Rising rates, wobbly currencies, and a tougher bond market have turned debt into a daily headline across Africa. Some countries have refinanced under pressure. Others are in the middle of slow, technical restructurings.

If you’re building, investing, or operating on the continent, knowing who owes what—and to whom—helps you read the room. Here are the top 10 African countries with the largest foreign debt as of 2025.

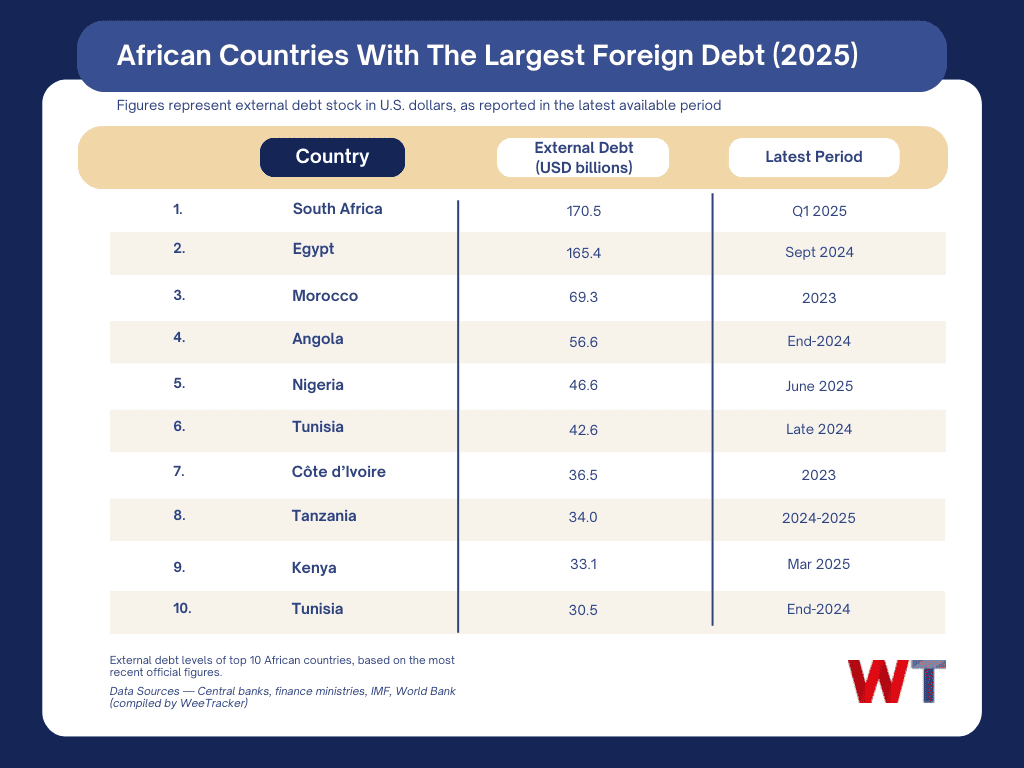

A quick note on method: figures below reflect the latest credible totals for external debt stocks available in 2024–2025 from central banks, finance ministries, the IMF or World Bank. Dates vary because countries publish on different cycles.

1) South Africa — about USD 170.5 B

South Africa tops the list. The Reserve Bank’s data shows external debt around USD 170.5 B in Q1 2025, helped by deep capital markets and long-standing foreign participation in local assets. The load is large, but so is the economy and the investor base watching it.

2) Egypt — about USD 165.4 B

Egypt’s foreign-currency squeeze pushed external debt near record highs. Central Bank data put the stock around USD 165.4 B at end-September 2024, a level shaped by multiple IMF programs, currency moves, and big energy and infrastructure outlays.

3) Morocco — about USD 69.3 B

Morocco’s external debt is far below the top two, yet still substantial. World Bank series show roughly USD 69.3 B in 2023, before earthquake reconstruction and new industrial investments began to filter through.

4) Angola — about USD 56.6 B

High oil-linked borrowing in the 2010s still casts a shadow. Reuters, citing official data, placed Angola’s external debt near USD 56.6 B at end-2024, with much of the market focus on repayments to Chinese lenders and Eurobond holders.

5) Nigeria — about USD 46.6 B

Nigeria’s debt management office reported USD 46.6 B in external debt as of June 30, 2025. The number sits alongside a much bigger domestic debt pile and ongoing reforms to lift dollar inflows and steady the naira.

6) Tunisia — about USD 42.6 B

Tunisia’s external debt stock hovered in the low-40s billions in late 2024. The challenge is more about growth, politics, and IMF program traction than the headline number alone.

7) Côte d’Ivoire — about USD 36.5 B

A fast-growing West African economy with frequent market access, Côte d’Ivoire’s external debt stood near USD 36.5 B in 2023, per CEIC data built on official sources. Investors watch cocoa revenue swings and Eurobond issuance closely.

8) Tanzania — roughly USD 33–35 B

IMF and World Bank materials, plus Bank of Tanzania reporting, place Tanzania’s public and publicly guaranteed external debt around the mid-30s billions through 2024–2025 as big transport and energy projects roll on.

9) Kenya — about USD 33.1 B

Kenya’s Central Bank tallied external debt near KES 5.17 T in March 2025, roughly USD 33.1 B at the time. The country eased a market scare by handling a June 2024 Eurobond maturity, a useful case study in crisis management.

10) Ghana — about $30.5 B

Ghana defaulted in 2022, then spent 2023–2025 working through a complex restructuring with official and private creditors. Bank of Ghana data shows external debt near USD 30.5 B at end-2024, with relief terms approved by parliament in mid-2025.

Context that matters

Restructuring stories to watch: Zambia and Ghana have been the market’s stress cases. Zambia is exiting default after hard-won deals with official creditors and bondholders, while a debate over so-called “baby multilaterals” has slowed final clean-up for both Zambia and Ghana. These episodes influence pricing for peers.

Market moments: Kenya’s 2024 Eurobond rollover turned a looming wall into a workable step, calming the shilling after months of anxiety. Expect similar test moments as other bullet maturities arrive.

Data quirks: Some governments report broader debt including private sector external liabilities, while others focus on public and publicly guaranteed debt. Publication lags mean South Africa and Egypt have fresher numbers than countries still finalising 2024 audits. Where windows differed, the newest high-quality figure was used and clearly dated above.

Why operators should care

Foreign debt trends shape currency risk, import costs, interest rates, and the likelihood of new taxes or capital controls. If you are signing multi-year leases, importing equipment, or pricing subscriptions in local currency, these macro currents can move your unit economics.

Also note that big economies lead this list by size, but the investment narrative turns on composition, maturity profiles, and policy credibility. Keep an eye on refinancing calendars, IMF program reviews, and central bank FX guidance in the months ahead.

Feature Image Credits: Getty Images