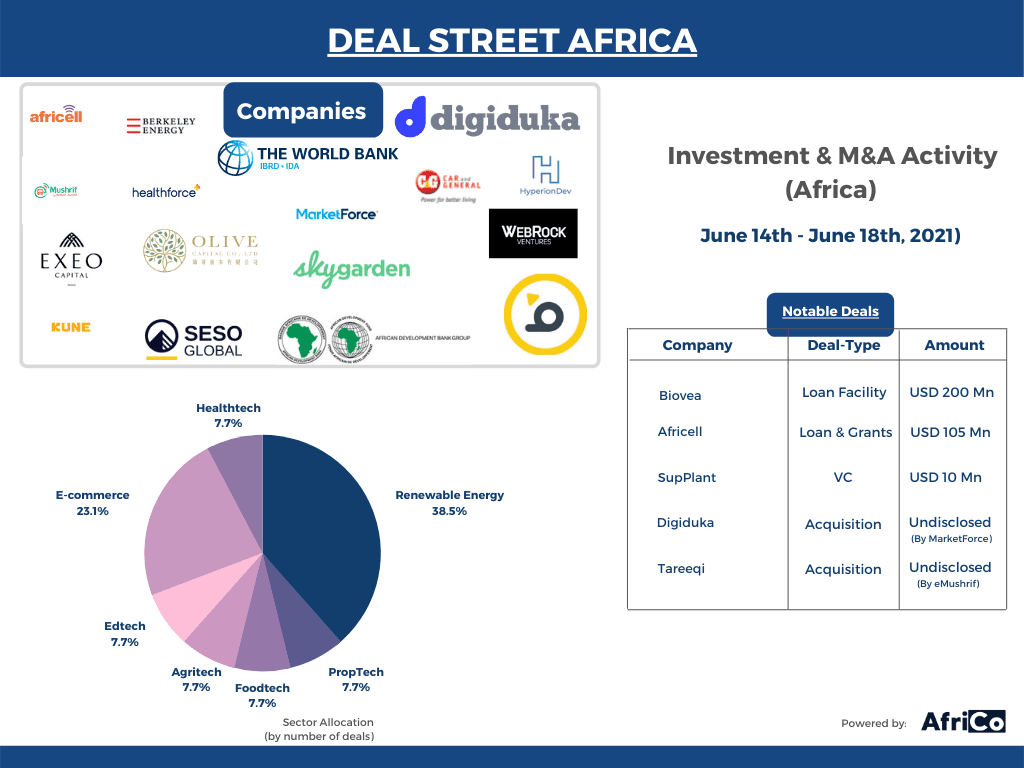

Kenya’s MarketForce Acquires Digital Payment Platform Digiduka

MarketForce, a Kenyan startup that provides end-to-end retail distribution for consumer brands, announced the strategic acquisition of Digiduka, a company that aims to bring Africa’s informal retailers into the digital economy.

Oman’s eMushrif Acquires Egyptian Start-up Tareeqi

eMushrif, an Internet of Things (IoT) and Artificial Intelligence (AI) start-up based in Oman, announced the completion of an acquisition deal with Tareeqi, a Cairo-based start-up that develops transportation-tracking software. eMushrif hopes to attract additional talent with this expansion to integrate IoT into people’s daily lives.

Biovea Receives USD 200 Mn From Proparco, AFD & EAIF

Cote d’Ivoire’s Biovea biomass power plant project received EUR 165 million (USD 200 Mn) in loans from Proparco, AFD, and EAIF to use to convert oil palm waste into electricity. The project is being developed by Biovea Energie, a company owned by Électricité de France (EDF), Meridiam, and Biokala, a joint venture created by Meridiam Ivorian industrial group Sifca. Under the terms of the agreements, Proparco and EAIF will contribute EUR 165 million (USD 200 Mn) in debt and EUR 13 million (USD 16 Mn) in grants, accounting for 77% of the overall project cost of EUR 232 million (USD 282 Mn). The shareholders of Biovea Energie will provide the balance.

Kenya’s Car & General Invests USD 3.65 Mn In New Motorcycle Helmet Plan

Car & General (C&G), an automotive equipment distributor, invested UD 3.65 Mn in a new motorcycle helmet manufacturing in Ruiru, Kenya, to expand its share of the Kenyan bike accessories market. The firm estimates that the new plant will raise at least USD 1.5 Mn in revenue by the close of 2021.

