Deal Street

African Startup Funding Tracker

USD 219,803,999+

*Data updated daily at 18:00 EAT

Egyptian Startup Nawy Raises Seed Round Funding

Nawy, a proptech startup based in Cairo, raised a seven-figure seed round lead by the Sawiris family office, with Hatem Dowidar and other angel investors participating. The newly acquired investment will enable Nawy to bolster its technology, diversify its services, and expand its team to serve more areas across Egypt.

Kenya’s Guidewheel Raises USD 8 Mn Series A Funding

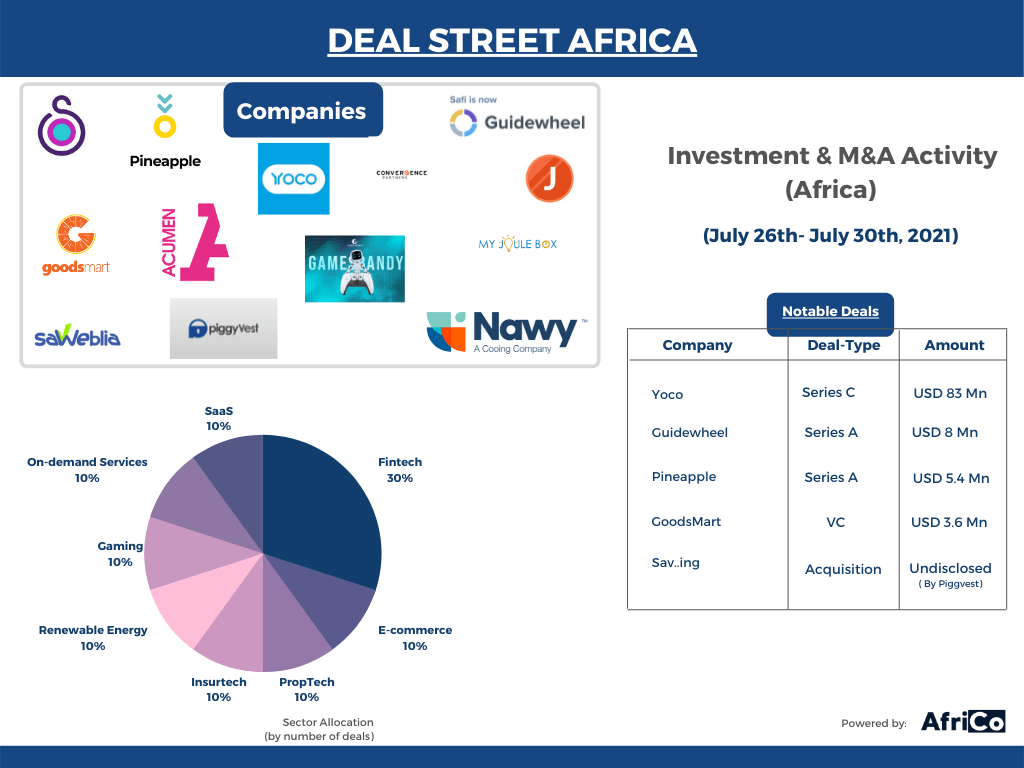

Guidewheel, a manufacturing technology pioneer in Nairobi, Kenya, closed a USD 8 Mn Series A fundraising round to support its expansion in the United States. Greycroft led the round with participation from leading firms, angel investors, and Fortune 500 executives.

South African Insurtech Startup Pineapple Raises USD 5.4 Mn Series A

Pineapple, a South African insurtech startup, raised ZAR80 million (USD 5.4 Mn) in Series A funding to expand deeper into the car insurance industry. The participants in this round included Lireas Holdings, the ASISA ESD Fund, E4E, Vunani Capital, and the Old Mutual Enterprise & Supplier Development Fund. The startup intends to use the investment to expand further into the car insurance space after an impressive last six months of growth.

South African Startup Yoco Raises USD 83 Mn Series C Funding Round

Yoco, a payments and software startup based in South Africa, raised USD 83 Mn in Series C funding to help it grow its platform and expand internationally. Among the company’s new investors is Dragoneer Investment Group. Also joining in the round are Breyer Capital, HOF Capital, The Raba Partnership, 4DX Ventures, TO Ventures, and several current and former executives from global tech leaders such as Coinbase, Revolut, Spotify, and Gojek. The funding round also included existing Yoco investors Partech, Velocity Capital Fintech Ventures, Orange Ventures, and Quona Capital. Yoco plans to expand across Africa and the Middle East to reach one million merchants in the next four years.

