A cloud of despair hangs over Nigeria’s economic landscape as citizens grapple with the implications of sweeping tax reforms signed into law in June 2025, set to take effect January 1, 2026, with many individuals expressing concerns about increased financial burden on struggling masses.

The new legislation represents the country’s most significant tax overhaul in decades, aiming to broaden the tax base and increase government revenue, but has sparked widespread anxiety among Nigerians already battling a severe cost-of-living crisis.

The four new laws – the Nigeria Tax Act, Nigeria Tax Administration Act, Nigeria Revenue Service Act, and Joint Revenue Board Act – consolidate multiple tax statutes into a unified code and introduce fundamental changes to how individuals and businesses are taxed.

While the government argues the reforms will streamline compliance and boost revenue for development, many Nigerians fear they will further erode dwindling disposable incomes.

What’s Changing for the Average Nigerian

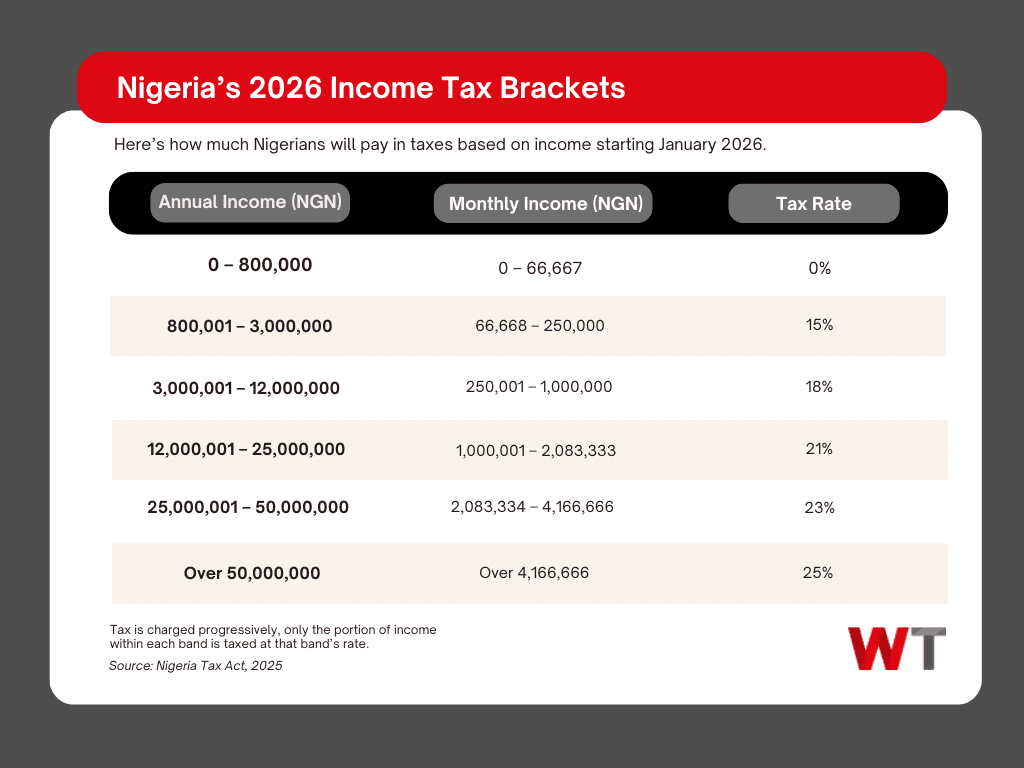

At the heart of public concern are changes to personal income tax that will see more Nigerians brought into the tax net. The new law introduces a progressive tax system for a range of income brackets.

While the government emphasises that those earning NGN 800 K (~USD 535.00) annually (approximately NGN 66.6 K or USD 44.50 monthly) or less will be exempt from income tax, critics note that this threshold still captures a significant portion of Nigeria’s working population who are already struggling with inflation that reached 34% last December before reducing over the last five months, notably after the stats body rebased data points used in its calculations.

“The exemption threshold might seem generous on paper, but in reality, it drags many struggling Nigerians into the tax net,” says Lagos-based economist Adeola Adebayo.

“When you consider that a mid-level civil servant with two children in urban Nigeria needs at least NGN 150 K monthly for basic subsistence, taxing incomes above NGN 66 K means taxing survival itself.”

Social Media Backlash and Public Anxiety

Social media platforms have become ground zero for expressing discontent with the upcoming tax changes. TikTok videos with the hashtag #NoToNewTax have garnered over 2 million views collectively, with many content creators sharing their financial struggles.

“Government wants to take from us what they cannot give,” declared popular TikTok sensation Habeeb Hamzat (known as Peller) in a recent viral video. The content creator himself recently faced a NGN 36 M tax bill from the Lagos State government, which authorities defended as “lawful and not targeted harassment” .

On Twitter, conversations about the tax reforms have trended consistently since August, with many users expressing scepticism about government efficiency in utilising tax revenue.

