Deal Street

African Startup Funding Tracker

USD 219,803,999+

*Data updated daily at 18:00 EAT

Nigerian Agritech Startup Zowasel Raises USD 100 K Funding

Nigerian agri-tech firm Zowasel received USD 100 K funding from Guinness Nigeria and Promasidor at the UN World Food Programme Zero Hunger Sprint. The United Nations World Food Program has developed the “Zero Hunger Sprint” as a platform to enable innovators to put their ideas into action to end hunger by 2030. The goal is to empower agricultural startups’ innovations with additional resources to accelerate their ideas.

Nigeria’s Decagon Raises Seed Round To Train Software Engineer

Decagon, a software engineering startup, announced its USD 1.5 Mn seed round and a student loan financing facility of USD 25 Mn from the Nigerian financial institution Sterling Bank. For its equity financing, Decagon raised money from Kepple Africa and Timon Capital. Some angel investors like Paul Kokoricha, managing partner of the private equity business of ACA, and Tokyo-based UNITED Inc., also took part.

Kenyan-based Blockchain Fundraising Platform Raise Secures Funding

Raise, a blockchain-based digital securities platform serving the African market received backing to scale its technology by 500 Startups, an early-stage venture fund, and seed accelerator.

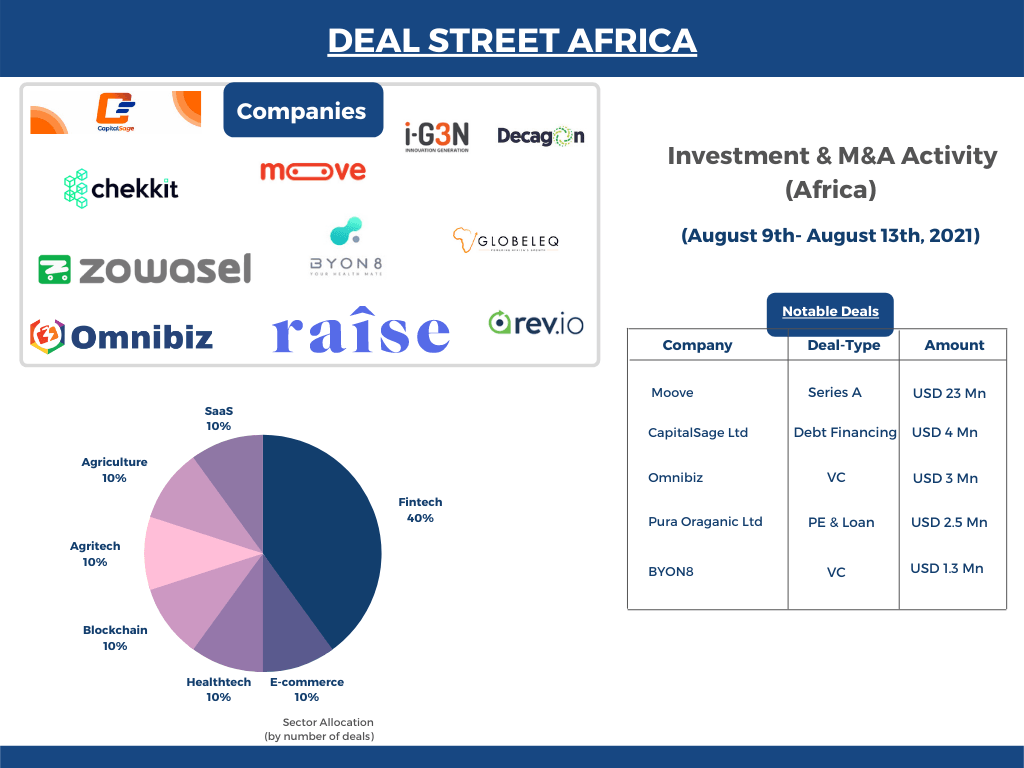

Mobility Startup Moove Raises USD 23 Mn Series A Funding

Moove, a Sub-Saharan mobility startup that offers revenue-based vehicle finance to assist people across Africa acquire cars, raised a USD 23 Mn Series A fundraising round to accelerate its growth. The funding round was led by Speedinvest and Left Lane Capital with participation from DCM, Clocktower Technology Ventures, LocalGlobe, Tekton, FJ Labs, Palm Drive Capital, Roka Works, KAAF Investments, Class 5 Global, and Victoria van Lennep, the co-founder of Lendable. Kepple Africa Ventures, and one of Moove’s existing lenders, Emso Asset Management, also joined the round, bringing Moove’s total funding to USD 68.2 Mn, including USD 28.2 Mn in equity and USD 40 Mn in debt.

