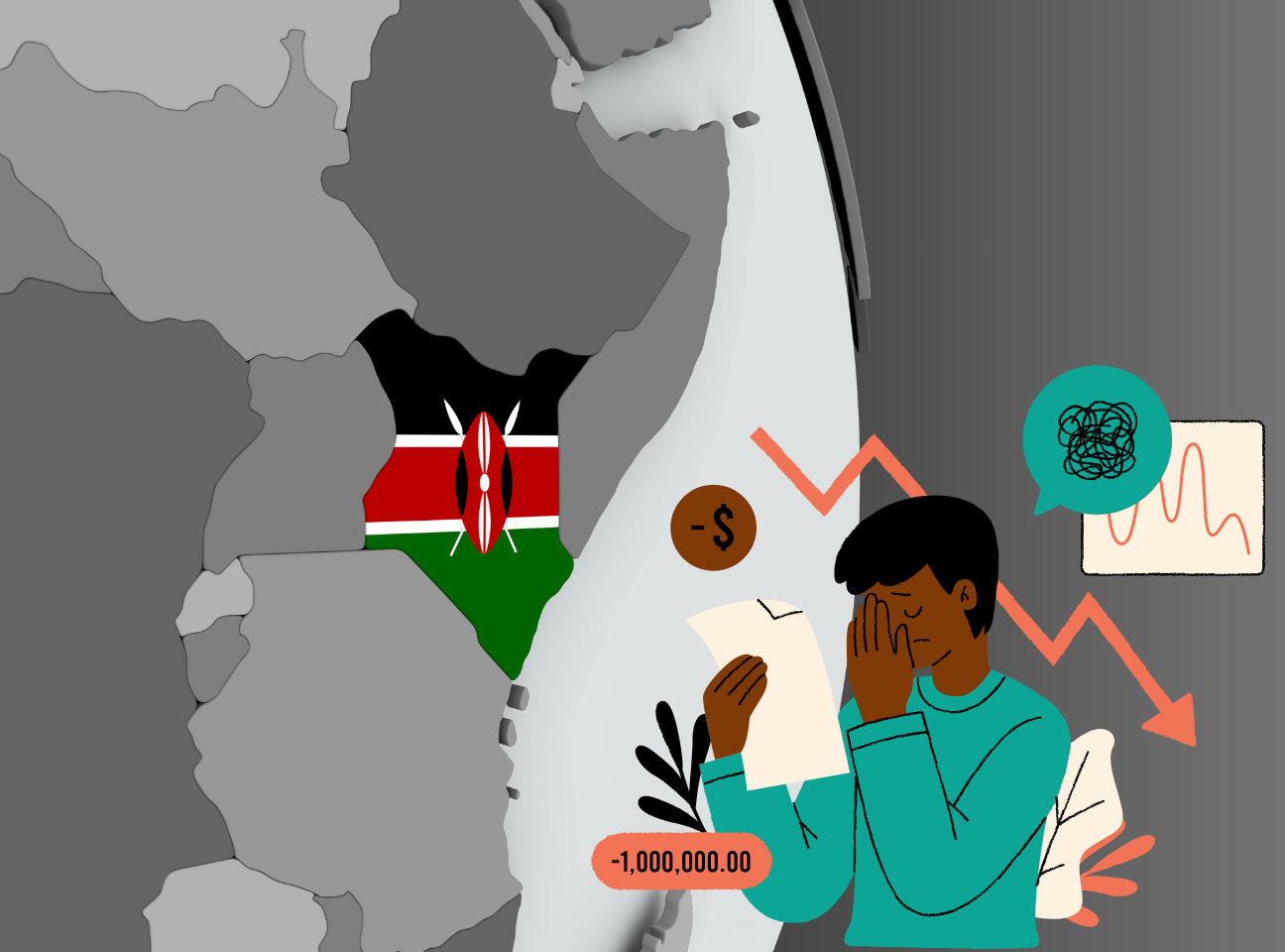

Top Players In Kenya’s Tech Economy Are Pushing Back On ‘Govt Cash Grab’

Kenya’s technology ecosystem and players in its digital economy are not pleased with a raft of tax expansion measures proposed in a new Finance Bill that is making its way through the country’s legislative scene.