“They want to tax my meagre salary while politicians travel with huge entourages and buy expensive cars with our money,” wrote one individual in a post that received over 4,000 likes.

The controversy highlights the trust deficit between citizens and government that may complicate implementation. A recent survey by the Nigerian Economic Summit Group found that only 18% of Nigerians believe tax revenue is utilised effectively by government at any level.

Government’s Rationale

The Tinubu administration argues that the reforms are necessary to address Nigeria’s historically low tax-to-GDP ratio, which at approximately 10% falls significantly below the African average of 16-18% . Government officials contend that expanding the tax base is essential to fund infrastructure and public services without excessive borrowing.

Finance Minister Wale Edun emphasised that the government is mindful of citizens’ economic challenges, noting the delayed implementation of certain provisions like the contentious 5% fuel surcharge until 2026.

“The order will not be issued immediately. Government is aware of the economic situation of the times and would not deliberately increase the burden on Nigerians” .

The administration also highlights provisions that could benefit low-income earners, including expanded zero-rating of essential items under VAT such as basic food, medical products, educational materials, and electricity services. This means businesses selling these items can recover their VAT costs, potentially lowering prices for consumers.

The Informal Economy Dilemma

A particularly contentious aspect of the reforms is how they will affect Nigeria’s vast informal economy, which according to the International Labour Organisation constitutes about 80% of the workforce. The new laws aim to bring informal sector workers into the tax net through mechanisms that include requiring banks to share transaction data with tax authorities.

“This represents a fundamental shift in tax collection approach,” notes tax consultant Ifeoma Okonkwo. “The government is leveraging financial intermediation to identify potential taxpayers, but the implementation must be sensitive to the realities of informal businesses where record-keeping is often minimal.”

For artisans, market traders, and small-scale entrepreneurs whose earnings exceed the NGN 66,667 monthly threshold, the new system could mean facing formal taxation for the first time, on top of various informal levies they already pay to local authorities.

Taxes Upon Taxes

Many Nigerians note that the income tax changes come atop numerous other financial burdens citizens already bear. These include: the 2023 fuel subsidy removal that increased transportation costs by over 200%; electricity subsidy removal that multiplied power tariffs; telecom services price hikes; existing VAT of 7.5% on many goods and services; various bank charges including transfer levies; the impending 5% fuel surcharge on petroleum products (delayed until 2026).

“The government is taking from every pocket,” complains Port Harcourt-based Uber driver Gabriel Uwem. “They take when I buy fuel, when I get paid, when I use my phone, when I transfer money. Soon they will tax the air we breathe.”

This sentiment reflects the frustration of many Nigerians who see their purchasing power diminishing while taxes multiply. The National Bureau of Statistics reports that real income has declined by approximately 35% since 2022, while the number of Nigerians living in poverty has increased to an estimated 56% of the population.

Implementation Challenges

Significant questions remain about the capacity of Nigeria’s tax administration system to implement the complex reforms smoothly. The new Nigeria Revenue Service (NRS) established by the laws is meant to replace the Federal Inland Revenue Service (FIRS), but transition challenges are anticipated .

The Acts also introduce a Tax Ombuds office to serve as an independent arbiter for taxpayer complaints, a mechanism that could prove crucial in addressing disputes fairly. However, many worry that aggressive revenue targets might lead to overzealous enforcement, particularly against vulnerable taxpayers.

“Even tax officials have revenue targets. So when you file, they reassess and add more. That’s where businesses start struggling,” economist Emmanuel Idenyi warned in a BBC interview.

While Nigerians express concern about the new tax burden, comparative data shows that the country’s overall tax burden remains relatively low by global standards. The top personal income tax rate of 25% compares favorably with many countries: South Africa (45%), China (45%), UK (45%), USA (37%), Kenya (30%), Ghana (30%).

However, what makes Nigeria’s situation unique is the combination of low incomes, high inflation, and already elevated living costs that make additional tax burdens particularly painful for citizens.

The Road to 2026

With the laws scheduled to take effect in January 2026, the government has a little over three months to conduct public education and address implementation concerns. The delay in implementing certain provisions like the fuel surcharge suggests awareness of the economic sensitivity.

Taiwo Oyedele, Chairman of the Presidential Fiscal Policy and Tax Reform Committee, has struck a hopeful tone, acknowledging that “successful implementation will depend on awareness and trust”.

How the government manages the transition could determine public acceptance. Transparent communication about how tax revenue is utilised, coupled with visible improvements in public services, would be essential to building taxpayer confidence.

As 2026 approaches, many Nigerians are preparing for tighter budgets. “I’ve started looking for additional side hustles,” confessed Temitope Oke, an administrative assistant earning NGN 120 K monthly.

“If they’ll take 15% of my salary above NGN 66 K, that means about NGN 8.1 K monthly. That’s two days’ feeding for my family.”

How many millions of Nigerians share this sentiment—and how the government addresses these concerns—may determine the success of Africa’s most ambitious tax reform in years.

Featured Image Credits: Currency News