Nigeria’s Chekkit Raises USD 500 K pre-Seed Funding

The Nigerian-based anti-counterfeiting startup, Chekkit Technologies, announced a USD 500 K pre-seed round as it looks to expand its team and technological infrastructure. This round included Pan African VC, Launch Africa, Japan Strategic Capital, Blockchain Founders Fund, and two angel syndicate groups. The company also received a grant from Netherlands’ Orange Corners program.

E-commerce Startup Omnibiz Raises USD 3 Mn Seed Round

Omnibiz, a Nigerian e-commerce startup, raised USD 3 Mn in a seed round to expand into other markets. V&R Africa, Timon Capital, and Tangerine Insurance led the funding round. The round also included Lofty Inc., Musha Ventures, Sunu Capital, Launch Africa, and Rising Tide Africa. Omnibiz will utilize the funds to expand in additional West African cities outside of Nigeria, including Abidjan, Takoradi, Kumasi, and Accra, over the next few months.

Globeleq Closes USD 362 Mn Renewables Refinancing In South Africa

Globeleq, a South African independent power producer (IPP), completed the senior debt refinancing of three renewable energy plants, totaling 238 MW. Absa Bank, part of financial services business Absa Group Ltd, served as the required lead arranger and sole underwriter for the power producer’s debt financing package worth ZAR 5.2 billion (USD 362 Mn). The refinancing will help free up capital for shareholders, encouraging reinvestment in the industry and speeding up equity payouts to the three community trust owners, allowing them to participate in high-impact, long-term projects.

Uganda’s Pura Organic Agro Tech Ltd Secures USD 2.5 Mn Investment

Yield Uganda Investment Fund (Yield Fund), managed by Pearl Capital Partners, announced a USD 2.5 Mn investment in Pura Organic Agro Tech Ltd (Pura), structured as straight equity and patient loans. The investment is the Fund’s ninth investment in Uganda’s agriculture sector, but it is the first significant value-added investment in the cassava sector.

South African Startup Revio Raises Seed Funding Round

Revio, a billing startup based in South Africa, raised more than USD 1 Mn in a seed round. The Delta, an international venture development business, led the round. The startup plans to expand into East Africa in 2022.

Nigerian Fintech CapitalSage Technology Raises USD 4 Mn Funding

CapitalSage Technology Limited, a Nigerian fintech startup, has secured N2.2 billion (USD 4 Mn) in a Series 1 Private Company Notes (PCN) issuance as part of its N10 billion ((USD 24.30 Mn) program to help the company expand into new markets in Nigeria and Africa. The Series 1 issuance, with a 365-day tenor, was subscribed with firm commitments from Fund managers and other institutional investors. United Capital Plc acted as Sole Adviser and Arranger on the transaction.

Healthtech Startup BYON8 Raises USD 1.5 Mn To Scale Across Africa

BYON8, an online doctor digital health platform, raised USD 1.5 Mn in seed capital to help in its expansions across Africa. The round included Danish early tech investor, People Ventures, and current investors T&W Holding and Jellyfish Invest.

South Africa’s I-G3N Secures USD 1.3 Mn Investment

I-G3N, a South African manufacturer of lithium-ion batteries, raised ZAR20 million (USD 1.3 Mn) from Edge Growth and the ASISA ESD initiative to help scale operations.

Paid Members Are Reading

-

December 22, 2025

The Full Basket: How Naivas CEO Andreas von Paleske Stocks Up For Success -

December 5, 2025

African Workers Feel Both Delight & Dread Using AI For Work & Fearing Being Replaced -

November 21, 2025

Nigeria’s Top Telcos Struggle To Sell Mobile Money In Crowded Market