You Can Own Real Estate In The United States From As Low As USD 100 – How? Ask These Founders

A Nigerian startup is helping people back home buy up properties in the U.S. with the local currency, and just about anyone can get in on the act.

“In the meantime, I got tired of complaining about the shitty investment options available to Nigerians and worked on @MyCashEstate instead. Relatively safe, USD returns backed by real estate. Get hip.”

So read the simple tweet dated 31st March 2019. Not the most ostentatious of introductions, alright, but one that had the looks of a bringer of good tidings all the same.

In the mean time, I got tired of complaining about the shitty investment options available to Nigerians and worked on @MyCashEstate instead. Relatively safe, USD returns backed by real estate. Get hip.

— InvestGod (@eldivyn) March 31, 2019

That tweet had come from Eleanya Eke, one arm of a trio of co-founders who had gotten the hang of helping Nigerians own real estate in the United States with investment amounts starting from as low as USD 100.00. Yes, just NGN 36 K, not that far off from the minimum wage which the Nigerian government put the federal seal on recently.

Actually, before rolling out this new project in 2018, Eleanya had been fiddling with the idea of making it possible for Nigerians to invest in U.S. dollar opportunities since as far back as 2014, something that was borne out of his dissatisfaction with the unnecessary baggage which often accompanied naira investments.

In a post that hit the web some five years prior, the Nigerian highlighted his fears with regards to the country’s economy. As though he were some Shaman from the future, he foresaw difficult times ahead for the Nigerian economy, and how a series of possible devaluations of the local currency could lay waste to naira assets. He had concluded by leaving a tip which screamed; “Fellow Nigerians, convert your money and invest in dollar-denominated assets.”

But like the biblical prophet in his homeland, his take on the matter was largely ignored. Many didn’t heed, not that they were entirely at fault. For those whose pockets were deep enough to make such investments, they didn’t exactly have a lot of options when it came to putting their money into dollar assets.

So, Eleanya thought to create those options having realized from his research at the time that there just weren’t that many places for someone in Nigeria to invest in dollars and earn a decent return.

Although it appears that the last few years have heralded an influx of fintech investment solutions in Nigeria, local investors still suffer untold financial damage due to the instability of the local economy.

The well-documented struggles with inflation and several economic indicators make the country quite a tough terrain to invest in. Last year, Nigeria’s wobbling stock market saw the mounting investor losses amount to a staggering NGN 1.89 Tn. And then there is the inflation rate which currently hovers dangerously around 11 percent.

On account of this, individuals and businesses across the country are in dire need of stable, profitable investment opportunities that are protected from the economic struggles on the local front.

Coupled with the fact that domiciliary accounts on the home front do not yield returns, and sometimes, the country’s tussle with forex makes even getting your own dollars more work than it should be, change became not only important but also necessary.

Armed with his background in finance and perhaps some exposure from his stay in the United States which had become something of a second home for the last eight years, Eleanya decided to put his money where his mouth is.

The task was simple; to create an easy, transparent, and feasible way to connect people in Nigeria with those opportunities abroad. But the execution? Not so much. It took a lot of doing.

A play in the world of cryptocurrency seemed appealing and viable initially. His first big break in trying to solve the puzzle came when he linked up with two other people who share similar interests to launch a platform known as Buycoins, which to this day, remains one of the biggest players in cryptocurrency on the continent.

With Buycoins, he seemed to have now added some spring to his step. The platform makes it possible for people to get in and out of naira to other currencies while providing access to non-correlated returns. Eleanya seemed to have gotten the better of the first hurdle.

But even as Buycoins made crypto transactions of all kinds seamless and connected the locals to the global financial revolution being enabled by cryptocurrency, he was still missing something. The platform was doing quite well but his goal has always been to create an avenue through which people could be served returns that are great, predictable, and consistent — something that he couldn’t achieve with Buycoins.

And so it became necessary that he parted ways with a company he pretty much built from scratch, alongside his colleagues – Ire Aderinokun and Timi Ajiboye – who he likes to call “programming ninjas.”

Having severed ties with the company, he directed full focus on building the platform that has now come to be known as Cashestate. This time too, like before, it was no cake walk and he coordinated with a brilliant, like-minded duo – Bosun Olanrewaju and Damilola Lawal. The three of them make up Cashestate’s co-founders.