PropTech Startup Seso Global Raises USD 600 K Pre-seed Funding

Seso Global, a Nigerian proptech firm, has raised a USD 600 K pre-seed funding round to build on good initial traction and compete for salesforce in emerging countries. Investors in the round include Kepple Africa Ventures, Rising Tide Africa, Moabi Group, angel investors Albert Essien, Ibrahim Sanga, and Jamie Broderick.

Africell Closes USD 105 Mn Loan Facility For Expansion

Africell, a fast-growing mobile network operator in Africa, secured a USD 105 Mn commercial loan to fund its expansion. This funding is a syndicate of new and existing lenders to Africell from a leading group of international financial institutions. Gemcorp Capital constructed and anchored the facility, including Gramercy Funds Management LLC and TC Credit Partner.

EXEO Capital Sells Majority Stake In Cape Olive

EXEO Capital, an African mid-market private equity fund, completed a strategic deal to exit one of its legacy portfolio firms. The private equity firm announced that it had sold its 62.7% ownership in Cape Olive Holdings Ltd to Imibala, a Lona Group affiliate and a current shareholder in the company. EXEO had invested in Cape Olive from its Agri-Vie Fund I in 2013.

World Bank Approves USD 142 Mn Loan To Integrate Solar Into Zanzibar Grid

The World Bank Group granted USD 142 Mn to modernize Zanzibar’s power network and integrate renewable energy, allowing 400,000 people to be electrified in this Indian Ocean archipelago. The International Development Association (IDA) provided a credit of USD 117 Mn, while the Clean Technology Fund (CTF) provided USD 22 Mn loan. The CTF is also offering a USD 3 Mn grant.

Kenyan Foodtech Startup Kune Raises USD 1 Mn Pre-seed Funding

Kune, a Kenyan foodtech startup, announced that it had closed a USD 1 Mn pre-seed round to launch its on-demand food service in August. The pre-seed round was led by Launch Africa Ventures, a pan-African venture capital firm. Century Oak Capital GmbH and Consonance were among the other investors, with Pariti, an ecosystem management firm, also contributing.

Africa Renewable Energy Fund II Closes USD 155 Mn Funding Round

Berkeley Energy’s Africa Renewable Energy Fund II (AREF II) concluded a new funding round of EUR 130 million (USD 155 Mn) to focus on developing, constructing, and operating renewable energy assets and technologies in Sub-Saharan Africa. Proparco contributed EUR 15 million (USD 17.93 Mn) to the new AREF II. CDP, CDC, FMO, Swedfund, the Sustainable Energy Fund for Africa (SEFA), managed by the African Development Bank), and the Clean Technology Fund (CTF), also contributed.

South African Edtech Startup HyperionDev Raises USD 3.54 Mn For Expansion

HyperionDev, a South African edtech startup, raised more than USD 3.54 Mn in funding, with some coming from private investors and some through public crowdsourcing. The funding round will aid the company’s expansion into other areas, including the United Kingdom and the United States. In addition, the edtech will grant USD 247.8 Mn in scholarships to deserving students.

South African Agritech SupPlant Raises USD 10 Mn To Scale Operations

SupPlant, a precision agricultural business, secured USD 10 Mn to expand the market for its smart irrigation technology in South Africa. The recent fundraising included private equity firm Boresight Capital, social impact fund Menomadin Foundation, Israel-listed Smart-Agro Fund, and Israel-based investment firm Mivtah Shamir. The round brought the company’s total funding to USD 19 Mn.

AfDB Approves USD 99 Mn Loan For The Electricity and Green Growth Support Program

The Board of Directors of the African Development Bank (AfDB) approved a EUR 83 million (USD 99.07 Mn) loan to fund the second phase of Egypt’s Electricity and Green Growth Support Program. The investment is part of the Bank’s budget support for Egypt’s government to improve its power infrastructure, which is supposed to boost the private sector and speed up its recovery from the Arab Spring.

Paid Members Are Reading

-

December 22, 2025

The Full Basket: How Naivas CEO Andreas von Paleske Stocks Up For Success -

December 5, 2025

African Workers Feel Both Delight & Dread Using AI For Work & Fearing Being Replaced -

November 21, 2025

Nigeria’s Top Telcos Struggle To Sell Mobile Money In Crowded Market