Why You Need A CBK Approval Before Receiving A Mobile Loan in Kenya

The Central Bank of Kenya is planning to launch a service which will enable customers to receive approval message from the regulator before getting a mobile loan from mobile lending firms, CBK Governor Patrick Njoroge has said.

Speaking during the Afro-Asian Fintech Festival 2019, he said that the move is part of the efforts by the regulator to protect consumers from unregulated mobile lenders which are on the rise.

“They are unregulated because there is no law that captures them and customers concerns are not taken care of, so they are at the mercy of the institution and that is something as a regulator we cannot accept.

“We want to ensure that the consumer is not being taken advantage of and that the client’s information is secure,” he said.

Part of the regulation would include identifying the way the apps use customer’s information in term of data security and identify how they get their money amid concerns that their channels are used to introduce illegally-obtained cash into the financial system,

“We don’t know where they are getting their money from so this could be a standard money-laundering operation. The way we regulate them should not be the same way we regulate banks because their model is different,” he added.

At the same time, Mr Njoroge noted that the Central Bank is working with banks to reduce the cost of mobile-based loans which mainly includes high fees beyond regulatory control.

“This is a bit more complicated. The issue is not just to look at it as interest rate component, but other charges as well. The charges are not part of that interest cap thing,” he explained.

Mobile money loans applications do not abide by the Government cap on interest of four points. Most of the apps charge a monthly interest of approximately 14%, which if standardized annually is approximately 168%, way above the commercial banks’ average of about 13% per annum

Lending apps in Kenya are numerous owing to the increased appetite of loans from Kenyans. Over time, the CBK boss has expressed dissatisfaction with these apps.

“Tala, Okash and Branch… There is a huge lacuna because there’s no specific law that is targeted at them…In fact, these institutions are nothing but shylocks,” he previously noted adding that they have a high potential of bringing down the economy of the country.

During the event, the CBK Governor also refuted the narrative that digital lenders are taking over the lending space in Kenya.

“At this moment, digital lenders maybe be many but that is not the best measure [for regulation]. The best measure is, how big are they in terms of lending which is less than 1% of all the lending done in the country… Our sense is that they are not that big in terms of lending,” he indicated.

The two-day event was organized as a partnership between the Central Bank of Kenya and the Central Bank of Singapore.

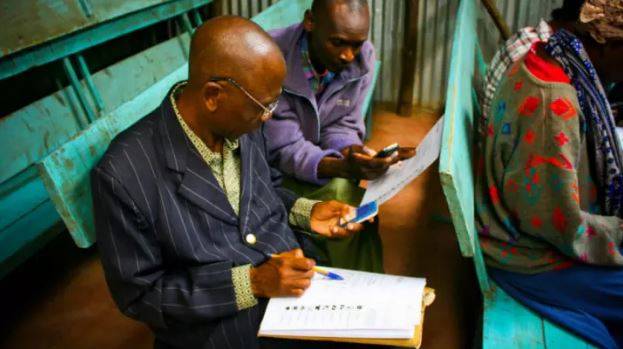

Featured Image Courtesy: www.devex.com