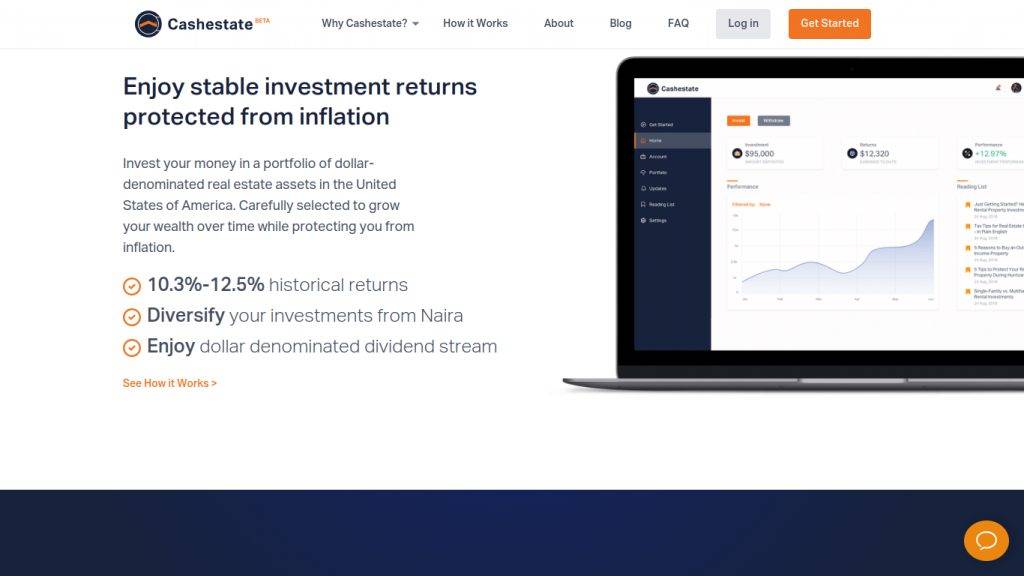

Today, Cashestate; a platform that allows people in Nigeria to invest their local currency into US-dollar-denominated assets and earn decent, consistent dollar returns, right from Nigeria, is in full swing.

In an effort to work around the shortcomings of investing in inherently unstable naira assets, the tech startup solves the problem by facilitating investments in the global economy, from Nigeria.

The company provides Nigerians easy access to the U.S. real estate markets, specifically commercial and rental real estate. Cashestate enables Nigerians to conveniently invest in these markets while reaping rental income and increased value, all dollar-denominated.

According to the co-founders, to invest with Cashestate, investors are required to make a minimum investment of USD 1 K or pay the same amount in installments of USD 100.00. All the deposits can be made through a naira card or bank account. Cashestate’s deal team then pools these funds, identifies affordable properties in high demand areas in the U.S. and purchases them in the investors’ names.

The investor receives returns via rental cash flow and property gains over time. The current interest rate on investment hovers between 10 and 12.5 percent annually. The minimum holding period on the platform is one year, though the company advises three to five-year holdings for the best results.

When comparing US-dollar investments with naira investments and adjusting for inflation, Cashestate claims a portfolio that has outperformed most naira investment instruments – bank savings, the Nigerian Stock Exchange and FGN Bonds.

And because the investments are made into real estate assets, they appear to be safer and better performing on a risk-return basis. Cashestate currently boasts NGN 175 Mn (nearly USD 500 K) under management and claims already-existing, returns-producing assets in its portfolio.

To guarantee the safety and legitimacy of investments, Cashestate invests via a special investment utility vehicle owned by the investors themselves. Investors are even allowed to trade ownership units to others if they want to exit the investments.

It was also gathered that all property purchases are completely insured against the worst case scenarios. The platform provides all the required information, returns, legal titles and other documents within its dashboard.

“We – my team and I – have tested out our value proposition with several deals over the past two years,” comments Eleanya. “And we have the benefits of not just my financial expertise, but also the years (in some cases decades) of experience in real estate from members of my team at companies ranging from Berkshire Hathaway Homes to U.S. National mortgage company, Fannie Mae.”

He adds; “The real estate business is easy to understand, maybe even boring. But there is nothing boring about the way we are doing it. We are not only using technology to give access to Nigerians to healthy returns in a stable industry in the U.S. market, but we are also using technology to streamline the process of sourcing, purchasing and managing our portfolio so that we can find the best deals wherever they happen to be.”

Eleanya Eke has spent the last 7 years putting in work in the U.S. financial services and consulting industry in a wide range of capacities. He graduated from South Carolina State University in 2014 with a bachelor’s degree in Accounting and Business Management, after which he worked in a number of firms.

On their part, Cashestate’s other co-founders, Bosun and Damilola, are quite the dynamic duo. Bosun is a software engineer with experience building solutions in the fintech, health & fitness, e-commerce, and hospitality industries. The third co-founder, Damilola, is an investment expert with 8 years experience in research, corporate finance and strategy, with stints at Vetiva Capital Management and CardinalStone Partners Limited boosting his resume.

Through their offering, Cashestate is linking a previously-disconnected market in a manner that is quite remarkable. There is a lot of confidence on the part of the co-founders that the platform will continue to generate strong and improving returns over time, better than the competition, and better than most investment options available within Nigeria.

Connecting Nigerians to the real estate market in the United States appears to be the company’s first play in a coordinated move that could see it accommodate many more countries and several other investment vehicles in the future.