Solar Company MyJouleBox Completes USD 3.54 Mn Series A Round

MyJouleBox, a solar distributor and operator, raised EUR 3 million (USD 3.54 Mn) in a Series A round to strengthen its position as one of the leading energy specialists in Benin and expand into Burkina Faso, Senegal, and Togo. EDFI ElectriFI invested a total of EUR1.5 million (USD 2 Mn ) split (under the Benin Country Window funded by the European Union) for EUR 500,000 (USD 600 K) into equity alongside Gaia Impact Fund and for EUR1 million (USD 1.4 Mn) into convertible notes together with Triodos Investment Management.

Ivorian Fintech Startup Julaya Raises USD 2 Mn Funding

Ivory Coast-based fintech startup Julaya announced a USD 2 Mn pre-Series A funding to expand its products across West Africa. The participants in this round included corporate venture capital firms Orange Ventures and MFS Africa Frontiers, VC firms Saviu Ventures, Launch Africa, 50 Partners Capital, and some angel investors in Africa and Europe. The startup plans to use the new investment to broaden its market share in Ivory Coast, launch digital payment products, and expand across West Africa.

Egyptian Startup GoodsMart Raises USD 3.6 Mn For Further Expansion

GoodsMart, a Cairo-based online household buying platform, raised USD 3.6 Mn in capital to help it expand its market. Sawari Ventures led the round of investment.

GamesBandy Receives USD 40 K Grant From Taqadam

GamesBandy received a USD 40 K grant from Taqadam, a Mena startup accelerator helping innovators push the boundaries of what is possible for their gamer marketplace platform. Taqadam will also spend six months guiding and developing the company through mentorship, zero-equity funding, and training. The startup intends to use the grant to expand its platform to support more games, expand geographically, and grow its user base.

Moroccan Startup Saweblia Raises USD 340 K Funding

Saweblia, a Casablanca-based startup secured MAD3 million (USD 340 K) in seed funding from CDG Invest, the investment arm of the Caisse de Dépôt et de Gestion (CDG) Group. The startup was crowned the winner of the second promotion of the 212Founders program. Under the investment, the startup now enters the acceleration phase of the 212Founders program.

Egyptian Startup CreditFins Raises Pre-Seed Round

CreditFins, a Cairo-based credit card management platform and fintech startup raised an undisclosed sum in a Pre-Seed funding round led by Flat6Labs, AUC Angels, TA Telecom Holding, and other strategic angel investors with technical and investment backgrounds.

Acumen Resilient Agriculture Fund Raises USD 58 Mn

The Acumen Resilient Agriculture Fund (ARAF), an equity fund that supports African agri-businesses that assist smallholder farmers in adapting to climate change, raised USD 58 Mn. The fund is supported by FMO, the Soros Economic Development Fund, PROPARCO, the Children’s Investment Fund Foundation, IKEA Foundation, Global Social Impact, and other respected investors and funders. It is sponsored by Acumen and anchored by Green Climate Fund (GCF).

Convergence Partners Close Digital Infrastructure Fund At USD 120 Mn

Convergence Partners, a private equity investor, announced it had successfully closed its Digital Infrastructure Fund (CPDIF) at USD 120 Mn. Investors in the CPDIF include the UK-based CDC Group, the European Investment Bank (EIB), and Proparco.

Nigerian Fintech Startup Piggyvest Acquires Counterpart Startup Savi.ng

Piggyvest, a Nigerian fintech startup that helps people save and invest money, acquired counterpart Savi.ng as it looks to expand its customer base. All existing Savi.ng users will now be automatically migrated to Piggyvest.

Paid Members Are Reading

-

December 22, 2025

The Full Basket: How Naivas CEO Andreas von Paleske Stocks Up For Success -

December 5, 2025

African Workers Feel Both Delight & Dread Using AI For Work & Fearing Being Replaced -

November 21, 2025

Nigeria’s Top Telcos Struggle To Sell Mobile Money In Crowded Market