Acha Leke was barely a year old when his family left the shores of their homeland, Cameroon, for Canada. Both his parents were medical students who had interests in both gynaecology and immunology and the move to Canada was motivated by the pursuit of those studies.

Once their academic work was done, the family returned to Cameroon where the little boy lived out his childhood years – up until he was on his way to Belgium for the completion of his high school studies. He followed that up with a stint in the United States where he attended college.

Those were the formative years of perhaps one of Africa’s most connected men, Acha Leke, Senior Partner and Chairman of McKinsey’s Africa office; a man with an enviable track record when it comes to the business end of things on the continent, not to mention the many past and present African leaders on his speed dial.

Source: McKinsey

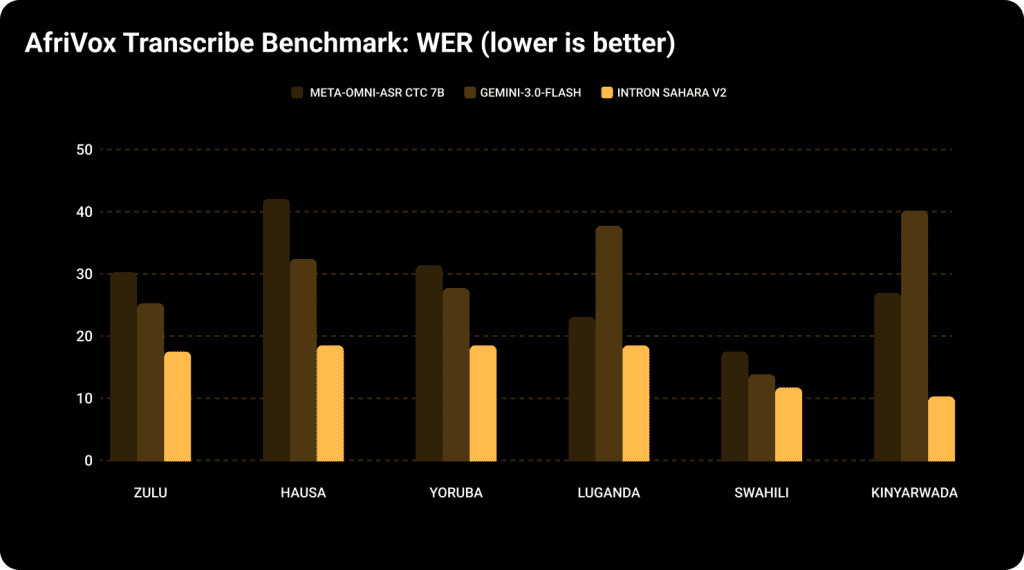

With over 400 companies doing revenues north of USD 1 Bn annually, consumer spending hitting as high as USD 1 Tn, and an average age of 19, opportunities for business in Africa have never been better. And behind the scenes, individuals like Leke are perhaps the ones pulling the strings and creating those possibilities.

When the Cameroonian graduated from Stanford with a Ph.D. in Electrical Engineering earned on the backs of a paper titled; “Dynamic Bandwith Optimization for Multicarrier Systems,” he had several options laid out in front him, which in spite of popular opinion, is not exactly ideal given that things get a whole lot trickier when there are too many options.

With his head probably bursting with ideas following his academic exploits and offers popping up from basically everywhere, he didn’t have the easiest of choices to make. And so when he made the unexpected decision of taking a consulting internship at a firm in the United States, many thought it a step down. It was an unspoken opinion that he could have done better.

But as he has been proving for the last twenty years, it was perhaps the best decision he ever made. Turning up for work at McKinsey for the first day many years ago, he wouldn’t have known that he was stepping into a stellar career that has put him in the same room as Presidents and billionaires from various parts of the world, in concerted efforts aimed at effecting positive change throughout the continent.

These days, there’s plenty of talks centred around self-employment and being one’s own boss; the new cool. But not enough is said about all the good stuff one could still do on the dreaded nine-to-five, or perhaps nine-to-nine as is often the case these days.

From his position as Senior Partner at the Johannesburg office McKinsey & Company, the Cameroonian is doing the most to introduce a new wave of investors to Africa’s economic potential – something he’s been achieving with his ingenious “Lions on the Move” series.

Besides that, his repertoire of great deeds speaks volumes. Leke has worked to save lives in both Nigeria and Uganda. He’s also become some kind of go-to consultant for African companies who are looking to boost performance. In addition, the Cameroonian is a vocal advocate of the need to open up the continent to visa-free travel, even though it might be argued that he’s got some vested interest there.

Even at that, while fulfilling the roles of his day job, Leke is also a known angel investor who has thrown some financial weight behind as many as a dozen African startups. Most recently, he’s known to have embarked on a mission to establish a network of schools and universities across the continent in the hopes of nurturing Africa’s future leaders.

