Global payments giant PayPal has launched a long-delayed service enabling Nigerians to receive and withdraw international payments, ending nearly two decades of exclusion by partnering with local fintech pioneer Paga.

The integration allows users to link their PayPal accounts to a Paga wallet, receive funds from over 200 countries, and instantly convert them to Naira for local spending or withdrawal, it said in a press release. This move grants Nigeria’s freelancers, online merchants, and families formal access to a global network of over 400 million users they were previously locked out of.

The partnership signals a strategic reversal for PayPal, which has cited fraud concerns since restricting Nigerians from receiving money in 2004. The decision had forced a generation of digital workers to rely on informal workarounds, endure frozen funds, or miss opportunities entirely. Paga’s founder, Tayo Oviosu, first pitched the collaboration idea to PayPal in 2013, a proposal that has now taken 13 years to materialise.

During PayPal’s absence, a vibrant local fintech ecosystem emerged to solve the problems it left behind. Companies like Paga, Flutterwave, and Paystack built robust infrastructure for local and cross-border payments, capturing a digital payments market that, per the press release, reached NGN 657.8 T (~USD 466 B) in 2023.

“For years, when PayPal was the standard, they shut us out,” said Kenneth Nwakanma, a tech entrepreneur who claims he lost USD 15 K when his account was abruptly closed in 2020. “Now they want to come back into a market we have built for ourselves.”

This history of exclusion fuels deep scepticism. Social media reactions to PayPal’s recent African expansion plans have been fiercely critical, with calls for a boycott from users citing years of frozen assets and frustration.

***

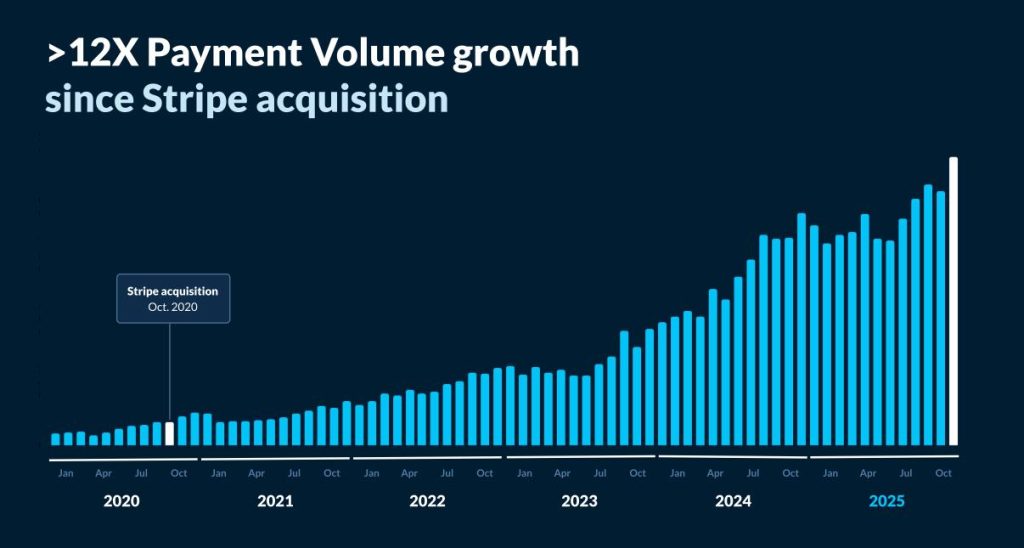

Analysts view the move as a critical part of PayPal’s broader international strategy to reignite growth. Facing intense competition from rivals like Stripe in its core U.S. market, PayPal’s share price has fallen about 75% from its 2021 peak. The company is now doubling down on emerging markets, where e-commerce is growing rapidly.

“PayPal’s international expansion is key,” Zennon Kapron, a fintech analyst, opines. “The company is looking to counter increased competition in mature markets and capitalise on the rapid growth of e-commerce in emerging economies.”

The Nigerian partnership is a cornerstone of this push. It aligns with “PayPal World,” a new global platform set for an African launch in 2026 that will connect local digital wallets to international commerce. The company has committed USD 100 M to invest in the Middle East and Africa region.

Crucially, PayPal is not launching a direct competitor to Paga but is using it as a local bridge. This partnership model—leveraging established local infrastructure instead of building its own—is central to its new African strategy.

“We’ve been intentional about partnering with local innovators like Paga,” said Otto Williams, PayPal’s Senior Vice President for Middle East and Africa. “This collaboration helps strengthen the broader payments ecosystem by supporting local innovation.”

***

For Paga, which processed NGN 17 T (USD 11.98 B) across 169 million transactions in 2025, the deal validates years of building local trust and infrastructure. “Until now, Nigerians could not receive money via PayPal. Our partnership unlocks that,” Oviosu says.

“This moment isn’t about a single announcement. It’s about patience. It’s about building robust, trusted local infrastructure. It’s about believing that global platforms scale better when they work with local systems, not around them. Partnerships like this don’t happen overnight. They are the result of years of conversations, trust-building, regulatory work, and showing up consistently,” he added.

The partnership unlocks significant new functionality, including allowing Nigerians to receive money directly from users of Venmo, PayPal’s popular U.S. peer-to-peer app.

The long-term test will be whether the utility of seamless global access can overcome the enduring resentment from two decades of exclusion. PayPal is entering a sophisticated market where trust was earned not by the global giant, but by the local players who filled the void it created.