In 2023, Saudi Arabia saw a record-breaking 13.5 million pilgrims visiting Mecca and Medina. This is a fantastic testament to the ongoing success of the Kingdom’s Vision 2030 initiative, a part of which is aimed at expanding the capacity and enhancing the experience of religious visitors. However, despite these figures there remain a number of challenges for many pilgrims. Acutely felt by those from developing countries, we see this most directly in the area of finance and financial inclusion.

Exemplified in regions such as West Africa and South Asia, a lack of access to stable and consistent financial services cause significant hurdles for pilgrims visiting Saudi Arabia. Whilst rarely experienced by travellers from more developed countries, financial difficulties overshadow Hajj and Umrah for many Muslims from economically emerging regions.

In 2024, almost 1mil Nigerian pilgrims attended Hajj and Umrah. Yet, these pilgrims often need help navigating currency exchange. Limited access to foreign currency means many must carry large sums of physical cash, exchanging it for Saudi Riyals upon arrival. This time-consuming process introduces security risks, detracting from the intended religious experience.

Upon arrival in Saudi Arabia, these financial challenges don’t end. While digital banking platforms like Revolut, Wise, or Monzo are available to travellers from developed countries, they remain inaccessible to many pilgrims from developing nations. This exclusion adds layers of complexity, creating an unequal experience for those from developing nations like Nigeria, Pakistan, and Bangladesh.

Building UmrahCash to Bridge the Financial Divide

To address these challenges, we developed UmrahCash, a fintech solution designed specifically to eliminate financial barriers for pilgrims from developing nations. Based in Jeddah and Kano, North Nigeria: UmrahCash aims to simplify the financial journey by leveraging technology that ensures safe, secure, and seamless financial transactions. With UmrahCash, we are not just providing a service, but we are enhancing the entire pilgrimage experience, making it more accessible and enjoyable for all.

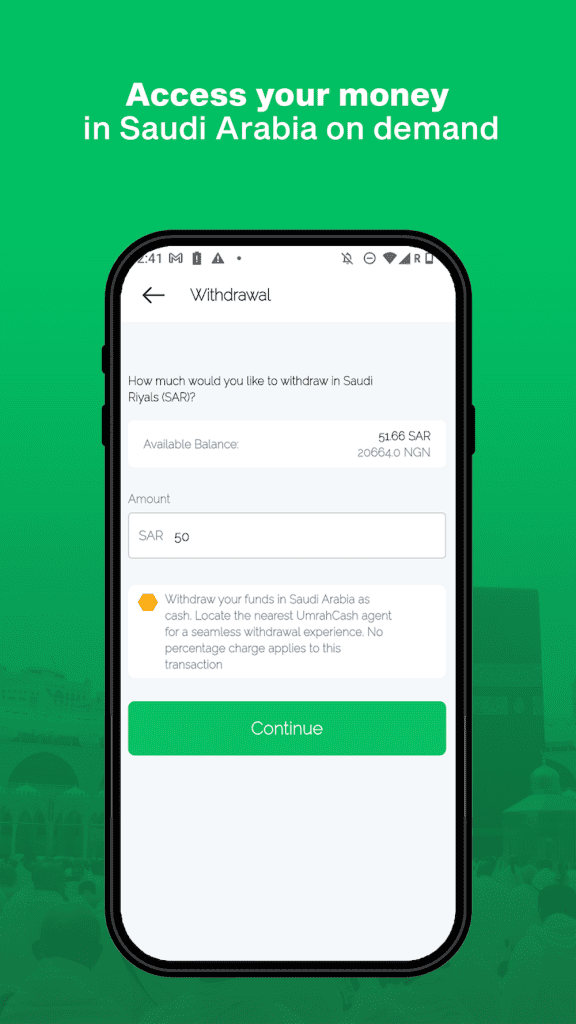

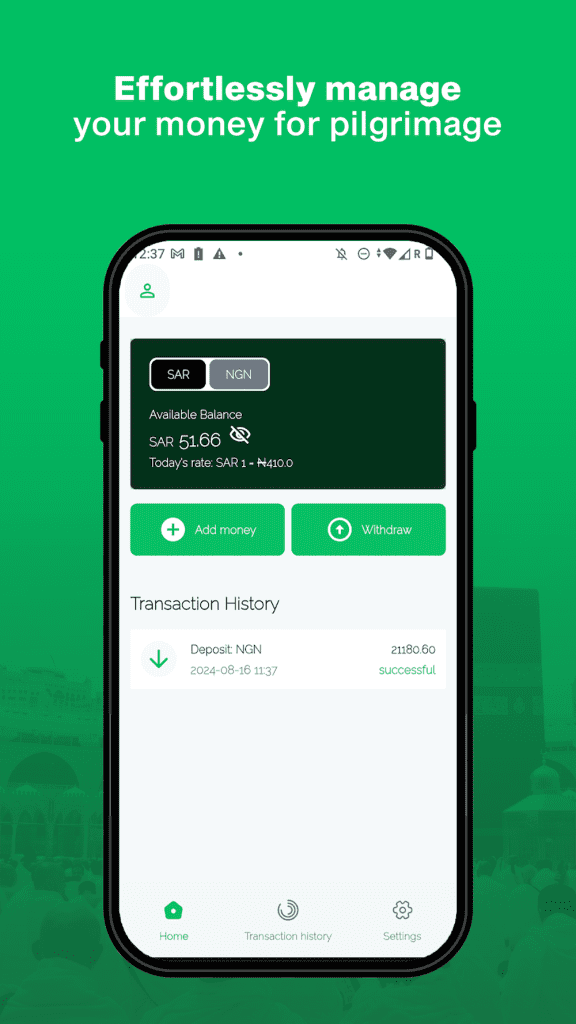

With UmrahCash, pilgrims can convert their home currency directly to Saudi Riyals through our digital platform, removing the need to carry large amounts of cash. We’ve built a network of vetted agents, starting in Northern Nigeria, who offer personalised support in local languages, ensuring that users—whether banked or unbanked—can access our services. The platform’s technology backbone ensures secure, transparent, and efficient financial transactions, allowing pilgrims to focus on their journey without worrying about managing cash.

By streamlining currency exchange, we’ve made the process easier and more secure. Our user-friendly app is designed to be accessible to all levels of financial and technological literacy, ensuring anyone can easily navigate it. We’ve combined cutting-edge backend technology with a simple front-end user interface, making UmrahCash a powerful yet easy-to-use tool for managing travel finances. This design ensures that our users feel confident and reassured, knowing that they have a reliable and accessible tool at their fingertips.

A Path Forward for All Pilgrims

The need for such inclusive financial solutions is pressing. In 2023, the majority of the 26.9 million Umrah pilgrims came from developing countries, underscoring the importance of financial technology in ensuring equal access to the pilgrimage experience. This realisation is a significant step towards a more inclusive and informed approach to pilgrimage. Saudi Arabia’s Vision 2030 has invested heavily in infrastructure at the holy sites, but for pilgrims to fully benefit from these improvements, we must also address the financial barriers they face.

At UmrahCash, we aim to empower all pilgrims, regardless of their financial background or country of origin, with the tools they need to enjoy a stress-free journey. By combining innovative technology with user-friendly design, we’re helping to level the playing field for millions of pilgrims worldwide.

Note: The article is written by William Phelps, CEO and Co-founder of UmrahCash. Established in 2024, UmrahCash allows pilgrims to make payments in their home countries and receive Saudi Riyals upon arrival in the Kingdom, thus simplifying access to the local currency.