It was the year 1998 when Leke joined McKinsey and this period coincided with the spiraling out of control of the deadly HIV infection in Uganda. For his first project on the job, he opted to tackle the menace head-on. Within a couple of weeks, Leke had championed an action plan that would make it possible for global pharmaceutical firms to cut down on the price of antiretrovirals (ARVs) significantly.

At the time, a month’s worth of ARVs could cost as much as USD 700.00 in Uganda, and this was a country where average annual salary stood at USD 300.00 – basically a death sentence for individuals infected by the virus.

Leke took the idea to his superiors and after a few tweaks here and there, what was rolled out was a plan that benefited both sides, without diluting the core markets of the pharmaceutical firms or bringing Uganda’s healthcare system to its knees.

These efforts brought about a rise in the use of ARVs amongst persons infected with the virus in Uganda – a climb from less than a thousand to well over 50,000 – saving many lives in the process. Before long, the ‘Leke-inspired’ model was replicated in other parts of Africa, saving yet more lives.

The Cameroonian was working out of the McKinsey office in Atlanta at the time and having come good with the idea for the cut-price ARVs, his stock was rising fast. He was proving himself an asset to the organisation, especially with contributions geared towards a better Africa.

It seems Africa kept beckoning on Leke during his time in the United States and in 2002, he got himself transferred to the company’s office in South Africa. Initially, the plan was to work from SA for only a year but things got better from there. He had hoped to do a lot more now that he was closer to his roots. And he did do much more.

Leke likes to describe the move to SA as his “best professional decision ever,” and for the self-named socialite who once had a stint as a nightclub owner, it was also a brilliant personal move as he feels right at home in his current surroundings. SA is now something of an adopted home for Leke and he’s taken quite a liking to the vibrant energy that seems to engulf the place.

Once he got transferred to SA, Leke wasted no time getting busy. Although the transfer arrangement was supposed to last for only a year, it soon became evident that he was even more effective in his new surrounding. So, he remained.

In 2010, he talked his bosses into opening a second African office – this time, in Lagos, Nigeria. He ran this new office for the best part of four years and during that time, he saw McKinsey assume the position of leading consulting firm in Africa.

And it’s remained there since – opening four more offices on the continent and championing improved business procedures and standardisation throughout the continent, as well as creating a ripple effect that has seen similarly decent platforms pop up over the years. In a country like Nigeria, for instance, the general improvement in professionalism and corporate governance in public institutions could be attributed, in part, to the arrival of McKinsey several years ago.

In Leke’s line of work, there’s always the potentially-rewarding lure of doing business with “glamorous” private sector clients and global corporates, but the Cameroonian has opted to tow a somewhat different line. The bulk of projects he’s taken on have strong ties to the public and social sectors.

In the years past, Leke has been able to warm his way into the hearts of key drivers of Africa’s economic transformation. Some would even say he’s on a first name basis with such distinguished personalities as President Paul Kagame of Rwanda, Ngozi Okonjo-Iweala (Nigeria’s former Finance Minister and ex-Managing Director of the World Bank), Donald Kaberuka (former President of the African Development Bank) and Aliko Dangote, the richest man in Africa – individuals whose ears you’d want to have.

In 2004, Leke put those contacts to good use when he joined forces with Swaniker to bring the African Leadership Academy to life. The prestigious high school which sits in Johannesburg has enrolled students from 46 African countries, with 85 percent of those on full scholarships.

The vision of the institution has since expanded to include the African Leadership University (with campuses in Mauritius and Rwanda, and more planned), as well as the African Leadership Network; a gathering of influencers from across the continent that seems like something from Davos.

By bringing in funding, serving on committees, and even interviewing prospective candidates, Leke has been on top of things with respect to putting the academy on solid footing.

If it seems Leke is too generous with his time, that’s probably because he is. Tarryn Govender, his longtime assistant, once said that she’s made attempts to put “measures in place” to fix this without much success.

In the end, what looks like an unreserved commitment to improving the fortunes of the continent on the business front, is indeed justified, especially as eight African countries happen to occupy the last twelve places in the most recent Doing Business Rankings released by the World Bank.

In any case, the Cameroonian is under no illusions as he’s well aware that the conditions on the continent are far from ideal, with such details as infrastructure, education, and business climate in need of drastic improvements. And then, it’s hard to ignore the fact that economic growth on the continent has slowed recently.

The stall in growth is undoubtedly a cause for concern but Leke is still betting massively on a continent where he has put together an impressive career and investment portfolio.

For now, the 45-year-old remains a key figure in McKinsey. Even as everyone gets to walk eventually, Leke doesn’t have any immediate plans to move on, though, he’s as committed as ever to making the African Leadership Group even bigger.

Oddly, his country of birth, Cameroon, is one of the few African countries he’s yet to work in and going forward, he probably has it at the back of his mind to go back and work in the country’s public sector.

Now, let’s give it up for Acha Leke; one of Africa’s illustrious sons!

Featured Image Courtesy: Youtube