Kenya’s tech ecosystem is facing a potential storm as the proposed Finance Bill 2024 sparks outrage from industry leaders. The Bill outlines a series of tax increases with telcos, ride-hailing companies, e-commerce giants, and even the nascent electric vehicle (EV) sector bracing for impact.

The country’s top mobile network operator Safaricom leads the charge, fearing a 20% excise duty on mobile money transfers and internet data will stifle financial inclusion and online access. Safaricom argues the burden will fall on ordinary citizens who rely on M-Pesa, online education platforms, and international money transfers.

Additionally, Telecommunication and Internet Service Distributors led by Safaricom and Airtel under TESPOK, warned of a looming Internet Distribution Paralysis, as a result of expensive operational costs stemming from a proposal to increase Digital Tax, reports local publication Citizen.

“I was in the US with the president’s delegation and was given money by a Kenyan who felt that because the tax regime wasn’t sure of the charges, she insisted I carry cash to her mother…that will happen a lot and is not the safest way of transmitting funds. We have to factor in the local mwananchi,” said Tespok CEO Fiona Asonga.

According to Safaricom’s Senior Tax Manager Cynthia Koech, the increase in the operational cost will affect vital services such as M-Pesa, Hustler Fund, and Inua Jamii, warning that the masses would ultimately bear the cost of the tax hikes.

Similar concerns resonate with e-commerce giant Jumia, which, along with others, worries about the impact of a proposed motor vehicle tax and eco-levy on essential goods.

Ride-hailing companies Uber and Bolt are equally vocal. The Bill’s 6% Significant Economic Presence (SEP) tax on non-resident companies is seen as a deterrent to foreign investment, potentially leading to job losses and even exits from the Kenyan market. They argue the tax structure is unclear and could stifle a crucial sector fostering economic activity.

“By introducing the 6% Significant Economic Presence Tax, the effective rate for a non-resident in the digital market space will be 22% on gross turnover without taking into consideration the operating costs,” said Bolt’s public policy manager, George Abasy.

Furthermore, Uber Tax Manager, Chizeba Nnonyeh added that “SEP, as proposed, does not indicate how a non-resident person will be deemed to have created a significant economic presence in Kenya therefore becoming liable to tax in Kenya.”

The Finance Bill 2024 also intends to hike the Digital Service Tax from 1.5% to 3% and the Corporate Tax Rate from 30% to 35%. A slew of additional levies and taxes such as the Motor Vehicle Tax will deepen the woes for ride-hailing platforms, who told the committee chaired by Molo MP Kuria Kimani that ride fares will be increased in the process, Kenyan Wallstreet reports.

The budding electric vehicle sector, championed by startups like Roam, BasiGo, and Spiro, also feels the heat. Proposed VAT on electric vehicles, solar panels, and lithium-ion batteries threatens to reverse the recent surge in EV adoption driven by previous tax breaks. Industry experts warn this could derail local manufacturing efforts and hinder Kenya’s transition to a greener future.

While the government, led by President William Ruto, defends the Bill as a necessary measure to address Kenya’s concerning debt levels, the tech sector feels the proposed measures are short-sighted. They argue that stifling innovation and digital inclusion will ultimately hinder economic growth, potentially creating a situation where the cure is worse than the disease.

The Departmental Committee on Finance and National Planning concluded the two-week public participation exercise on the Finance Bill 2024 on Friday, June 7, with a pledge to incorporate some of the views from stakeholders. This will be followed by a public town hall-type hearing and subsequent engagements with the executive arm. Kenya now faces a critical juncture where balancing fiscal needs and fostering a conducive atmosphere for business becomes paramount.

Featured Image Credits: Africa Check